Skip to main content

Global Financial Services

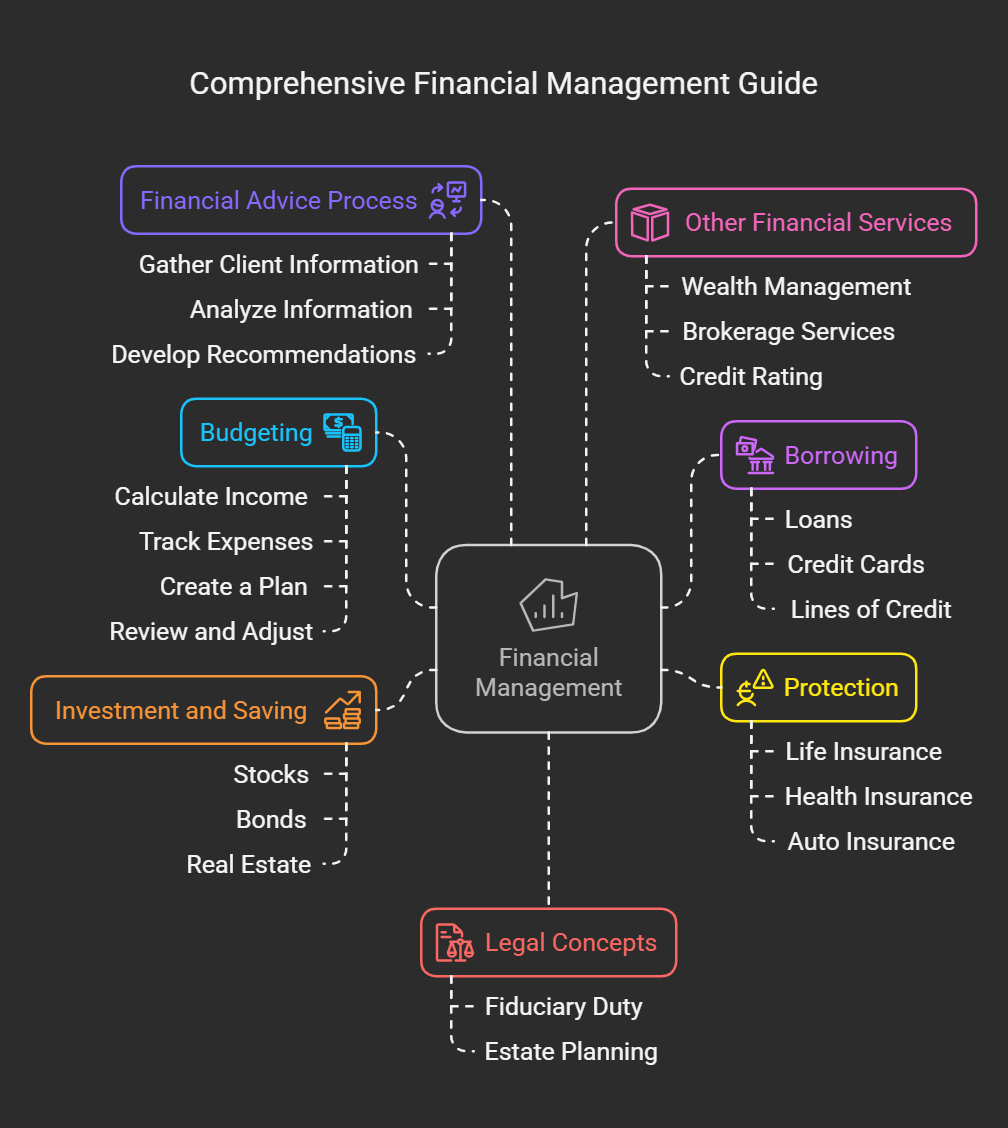

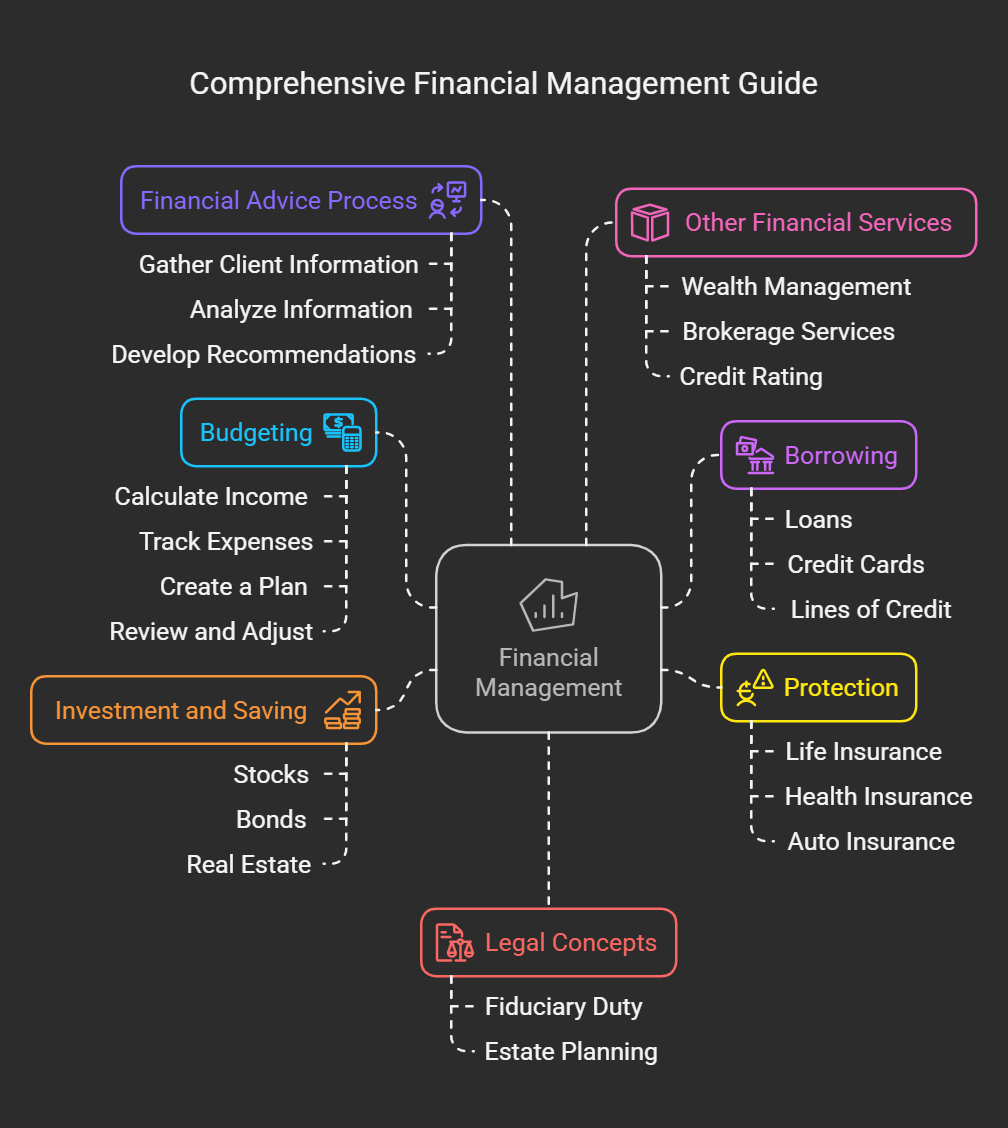

1. Budgeting

-

Definition: Creating a plan for how to spend your money.

-

Purpose:

- Track income and expenses.

- Identify areas to save.

- Achieve financial goals (e.g., buying a house, retirement).

- Avoid debt.

-

Key Steps:

-

Calculate Income: Know your net income (after taxes).

-

Track Expenses: Use budgeting apps, spreadsheets, or notebooks.

-

Create a Plan: Allocate money to different categories (housing, food, transportation, etc.).

-

Review and Adjust: Regularly compare your plan to actual spending and make changes.

-

Common Budgeting Methods:

-

50/30/20 Rule: 50% for needs, 30% for wants, 20% for savings/debt repayment.

-

Zero-Based Budget: Every dollar is assigned a purpose.

2. Borrowing

-

Definition: Obtaining money with the agreement to pay it back, usually with interest.

-

Types of Borrowing:

-

Loans: (e.g., personal loans, mortgages, student loans) Fixed amount, fixed repayment schedule.

-

Credit Cards: Revolving credit, flexible repayment options (but high interest if not paid in full).

-

Lines of Credit: Flexible borrowing amount, interest charged on what's used.

-

Key Considerations Before Borrowing:

-

Need vs. Want: Is it essential?

-

Affordability: Can you comfortably make the repayments?

-

