Ownership Securities

Business Funds: Understanding Equity, Preference, and Other Share Types

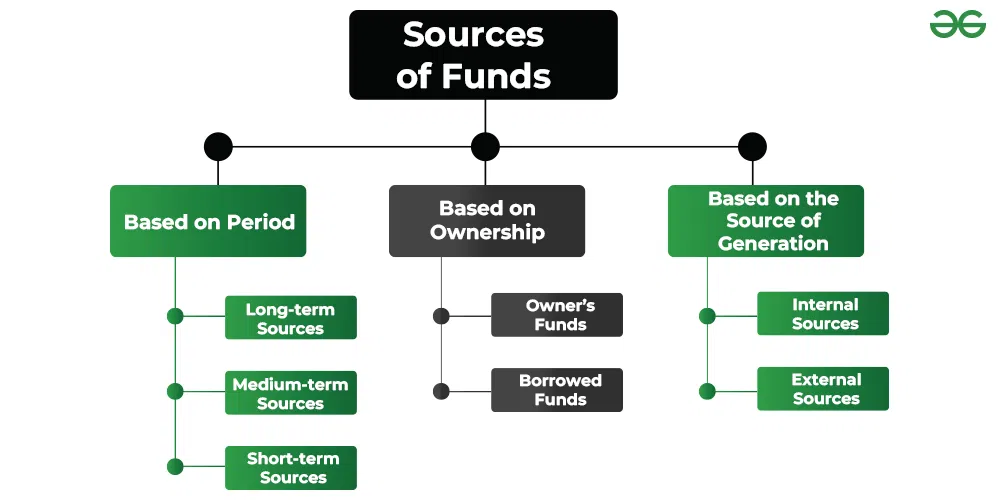

Businesses require a continuous flow of funds to operate and grow. These funds can be categorized based on time period, ownership, control, and source of generation. This document will focus on different types of shares, specifically equity shares, preference shares, and other related concepts.

Core Concepts

- Business Funds: Money required for a business to function.

- Shares: Units into which a company's capital is divided.

- Shareholder: A person holding shares in a company.

Equity Shares (Ordinary Shares)

-

Definition: Equity shares represent fractional ownership in a company. Holders are considered members and bear the maximum business risk.

-

Key Characteristics:

- Ownership Capital: Capital raised through equity is considered ownership capital.

- Voting Rights: Equity shareholders have voting rights and participate in company management.

- Residual Owners: They receive dividends only after all other claims are settled, and dividend payment is not fixed.

- Long-Term Capital: Equity shares are a crucial source of long-term finance.

-

Merits of Equity Shares:

- Foundation of Capital: Provides the base for the company's capital structure.

- Creditworthiness: Enhances the company's credit rating and confidence among lenders.

- High Returns: Attracts investors seeking higher returns (with higher risk).

- No Compulsory Dividend: No legal obligation to pay dividends if the company doesn't profit.

- No Asset Charge: Does not create a charge on the company's assets.

- Democratic Control: Voting rights allow shareholders to have democratic control over management.

-

Limitations of Equity Shares:

- Unstable Income: Not ideal for investors who prefer steady income.

- High Cost: Often the most expensive way for a company to raise funds.

- Dilution of Voting: Issuing new equity dilutes the voting power of existing shareholders.

- Time-Consuming: Involves many legal procedures and delays.

Preference Shares

Other Types of Shares

Creditorship Securities

- Definition: Also known as debt finance, these are funds raised from creditors (not through ownership).

- Examples: Debentures and bonds are the main types of creditorship securities.

Key Takeaways

This information provides a fundamental understanding of different share types and their relevance in business financing. When making investment or financing decisions, it's important to carefully assess the characteristics, advantages, and limitations of each type of share.