Meanin and sinificance , types of workin capital , workin capital cycle

I. Management of Working Capital: Meaning and Significance

Definition: Working capital management is the process of planning and controlling a company's current assets (cash, marketable securities, accounts receivable, inventory) and current liabilities (accounts payable, short-term debt, accrued expenses) to ensure the company has sufficient liquidity to meet its short-term obligations and operate efficiently. It's about managing the difference between current assets and current liabilities.

Formula: Working Capital = Current Assets - Current Liabilities

Goal: To maintain an optimal level of working capital that supports the company's day-to-day operations while minimizing the cost of holding current assets.

Significance:

Liquidity: Ensures the company has enough liquid assets (cash or easily convertible assets) to pay its bills and meet its short-term obligations as they come due.

Profitability: Efficient working capital management can improve profitability by minimizing financing costs, reducing inventory holding costs, and optimizing credit policies.

Operational Efficiency: Effective working capital management allows a company to operate smoothly by ensuring that sufficient inventory is available, payments are collected on time, and suppliers are paid promptly.

Solvency: Maintaining a healthy level of working capital is crucial for a company's long-term solvency (ability to meet long-term obligations).

Creditworthiness: Strong working capital management enhances a company's creditworthiness, making it easier to obtain financing from banks and other lenders.

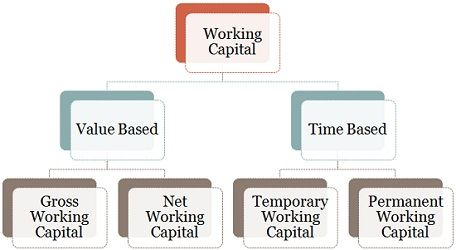

A. Based on Concept:

- Gross Working Capital:

Definition: The total investment in current assets.

Focus: Emphasizes the operational aspect of working capital (managing assets).

Advantage: Simple to calculate.

Disadvantage: Doesn't reflect the true liquidity position (because it ignores current liabilities).

- Net Working Capital (NWC):

Definition: The difference between current assets and current liabilities.

Formula: Net Working Capital = Current Assets - Current Liabilities

Focus: Emphasizes the financial aspect of working capital (liquidity and solvency).

Significance: Provides a more accurate picture of a company's liquidity position. A positive NWC indicates the company has enough current assets to cover its current liabilities.

B. Based on Time:

- Permanent (Fixed) Working Capital:

Definition: The minimum level of current assets that a company needs to operate at all times. It's the portion of working capital that remains relatively constant.

Example: A baseline level of inventory needed to meet customer demand, a minimum cash balance for day-to-day transactions.

Financing: Should ideally be financed with long-term sources of funding (e.g., equity, long-term debt).

- Temporary (Variable) Working Capital:

Definition: The additional current assets needed to support fluctuations in sales or production levels. It varies with the business cycle or seasonal changes.

Example: Increased inventory during peak sales seasons, higher accounts receivable when sales are high.

Financing: Can be financed with short-term sources of funding (e.g., bank loans, trade credit).

III. Working Capital Cycle

Definition: The working capital cycle (also called the cash conversion cycle) is the length of time it takes for a company to convert its investments in inventory and other current assets into cash. It measures the time it takes to turn raw materials into cash from sales.

Components:

- Inventory Conversion Period (ICP): The time it takes to convert raw materials into finished goods and sell them.

Formula: ICP = (Average Inventory / Cost of Goods Sold) * 365 days

- Receivables Conversion Period (RCP) / Days Sales Outstanding (DSO): The time it takes to collect cash from customers after a sale.

Formula: RCP = (Average Accounts Receivable / Credit Sales) * 365 days

- Payables Deferral Period (PDP): The time a company takes to pay its suppliers.

Formula: PDP = (Average Accounts Payable / Purchases) * 365 days

Working Capital Cycle Formula:

Working Capital Cycle = Inventory Conversion Period + Receivables Conversion Period - Payables Deferral Period

WCC = ICP + RCP - PDP

Significance:

Shorter Cycle: A shorter working capital cycle is generally desirable. It means the company is more efficient at converting its resources into cash.

Longer Cycle: A longer cycle can indicate problems such as slow-moving inventory, difficulty collecting payments from customers, or overly generous payment terms to suppliers.

Cash Flow Management: Understanding the working capital cycle helps companies manage their cash flow more effectively.