Financial instruments in capital markets :shares ,mutual funds , debentures ,bonds

- Mutual Funds:

Definition:

Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities (stocks, bonds, etc.).

Key Features:

Diversification, reducing risk.

Professional management.

Liquidity (shares can be redeemed).

Various types of mutual funds catering to different investment goals (e.g., equity funds, debt funds).

Role:

Provide investors with access to diversified portfolios.

Enable investors to participate in markets with smaller investments. 3.

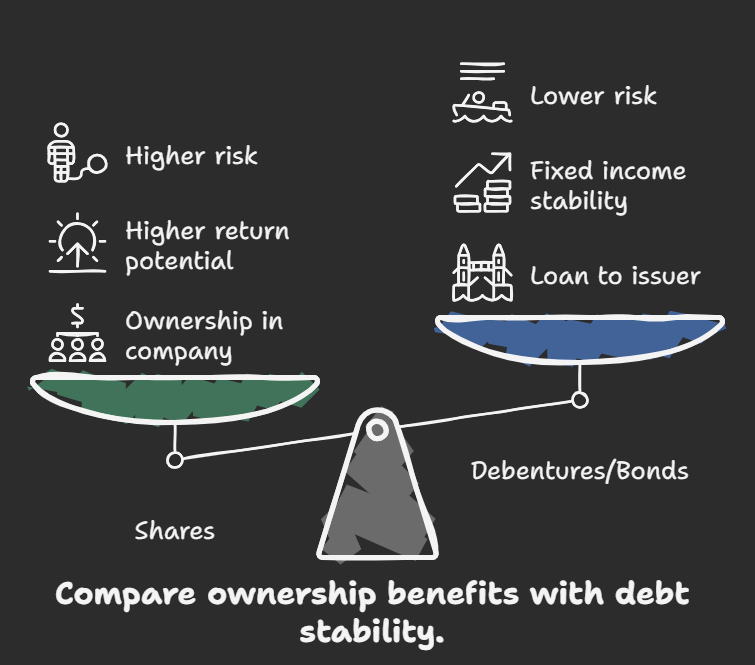

- Debentures:

Definition:

Debentures are debt instruments issued by corporations to raise capital. They represent a loan from the investor to the company.

Key Features:

Fixed interest payments.

Typically unsecured (not backed by specific assets).

Represent a debt obligation of the company.

Generally considered less risky than shares but riskier than secured bonds.

Role:

Companies use debentures to raise debt capital.

Investors use debentures to earn fixed income. 4.

- Bonds:

Definition: Bonds are debt instruments issued by governments, municipalities, or corporations. They represent a loan from the investor to the issuer. Key Features: Fixed interest payments (coupon payments). Principal repayment at maturity. Can be secured (backed by assets) or unsecured. Varying levels of risk depending on the issuer's creditworthiness. Role: Governments and corporations use bonds to raise debt capital. Investors use bonds to earn fixed income and preserve capital. Key Differences: