Depositary receipts, world stock markets, indices and settlement systems

Depositary Receipts

What are Depositary Receipts?

- Financial instrument representing ownership of a foreign company's shares.

- Allows indirect investment in foreign companies without directly purchasing shares.

- Various forms: American Depositary Receipts (ADRs), Global Depositary Receipts (GDRs), European Depositary Receipts (EDRs).

- Issued by banks or financial institutions holding the actual shares.

- Provides portfolio diversification and exposure to international markets.

- Custodian Bank: The bank or financial institution that issues the depository receipts acts as a custodian for the underlying shares of the foreign company. They hold these shares on behalf of the depository receipt holders and facilitate the issuance and redemption of receipts.

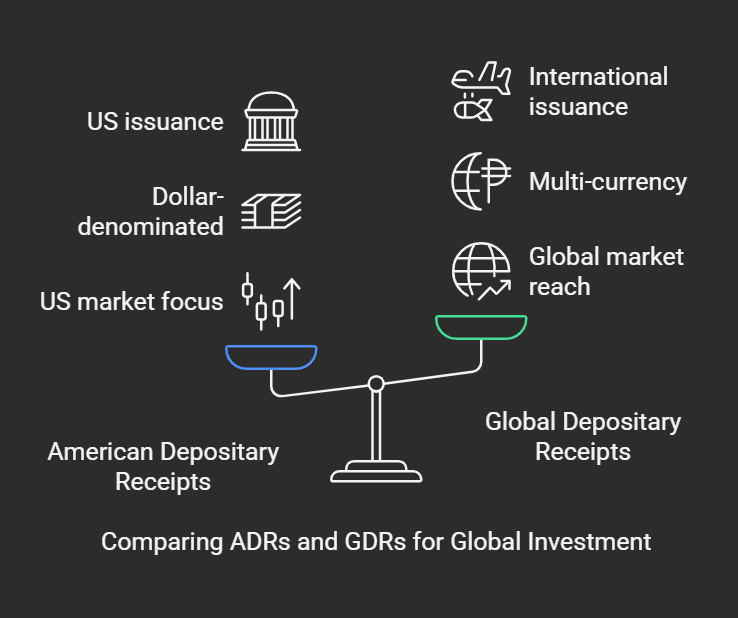

American Depositary Receipts (ADRs)

- Introduced in 1927.

- Enables US investors to hold overseas shares, avoiding high dealing costs and settlement delays.

- Dollar-denominated, issued in bearer form, depository bank is the registered shareholder.

- Depository bank handles dividend payments (in USD) and voting via proxy.

- Beneficial owner can cancel the ADR and become the registered owner of the shares.

- Helps non-US companies attract US investors to raise funds.

- Listed and traded on NYSE and NASDAQ.

Global Depositary Receipts (GDRs)

- Issued outside the US.

- Traded on many exchanges.

World Stock Markets

- Organized marketplace for issuing and trading securities.

- Listed companies must meet specific criteria.

- Trading systems: quote-driven or order-driven.

Trading Systems

Quote-Driven Systems

- Market makers provide continuous bid and offer prices.

- Make a profit through the price spread.

- Example: NASDAQ

Order-Driven Systems

- Electronic order book or auction process matches buyers and sellers.

- Buyers and sellers matched chronologically by price and quantity.

- No market makers required.

- Member firms input orders via computer terminals.

- Orders added to buy/sell queues or executed immediately.

Stock Market Indices

- Compute prices of a country’s listed companies.

- Snapshot of share price progress.

- Benchmark for investors to assess portfolio performance.

- Four uses:

- Act as Market Barometer

- Assist in Performance Measurement

- Act as the basis for index tracker funds, exchange-traded funds, index derivatives and other index-related products.

- Support Portfolio Management Research and Asset Allocation Decisions

Types of indices:

- Price-weighted: (Dow Jones Industrial Average (DJIA)) Only share price considered.

- Market capitalization-weighted: Takes into account the relative market capitalization of each stock.

- Equal-weighted: Assumes an equal investment in each stock.

Settlement Systems

###What is the difference between a depository and a clearing house?

- A depository holds and transfers securities, while a clearing house validates and settles transactions. ##Depository

- A financial institution that keeps securities safe and facilitates their transfer

- A centralized facility that holds securities in electronic form, known as demat accounts

- Eliminates the risk of theft and loss of physical securities

- Processes and settles transactions

- Distributes corporate benefits

- Typically pays interest on deposits

- Creates liquidity by lending out money ##Clearing house

- A financial institution that acts as an intermediary between buyers and sellers

- Validates transactions so that the buyer pays the seller the agreed-upon amount

- Ensures that both parties fulfill their obligations in a trade

- Processes payments safely and accurately

- Validates, clears, and settles trades executed on a stock exchange or other trading platform

- Helps payments move between different banks

- Ensures the smooth transfer of funds and securities

Settlement

- Final phase of the trading process.

- Delivery versus payment (DvP): Simultaneous exchange of stock and cash.

- Electronic systems: "Book entry transfer" (changing electronic records of ownership).

- For example, European equity trades are settled at T+2 which means that the trade will settle two business days after the trade date – so, a trade executed on Monday should settle two business days later on Wednesday.