Interest Rate: Compare rates from different lenders.

-

Loan Terms: Length of the loan impacts repayment amount and total interest paid.

-

Credit Score Impact: Borrowing and repayment history affects your credit score.

3. Protection (Insurance)

-

Definition: Transferring risk of financial loss to an insurance company.

-

Types of Insurance:

-

Life Insurance: Provides financial support to beneficiaries upon death.

-

Health Insurance: Covers medical expenses.

-

Homeowner's/Renter's Insurance: Protects your home and possessions.

-

Auto Insurance: Covers vehicle damage and liability.

-

Disability Insurance: Replaces income if you become disabled.

-

Importance:

- Provides financial security in unexpected events.

- Avoids wiping out savings due to large expenses.

-

Key Considerations:

-

Coverage Amount: How much protection do you need?

-

Deductible: Amount you pay out-of-pocket before insurance covers the rest.

-

Premiums: Cost of the insurance policy.

4. Critical Illness Insurance Cover

-

Definition: Insurance that pays a lump sum if you are diagnosed with a specified critical illness (e.g., cancer, heart attack, stroke).

-

Purpose:

- Cover medical expenses not covered by health insurance.

- Replace lost income.

- Pay for lifestyle changes or care needs.

-

Key Considerations:

-

Covered Illnesses: Understand which illnesses are included.

-

Waiting Period: Time before coverage begins.

