Over capitalization and Under capitalization

Over-Capitalization

Concept of Over-Capitalization

Over-capitalization is a situation where a company's total capitalization is greater than the real value of its assets. The earning capacity of the company is lower than what its capitalization would suggest. Over-capitalization is a chronic financial problem.

Explanation with Example: Consider a company with a book value of assets at Rs. 25,00,000 and a capitalization of Rs. 25,00,000 (through equity, preference capital and debentures). However, the true value of its assets, based on its earnings capacity, might only be Rs. 15,00,000. This signifies that the company is over-capitalized by Rs. 10,00,000. The excess of Rs. 10,00,000 represents idle funds not generating any profits for the company.

Key Characteristics:

- Book Value > Real Value: The company's assets are valued at more on paper than their actual worth.

- Reduced Earning Capacity: The company's ability to generate profits is lower than it should be.

- Chronic Financial Disease: Over-capitalization is a long-term financial problem.

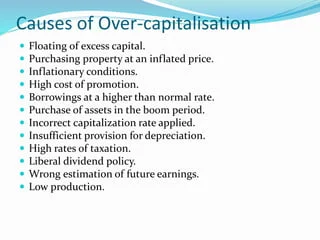

Causes of Over-Capitalization

-

Assets Acquired at Inflated Prices: When assets are purchased from promoters at prices higher than their market value, it leads to over-capitalization. The excess price paid does not contribute to the earning capacity of those assets.

-

Issue of Excessive Finances: When a company raises more funds than it can profitably use, it leads to over-capitalization. A large portion of those funds remains idle without generating profit.

-

Huge Borrowings at High Interest Rates: Taking on significant debt at high interest rates can hinder a company's ability to pay a good return on equity, resulting in over-capitalization.

-

Liberal Dividend Policy: If a company pays out a large portion of its profits as dividends instead of reinvesting in the business, it can hinder growth, reduce earning capacity, and contribute to over-capitalization.

-

High Rates of Corporate Taxes: High corporate taxes reduce the company’s earnings which can be used for reinvestment purposes. This can further contribute to over-capitalization

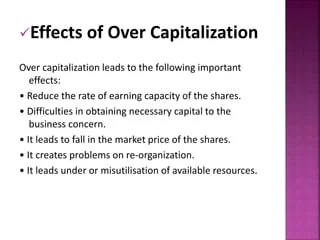

Consequences of Over-Capitalization

Over-capitalization has negative effects on companies, their members, workers, and society.

1. Consequences for the Company:

- Poor Market Value of Shares: An unsatisfactory rate of return on equity lowers the value of the company's stock.

- Loss of Goodwill: Investors lose faith in the company.

2. Consequences for the Members (Shareholders):

- Reduced and Uncertain Dividends: Shareholders receive lower and less consistent dividends.

- Capital Loss: The market value of their shares decreases.

3. Consequences for the Workers:

- Wage Cuts: Reduced profitability can lead to a decrease in workers' wages.

- Loss of Employment: In severe cases of over-capitalization, the company could get liquidated, resulting in unemployment for the workers.

4. Consequences for the Society:

- Wastage of Resources: An underperforming company wastes valuable resources that could be more productively used elsewhere.

- Loss of Production and Employment: The closure of an over-capitalized company leads to a loss of production and job losses within the community.

Remedial Actions for Overcapitalization:

Here are various strategies a company can employ to address its overcapitalized state:

1. Reducing Capital Base

- Repurchase Stock: If the company has excess cash, it can buy back its own shares. This reduces the number of outstanding shares and can increase earnings per share (EPS), making the stock more attractive to investors.

- Pay Down Debt: Use excess cash to pay off outstanding loans. This reduces interest expenses and improves the company's financial health.

- Return Capital to Investors: If the company cannot find profitable uses for its excess capital, it might consider returning it to shareholders through special dividends or other distributions.

2. Optimizing Asset Utilization

- Sell Unproductive Assets: Dispose of assets that are not contributing to the company's profitability. This could include obsolete equipment, unused land, or other non-core assets.

- Lease Instead of Buying: Consider leasing assets rather than purchasing them. This reduces the initial capital outlay and may improve cash flow.

- Increase Asset Turnover: Focus on utilizing existing assets more efficiently to generate more revenue. Improve processes, optimize scheduling, and find ways to increase output without requiring new investments.

3. Improving Operational Efficiency

- Cost Cutting Measures: Analyze and reduce operating expenses. This can involve negotiating better deals with suppliers, improving efficiency, streamlining processes, and reducing waste.

- Increase Revenue: Develop strategies to increase sales volume, diversify product offerings, or enter new markets.

- Optimize Pricing: Review pricing strategies to ensure they are competitive and profitable.

- Focus on Profitable Segments: Concentrate on the most profitable areas of the business and cut back on less profitable ones.

4. Strategic Repositioning

- Divest Non-Core Businesses: If the company has diversified into areas that are not performing well, consider selling off non-core businesses to focus on core competencies.

- Refocus on Growth Opportunities: Identify and invest in areas with higher growth potential and profitability. This might require shifting resources from underperforming areas.

- Develop New Products or Services: Innovate and develop new offerings that can generate new revenue streams and improve overall profitability.

