Benefits of Owning Shares, Risks of Owning Shares, and Corporate Actions

Benefits of Owning Shares, Risks of Owning Shares, and Corporate Actions

I. Benefits of Owning Shares

- Ownership: Holding shares means having an ownership stake in a company, which carries certain benefits and rights.

- Ordinary Shareholders: Expected to be the major beneficiaries of a company’s success.

1. Dividends

- Definition: Return that an investor gets for providing risk capital to a business, paid out of company profits (distributable reserves).

- Company Goal: Companies aim to pay steadily growing dividends to maintain shareholder confidence.

-

Dividend Yield: Dividend as a percentage of the current share price.

- Facilitates comparison with other investments (shares, bonds, bank deposits).

-

Higher than Average Dividend Yield:

- Mature company with limited growth potential, distributes profits. (e.g., utilities)

- Company has a low share price, possibly due to poor performance or expectations.

-

Lower than Average Dividend Yield:

- High share price due to perceived high growth prospects.

- Profits being reinvested in the business.

- Low dividend yields might indicate poor past performance, which has now been reflected in the share price.

2. Capital Gains

- Definition: Profit from an increase in share price over time.

- Unrealized Gain: Gain exists on paper until shares are sold.

- Realized Gain: Gain made when shares are actually sold.

-

Total Financial Return: Historically split between dividends and capital gains.

- Capital gains simply accumulate in value; dividends need to be reinvested.

3. Shareholder Benefits (Perks)

- Some companies offer perks to shareholders, such as discounts on products or services. (e.g., mobile phones, ferry tickets).

- Not a major factor in investment decisions, but can be a nice bonus.

4. Right to Subscribe for New Shares (Pre-emption Rights)

- Purpose: Protects existing shareholders from losing control or having their ownership diluted.

- Pre-emption Rights: Existing shareholders are given the right to subscribe for new shares before they are offered to the public, in many cases, with some form of compensation if they decide not to do so.

- Rights Issue: A method to raise additional capital from existing shareholders by offering new shares.

-

Global Differences:

- UK: Pre-emption rights are taken very seriously.

- US: Pre-emption rights are not common, and new shares can be sold to the highest bidder without shareholder protection.

5. Right to Vote

II. Risks of Owning Shares

- General: Risk levels depend on the company, industry, and country it operates in.

- Potential: Shares offer the potential for high returns, but it is important to assess the associated risks.

1. Price and Market Risk

- Definition: Risk that share prices, in general, might fall, even if a company is doing well.

- Impact: Investors could face a loss of capital, despite the company continuing to pay dividends.

-

Variations:

- Volatile shares (e.g., companies exposed to global economic trends) exhibit more price risk than ‘defensive’ shares (e.g., utility companies).

2. Liquidity Risk

- Definition: Risk that shares may be difficult to sell at a reasonable price.

-

Triggers:

- Shares in thinly traded companies (smaller companies or those with low trading activity).

- Falling share prices, which can widen the spread between bid and offer prices.

3. Issuer Risk

- Definition: Risk that the issuing company collapses and shares become worthless.

- Low Issuer Risk: Larger, well-established companies are generally viewed as having low issuer risk.

- High Issuer Risk: New companies that have not managed to report profits might have a higher level of issuer risk.

- Examples: Collapse of Enron and Lehman Brothers show the risk is real and present.

4. Foreign Exchange Risk

- Definition: Risk that currency fluctuations will negatively impact the value of an investment.

- Impact: Currency movements can wipe out or reduce gains or enhance gains.

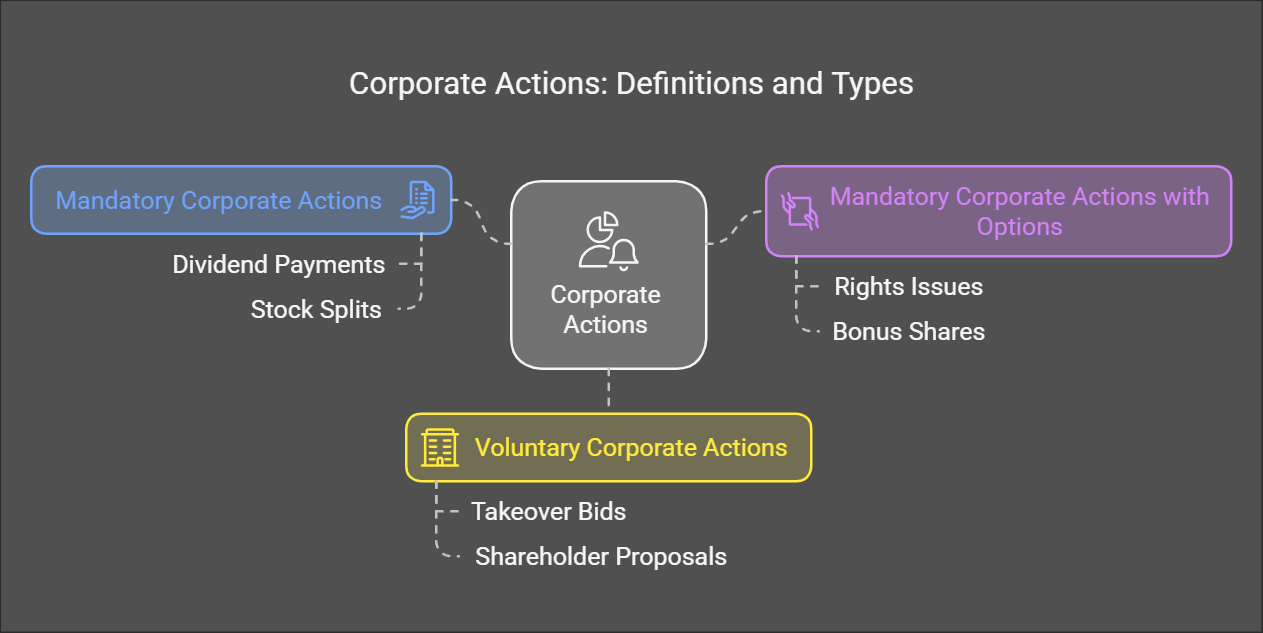

III. Corporate Actions

-

Definition: Actions taken by a company that affect its share capital or bonds.

-

Types:

-

Mandatory Corporate Actions:

- Definition: Actions mandated by the company that do not require shareholder intervention (e.g., dividend payments).

-

Mandatory Corporate Actions with Options:

- Definition: Actions that have a default option, but shareholders can choose an alternative (e.g., rights issues).

-

Voluntary Corporate Actions:

-

-

US Classification:

- Corporate actions are classified simply as "voluntary" and "mandatory".

- Mandatory events with options are split into two or more events.