Capitalization and its theories

Understanding Capitalization in Business

Introduction

Every business aims to maximize its value. To achieve this, both finance managers and individual investors need to understand the concept of capitalization. Capitalization essentially refers to the total value of a business, reflecting how it's funded and its worth. It’s a critical aspect of financial management, relevant at all stages of a company's lifecycle.

Concept of Capitalization

Capitalization is the total valuation of a business. It's the sum of all long-term funds invested in the company, including:

- Owned Capital: Money invested by the owners (shareholders).

- Borrowed Capital: Money raised through loans and debt instruments.

More specifically, capitalization is the valuation of long-term funds that have been invested in the business. It represents how a company's long-term financial obligations are distributed between its owners and creditors. In broader terms, it includes owner’s funds, borrowed funds, long-term loans, and any surplus earnings

Understanding Capitalization in Business

Introduction

Every business aims to maximize its value. To achieve this, both finance managers and individual investors need to understand the concept of capitalization. Capitalization essentially refers to the total value of a business, reflecting how it's funded and its worth. It’s a critical aspect of financial management, relevant at all stages of a company's lifecycle.

Concept of Capitalization

Capitalization is the total valuation of a business. It's the sum of all long-term funds invested in the company, including:

- Owned Capital: Money invested by the owners (shareholders).

- Borrowed Capital: Money raised through loans and debt instruments.

More specifically, capitalization is the valuation of long-term funds that have been invested in the business. It represents how a company's long-term financial obligations are distributed between its owners and creditors. In broader terms, it includes owner’s funds, borrowed funds, long-term loans, and any surplus earnings.

Different financial experts define capitalization slightly differently, but the central idea remains consistent: It's the total value of a company's long-term funding.

Definitions by Experts:

- Guthmann and Dougall: Capitalization is the total of the par value of outstanding stocks and bonds.

- Walker and Baughen: Capitalization includes long-term debt and capital stock, rejecting the idea that short-term creditors don't contribute to a company's total capital.

- Bonneville and Deway: Capitalization is the balance sheet value of outstanding stocks and bonds.

In Simple Terms: Capitalization represents the total value of the securities (stocks, bonds, etc.) issued by a company. It’s the sum of what the company owes to its owners and long-term lenders.

Theories of Capitalization

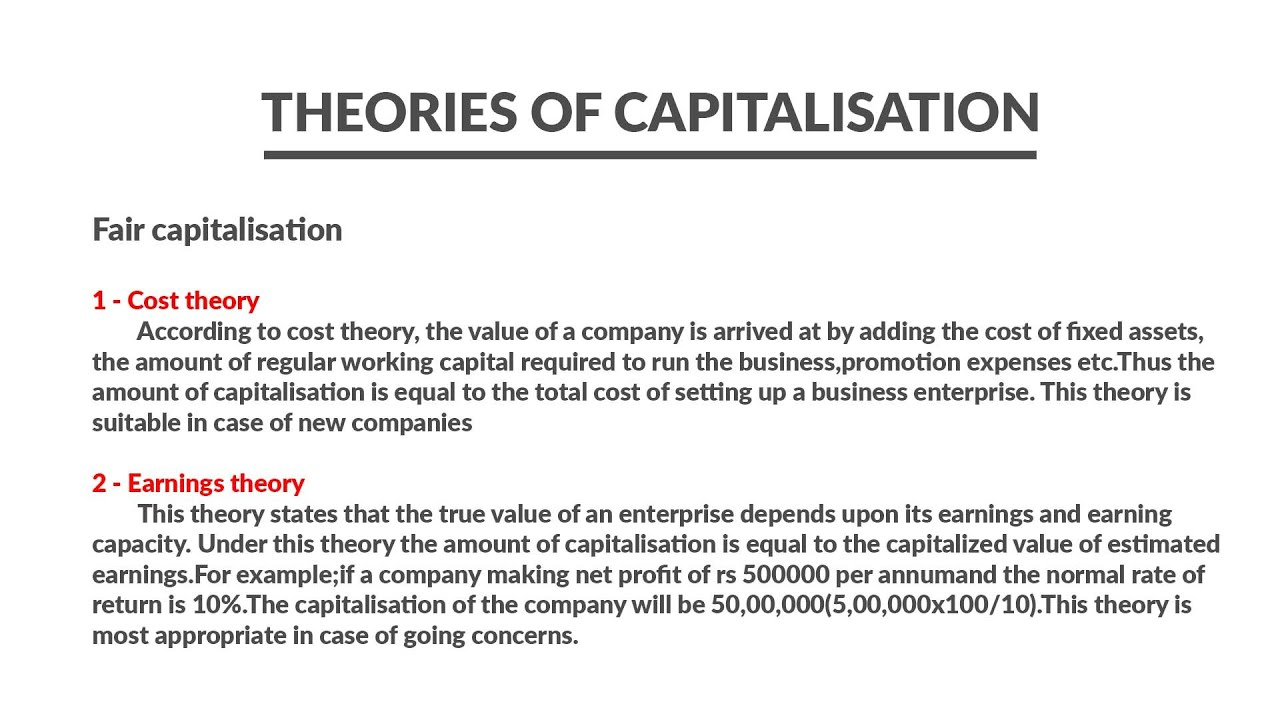

There are two main theories on how to determine the value of a company through capitalization: the Cost Theory and the Earning Theory.

