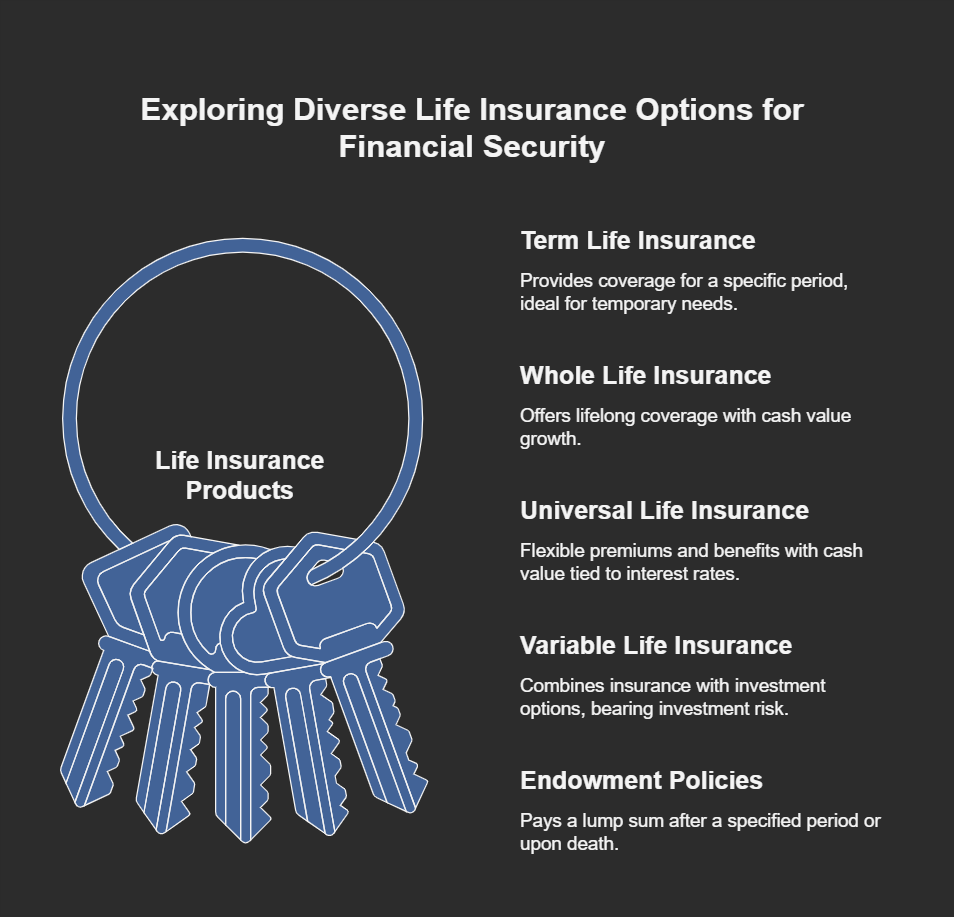

Life Insurance Products

Life insurance products are designed to provide financial security to beneficiaries upon the death of the insured. They come in various forms, catering to different needs and financial goals. Here's an overview of common life insurance products:

.

- Term Life Insurance:

Description: Provides coverage for a specific period (the "term"), such as 10, 20, or 30 years. If the insured dies within the term, the beneficiaries receive the death benefit. If the insured survives the term, the coverage expires. Key Features: Generally the most affordable type of life insurance. Simple and easy to understand. Ideal for covering temporary needs, such as a mortgage or children's education. Types: Level Term: The death benefit remains constant throughout the term. Decreasing Term: The death benefit decreases over time.

- Whole Life Insurance:

Description: Provides lifelong coverage. Builds cash value over time, which can be borrowed against or withdrawn. Key Features: Guaranteed death benefit and cash value growth. More expensive than term life insurance. Provides both death protection and a savings component.

- Universal Life Insurance:

Description: Offers flexible premiums and death benefits. Builds cash value based on current interest rates. Key Features: Policyholders can adjust their premiums and death benefits within certain limits. Cash value growth is tied to market interest rates. Provides more flexibility than whole life insurance.

- Variable Life Insurance:

Description: Combines life insurance coverage with investment options. Cash value is invested in sub-accounts, similar to mutual funds. Key Features: Potential for higher returns than whole or universal life insurance. Investment risk is borne by the policyholder. Death benefit and cash value can fluctuate based on investment performance.

- Variable Universal Life Insurance:

Description: Combines the flexibility of universal life insurance with the investment options of variable life insurance. Key Features: Policyholders can adjust premiums and death benefits. Cash value is invested in sub-accounts. Offers both flexibility and investment potential.

- Endowment Policies:

Description: Pays a lump sum to the insured after a specified period or to beneficiaries upon the insured's death. Key Features: Combines life insurance with a savings plan. Provides a guaranteed payout at the end of the term.

- Unit Linked Insurance Plans (ULIPs):

Description: Combines life insurance coverage with investment in market-linked funds. Key Features: Offers flexibility in choosing investment funds. Part of the premium is used for insurance coverage, and the rest is invested. Returns are linked to market performance. Factors to Consider:

Financial Goals: Determine your specific financial needs and objectives. Risk Tolerance: Assess your comfort level with investment risk. Affordability: Choose a policy that fits your budget. Coverage Needs: Calculate the amount of coverage you need to protect your beneficiaries. It's important to consult with a qualified financial advisor to determine the most suitable life insurance product for your individual circumstances.