5. Restructuring Capital Structure

- Debt Refinancing: If the company has high-interest debt, consider refinancing it with lower interest rates. This reduces interest expenses and improves cash flow.

- Equity Restructuring: Reorganizing or consolidating various classes of equity to create a more efficient capital structure.

- Convert Debt to Equity: If appropriate, consider converting debt into equity, reducing the company's debt burden.

Under-Capitalization

Under-capitalization occurs when a business doesn't have enough capital to operate effectively and reach its full potential. This can hinder growth, create financial instability, and ultimately threaten the survival of the business. It's the opposite of overcapitalization, where a company has too much capital.

Understanding Under-Capitalization

Simply put, under-capitalization means a company doesn't have sufficient funds to cover its operational costs, investments, or growth initiatives. This lack of funding can severely limit a company's ability to compete, innovate, and expand.

Effects of Under-Capitalization

The consequences of under-capitalization can be severe and wide-ranging:

- Slowed Growth: Limited funds restrict the ability to expand operations, hire key talent, or enter new markets, hindering growth potential.

- Missed Opportunities: The inability to seize market opportunities, develop new products, or respond quickly to customer needs due to lack of capital.

- Cash Flow Problems: Difficulty in meeting short-term obligations, paying suppliers, and managing payroll, leading to potential cash flow crises.

- Inability to Invest in Essential Infrastructure: Lack of funds to invest in necessary equipment, technology, or facilities, limiting efficiency and productivity.

- Reduced Profitability: Increased operating costs, higher interest expenses (due to reliance on short-term loans), and missed opportunities can lead to reduced profitability.

- Poor Credit Rating: Difficulty meeting financial obligations can damage the company's credit rating, making it harder to secure future financing.

- Increased Risk of Failure: The combination of these factors can significantly increase the risk of business failure or bankruptcy.

- Damaged Reputation: Inability to meet commitments to customers or suppliers can damage the company's reputation.

- Limited Innovation: Lack of funds to invest in R&D limits a company's ability to innovate and remain competitive.

Causes of Under-Capitalization

Several factors can lead to a company being under-capitalized:

- Inadequate Initial Funding: Starting a business with insufficient capital, often due to underestimation of startup costs or over-reliance on personal savings.

- Poor Financial Planning: Lack of a comprehensive financial plan that accurately projects capital needs and identifies funding sources.

- Overly Optimistic Sales Forecasts: Underestimating the time it takes to generate revenue, leading to a cash shortfall before sales pick up.

- Unexpected Expenses: Unforeseen costs that were not accounted for in the budget can deplete available capital.

- Rapid Growth Without Sufficient Capital: Experiencing rapid growth that outpaces the company's financial resources, leading to a cash crunch.

- Difficulty Obtaining Financing: Struggling to secure loans or attract investors due to poor credit, lack of a proven track record, or unfavorable market conditions.

- Mismanagement of Funds: Inefficient spending, poor budgeting, and inadequate cash flow management can contribute to under-capitalization.

- Economic Downturns: Economic recessions or industry-specific challenges can impact a company's sales and its ability to secure financing.

Remedies for Under-Capitalization

Addressing under-capitalization requires proactive measures to secure additional funding and improve financial management. Here are some remedies:

1. Securing Additional Funding

-

Equity Financing:

- Angel Investors: Seek funding from individual investors who provide capital in exchange for equity.

- Venture Capital: Raise capital from venture capital firms that invest in high-growth potential companies.

- Strategic Partners: Partner with other companies that can provide funding and resources.

- Initial Public Offering (IPO): Consider an IPO if the company is large enough and ready for the public market.

-

Debt Financing:

- Bank Loans: Secure loans from banks or other financial institutions.

- Lines of Credit: Obtain a line of credit that can be accessed as needed.

- Small Business Administration (SBA) Loans: Explore government-backed loan programs for small businesses.

- Corporate Bonds: Issue corporate bonds to raise capital from investors.

-

Alternative Financing:

- Crowdfunding: Raise small amounts of capital from a large number of individuals online.

- Invoice Factoring: Sell outstanding invoices to a factoring company for immediate cash.

- Equipment Leasing: Lease equipment instead of purchasing it to conserve cash.

2. Improving Financial Management

- Develop a Robust Financial Plan: Create a detailed financial plan that includes accurate sales projections, cost estimates, and cash flow forecasts.

- Effective Budgeting: Implement a strict budgeting process to track income and expenses, identify areas for cost savings, and ensure resources are allocated effectively.

- Cash Flow Management: Monitor cash flow regularly, implement strategies to speed up collections and delay payments when possible, and maintain sufficient cash reserves.

- Expense Control: Reduce unnecessary costs, negotiate better rates with suppliers, and cut back on non-essential spending.

- Inventory Management: Optimize inventory levels to avoid excessive stock or shortages, minimizing storage costs and waste.

- Seek Expert Advice: Consult with financial advisors, accountants, or business mentors to develop a sound financial strategy.

3. Operational Efficiency

- Increase Revenue: Focus on increasing sales by exploring new markets, diversifying product offerings, and improving marketing efforts.

- Improve Productivity: Streamline processes, train employees, and adopt technology to improve efficiency and reduce operational costs.

- Strategic Partnerships: Partner with complementary businesses to expand reach, reduce costs, and share resources.