1. Cost Theory

This theory focuses on the cost of acquiring assets. The total capitalization value is determined by adding up all the costs incurred in acquiring the assets a company uses. These costs include:

- Fixed Assets: Land, buildings, machinery, etc.

- Current Assets: Raw materials, inventory, debtors.

- Preliminary Expenses: Costs associated with starting the business, including expenses for issuing shares or securities.

When it's best used: The Cost Theory is often most useful for new companies because it helps them determine the total amount of capital they need to launch and operate their business.

Limitations:

- Ignores Earning Capacity: The cost theory only looks at what was spent to acquire assets. It does not consider how well those assets are able to produce income.

- Ignores Obsolescence: The cost theory does not take into account the time when the asset may become outdated or no longer useful.

- Not Useful for Fluctuating Earnings: The cost theory doesn't work well for companies that have very inconsistent or changing earnings.

2. Earning Theory

This theory focuses on the earning capacity of the business. It determines the capitalization value based on how much money a company is expected to make. The calculation uses a capitalization rate, which is usually the representative rate of return in the industry.

Calculation:

When it's best used: This theory is generally more relevant for mature companies with a stable history of earnings.

Limitations:

- Difficult to Estimate Future Earnings: For new companies, it can be difficult to accurately estimate future earnings.

- Inaccurate Capitalization Rate: If the capitalization rate is not a proper representation for a firm, then the calculation will be inaccurate.

- Influence of Mistake in Earnings: Any error in the future earnings estimation will have a direct impact on the amount of capitalization value.

Watered Stock

Watered stock is an illegal practice where a company issues shares at a value that is much higher than the actual value of the company's assets. It is a way to fraudulently inflate the value of the company. It typically happens by overstating the book value of the company.

Origin of the Term: The term "watered stock" is believed to have come from ranchers who would make their cattle drink large amounts of water before taking them to market. The weight of the consumed water would deceptively make the cattle appear heavier.

Key Characteristics:

Fraudulent Scheme:It's a deliberate attempt to deceive investors.Inflated Value:Shares are issued at a price higher than their true worth.Overstated Book Value:The company inflates its asset value on paper to justify the inflated share price.

Consequences: Once revealed, watered stock becomes difficult to sell and is often sold at much lower prices than the initial price.

Over-Capitalization

Concept of Over-Capitalization

Over-capitalization is a situation where a company's total capitalization is greater than the real value of its assets. The earning capacity of the company is lower than what its capitalization would suggest. Over-capitalization is a chronic financial problem.

Explanation with Example:

Consider a company with a book value of assets at Rs. 25,00,000 and a capitalization of Rs. 25,00,000 (through equity, preference capital and debentures). However, the true value of its assets, based on its earnings capacity, might only be Rs. 15,00,000. This signifies that the company is over-capitalized by Rs. 10,00,000. The excess of Rs. 10,00,000 represents idle funds not generating any profits for the company.

Key Characteristics:

Book Value > Real Value:The company's assets are valued at more on paper than their actual worth.Reduced Earning Capacity:The company's ability to generate profits is lower than it should be.Chronic Financial Disease:Over-capitalization is a long-term financial problem.

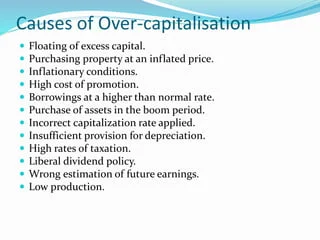

Causes of Over-Capitalization

Assets Acquired at Inflated Prices:When assets are purchased from promoters at prices higher than their market value, it leads to over-capitalization. The excess price paid does not contribute to the earning capacity of those assets.Issue of Excessive Finances:When a company raises more funds than it can profitably use, it leads to over-capitalization. A large portion of those funds remains idle without generating profit.Huge Borrowings at High Interest Rates:Taking on significant debt at high interest rates can hinder a company's ability to pay a good return on equity, resulting in over-capitalization.Liberal Dividend Policy:If a company pays out a large portion of its profits as dividends instead of reinvesting in the business, it can hinder growth, reduce earning capacity, and contribute to over-capitalization.High Rates of Corporate Taxes:High corporate taxes reduce the company’s earnings which can be used for reinvestment purposes. This can further contribute to over-capitalization

Consequences of Over-Capitalization

Over-capitalization has negative effects on companies, their members, workers, and society.

1. Consequences for the Company:

Poor Market Value of Shares:An unsatisfactory rate of return on equity lowers the value of the company's stock.Loss of Goodwill:Investors lose faith in the company.

2. Consequences for the Members (Shareholders):

Reduced and Uncertain Dividends:Shareholders receive lower and less consistent dividends.Capital Loss:The market value of their shares decreases.

3. Consequences for the Workers:

Wage Cuts:Reduced profitability can lead to a decrease in workers' wages.Loss of Employment:In severe cases of over-capitalization, the company could get liquidated, resulting in unemployment for the workers.

4. Consequences for the Society:

Wastage of Resources:An underperforming company wastes valuable resources that could be more productively used elsewhere.Loss of Production and Employment:The closure of an over-capitalized company leads to a loss of production and job losses within the community.