Components of Financial System

The financial system is a complex network of interconnected components that facilitate the flow of funds between savers and borrowers. Here are some key components:

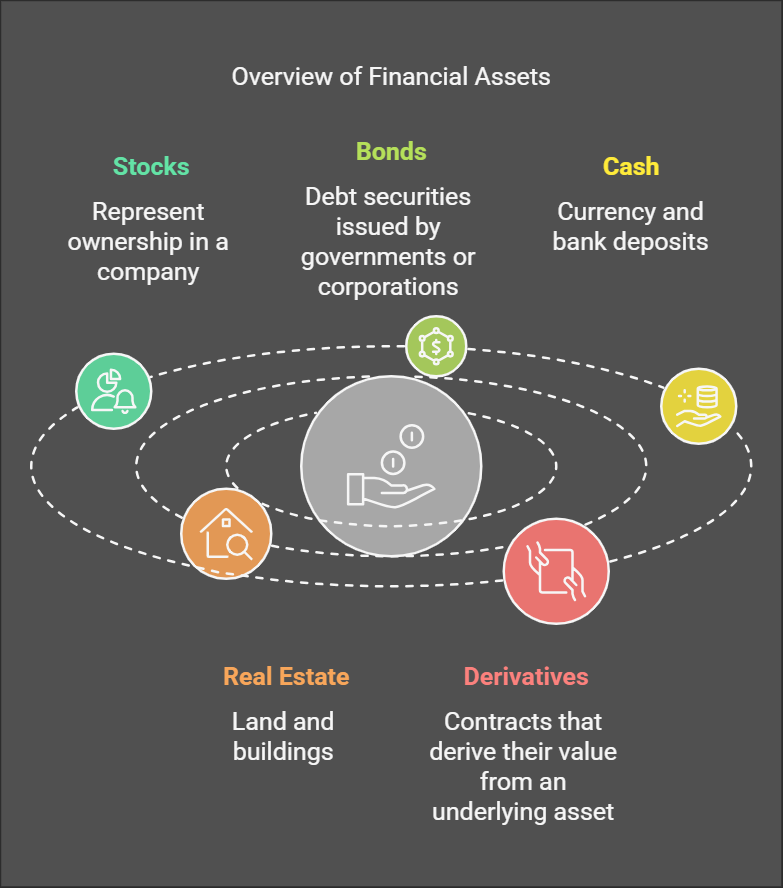

1. Financial Assets:

- These are any asset that can be bought, sold, or traded.

- Examples:

- Stocks: Represent ownership in a company.

- Bonds: Debt securities issued by governments or corporations.

- Cash: Currency and bank deposits.

- Real estate: Land and buildings.

- Derivatives: Contracts that derive their value from an underlying asset (e.g., options, futures).

Overview of Financial Assets

Stocks

Bonds

Cash

Represent ownership in a company

Debt securities issued by governments or corporations

Currency and bank deposits

Real Estate

Derivatives

Land and buildings

Contracts that derive their value from an underlying asset

Difference between Financial Assets and Physical assets?

Unlike Financial assets, physical assets are not useful for the further production of goods or for earning income.

Ex: X purchases land and building, or gold and silver. These are physical assets that cannot be used for production.

Classification of Financial Assets

Financial assets can be broadly classified into two categories:

1. Marketable Assets:

- Definition: These are assets that can be easily bought, sold, or transferred from one person to another in a short period of time at a competitive market price.

-

Characteristics:

- High liquidity: Easily converted into cash.

- Active trading: Frequently traded in organized markets.

- Price transparency: Market prices are readily available and easily accessible.

-

Examples:

- Stocks: Shares of publicly traded companies.

- Bonds: Debt securities issued by governments or corporations.

- Treasury bills: Short-term debt securities issued by the government.

- Mutual funds: Pooled investments in a variety of securities.

- Exchange-Traded Funds (ETFs): Traded on stock exchanges and track an underlying index or asset.

2. Non-Marketable Assets:

- Definition: These are assets that cannot be easily bought, sold, or transferred in a short period of time at a readily determinable market price.

-

Characteristics:

- Low liquidity: Difficult to convert into cash quickly.

- Limited trading: May not have an active market for trading.

- Price uncertainty: Difficult to determine a fair market value.

-

Examples:

- Bank deposits: While generally liquid, may have restrictions on early withdrawal.

- Life insurance policies: Have limited secondary market liquidity.

- Private company stock: Not publicly traded and difficult to sell.

- Real estate: Can take time to sell and may be subject to market fluctuations.

- Collectibles: Such as art and antiques, may have illiquid markets.

This classification helps investors understand the liquidity and risk associated with different types of financial assets when making investment decisions.

2. Financial Intermediaries:

- These are institutions that act as intermediaries between savers and borrowers.

- Examples:

- Banks: Accept deposits, lend money, and provide other financial services.

- Insurance companies: Provide protection against financial losses.

- Investment funds: Pool money from investors and invest in a diversified portfolio of assets.

- Pension funds: Manage retirement savings for individuals.

-

Classification of Financial Institutions

Financial institutions can be broadly classified into two categories based on the maturity of the funds they deal with:

1. Money Market Intermediaries:

- Focus: Primarily deal with short-term funds (maturity less than one year).

-

Functions:

- Facilitate the flow of short-term funds between borrowers and lenders.

- Provide liquidity to the financial system.

-

Examples:

- Commercial Banks: Offer a wide range of services, including deposits, loans, and payment processing.

- Co-operative Banks: Member-owned financial institutions that provide banking services to their members.

- Money Market Mutual Funds: Invest in short-term debt instruments.

2. Capital Market Intermediaries:

- Focus: Primarily deal with long-term funds (maturity greater than one year).

-

Functions:

- Facilitate the flow of long-term funds between borrowers and lenders.

- Provide long-term financing for businesses and governments.

-

Examples:

- Investment Banks: Assist corporations in raising capital through activities like issuing stocks and bonds.

- Insurance Companies: Provide protection against financial losses and also invest in long-term assets.

- Pension Funds: Manage retirement savings and invest in long-term assets like stocks and bonds.

- Life Insurance Corporation (LIC): A major player in the Indian insurance and investment market.

- Financial Corporations: Provide long-term loans to businesses and individuals.

This classification helps in understanding the different roles played by various financial institutions in the economy and their contribution to the financial system.

3. Financial Markets:

- These are platforms where financial assets are bought and sold.

- Examples:

- Stock exchanges: Where stocks are traded.

- Bond markets: Where bonds are traded.

- Foreign exchange markets: Where currencies are traded.

-

Money markets: Where short-term debt instruments are traded.

Institutional Arrangements for Dealing in Financial Assets

Financial markets are the institutional arrangements that facilitate the exchange of financial assets and credit instruments. They provide a platform for borrowers to raise funds and for investors to invest their savings. Here are two major types of financial markets:

Classification of Financial Markets

Financial markets can be broadly classified into two categories:

1. Unorganized Markets:

-

Characteristics:

- Informal and unregulated: Operate outside the formal regulatory framework.

- Lack of standardization: No standardized rules, regulations, or procedures.

- Higher risk: Higher risk of default and fraud.

- Limited transparency: Lack of transparency in terms of interest rates and lending practices.

-

Participants:

- Money lenders: Individual lenders who charge high interest rates.

- Indigenous bankers: Traditional lenders operating within local communities.

- Traders: May extend credit to their customers.

- Chit funds: Operate on a rotating savings and credit basis.

- Informal lending groups: Small groups of individuals who lend money to each other.

2. Organized Markets:

-

Characteristics:

- Regulated and supervised: Operate under a strict regulatory framework (e.g., by the Reserve Bank of India).

- Standardized procedures: Follow established rules and regulations for trading and operations.

- Higher transparency: Transparent pricing and disclosure of information.

- Lower risk (relatively): Lower risk of default and fraud due to regulatory oversight.

-

Participants:

- Stock exchanges: Facilitate the trading of stocks and other securities.

- Bond markets: Facilitate the trading of government and corporate bonds.

- Money markets: Facilitate the trading of short-term debt instruments.

- Foreign exchange markets: Facilitate the trading of currencies.

- Banks: Regulated by the Reserve Bank of India.

- Insurance companies: Regulated by insurance regulatory authorities.

Key Differences:

| Feature | Unorganized Markets | Organized Markets |

|---|---|---|

| Regulation | Unregulated | Regulated |

| Standardization | Low | High |

| Transparency | Low | High |

| Risk | Higher | Lower |

| Liquidity | Lower | Higher |

This classification highlights the key differences between unorganized and organized financial markets, emphasizing the importance of regulation and standardization in ensuring a stable and efficient financial system.

1. Negotiated Loan Market

-

Characteristics:

- Direct negotiations: Lending and borrowing occur through direct negotiations between the borrower and lender.

- Customized terms: Loan agreements are tailored to the specific needs and circumstances of the borrower.

- Less standardized: Lack of uniformity in terms and conditions across loans.

- Lower liquidity: Loans are typically less liquid than securities traded in open markets.

-

Examples:

- Bank loans: Loans from commercial banks to businesses and individuals.

- Loans from finance companies: Loans for consumer durables, mortgages, etc.

- Loans from family and friends: Private lending arrangements.

2. Open-Ended Markets

-

Characteristics:

- Impersonal and standardized: Standardized securities are traded in large volumes through impersonal market mechanisms.

- High liquidity: Securities can be easily bought and sold in the market.

- Price transparency: Market prices are readily available and easily accessible.

- Reduced transaction costs: Standardized procedures and technologies reduce transaction costs.

-

Examples:

- Stock market: Where stocks of publicly traded companies are traded.

- Bond market: Where government and corporate bonds are traded.

- Money market: Where short-term debt instruments (like Treasury bills) are traded.

- Foreign exchange market: Where currencies are traded.

Key Differences:

| Feature | Negotiated Loan Market | Open-Ended Market |

|---|---|---|

| Nature | Direct negotiation | Impersonal |

| Standardization | Less standardized | Highly standardized |

| Liquidity | Lower | Higher |

| Price discovery | Less transparent | More transparent |

| Transaction costs | Higher | Lower |

This classification highlights the key differences between negotiated loan markets and open-ended markets, providing a better understanding of how these markets function and their role in the financial system.

4. Financial Instruments:

- These are contracts or legal agreements that represent financial value.

- Examples:

- Stocks: Represent ownership in a company.

- Bonds: Debt securities issued by governments or corporations.

- Loans: Agreements to lend money with specified terms.

- Insurance policies: Contracts that provide financial protection.

- Derivatives: Options, futures, and other contracts that derive their value from an underlying asset.

These components interact with each other to form a complex and dynamic system that supports economic growth and development.