-

Benefit Amount: How much lump sum will be paid?

-

Survival Period: Must survive a certain period after diagnosis to receive benefit.

-

Benefits vs. Life Insurance:

-

Critical Illness: Pays out while you are alive, to help with expenses related to the illness.

-

Life Insurance: Pays out after death, to provide for beneficiaries.

5. Investment and Saving

-

Definition: Setting aside money for future use and/or growing your wealth.

-

Saving: Typically short-term goals, low-risk, easily accessible (e.g., savings accounts, CDs).

-

Investment: Typically long-term goals, higher risk, potential for higher returns (e.g., stocks, bonds, real estate).

-

Key Principles:

-

Time Value of Money: Money today is worth more than money in the future due to potential earnings.

-

Compounding: Earning returns on your initial investment and accumulated interest.

-

Diversification: Spreading investments across different asset classes to reduce risk.

-

Risk Tolerance: Understanding your comfort level with potential losses.

-

Investment Options:

-

Stocks: Ownership shares in a company (higher risk, higher potential return).

-

Bonds: Lending money to a government or corporation (lower risk, lower potential return).

-

Mutual Funds: Pools money from many investors to invest in a diversified portfolio.

-

Exchange-Traded Funds (ETFs): Similar to mutual funds, but trade on stock exchanges.

-

Real Estate: Buying property (potential for appreciation and rental income).

-

Retirement Savings:

-

Employer-Sponsored Plans: 401(k), 403(b).

-

Individual Retirement Accounts (IRAs): Traditional IRA (tax-deductible contributions), Roth IRA (tax-free withdrawals).

6. Legal Concepts in Financial Advice

-

Fiduciary Duty: Financial advisors must act in the best interest of their clients.

-

Suitability Standard: Recommendations must be suitable for the client's financial situation.

-

Disclosure Requirements: Advisors must disclose fees, conflicts of interest, and other relevant information.

-

Privacy: Protecting client's financial information.

-

Contract Law: Understanding agreements between advisors and clients.

-

Estate Planning:

-

Wills: Legal document outlining how assets are distributed after death.

-

Trusts: Legal arrangement where assets are held and managed by a trustee for beneficiaries.

-

Power of Attorney: Authorizing someone to make financial or medical decisions on your behalf.

7. The Financial Advice Process

-

Gather Client Information:

- Financial goals, risk tolerance, time horizon, current financial situation.

-

Analyze Information:

- Assess assets, liabilities, income, expenses.

-

Develop Recommendations:

- Create a financial plan tailored to the client's needs and goals.

-

Implement Plan:

- Help the client execute the plan (e.g., open accounts, purchase investments).

-

Monitor and Review:

- Regularly track progress and make adjustments as needed.

- Review with the client at least annually.

8. Other Financial Services

-

Wealth Management: Comprehensive financial planning and investment management for high-net-worth individuals.

-

Portfolio Management: Professional management of investment portfolios to achieve specific goals.

-

Brokerage Services: Facilitating the buying and selling of securities for clients.

-

Credit Rating: Evaluation of a borrower's creditworthiness.

-

Investment Banking: Raising capital for companies through the issuance of securities.

-

Factoring: Purchasing a company's accounts receivable at a discount.

-

Depositories: Institutions that hold securities for safekeeping and facilitate electronic transfers.

9. Credit Rating

-

Definition: An evaluation of a borrower's ability to repay debt.

-

Purpose:

- Lenders use credit ratings to assess risk and determine interest rates.

- Investors use credit ratings to evaluate the creditworthiness of bonds.

-

Factors Considered:

- Payment history

- Outstanding debt

- Length of credit history

- Types of credit used

- New credit inquiries

-

Credit Score Ranges:

- Excellent: 750+

- Good: 700-749

- Fair: 650-699

- Poor: Below 650

-

Major Credit Rating Agencies:

- Equifax, Experian, TransUnion

10. Investment Banking

-

Definition: Financial institutions that help companies raise capital by issuing securities.

-

Key Activities:

-

Underwriting: Guaranteeing the sale of newly issued securities.

-

Mergers and Acquisitions (M&A) Advisory: Assisting companies with buying or selling other companies.

-

Financial Restructuring: Advising companies on how to reorganize their finances.

-

Research: Providing investment recommendations to clients.

11. Factoring

-

Definition: A financial transaction where a company sells its accounts receivable (invoices) to a third party (the factor) at a discount.

-

Purpose:

- Improve cash flow.

- Outsource credit control and collections.

-

Types of Factoring:

-

Recourse Factoring: The company is responsible for any uncollected invoices.

-

Non-Recourse Factoring: The factor assumes the risk of uncollected invoices.

12. Depositories

-

Definition: Institutions that hold securities for safekeeping and facilitate electronic transfers.

-

Purpose:

- Reduce the risk of physical loss or theft of securities.

- Streamline the settlement process.

- Facilitate electronic trading.

-

Key Functions:

- Safekeeping of securities

- Clearing and settlement

- Dividend and interest payments

- Proxy voting

-

Examples of Depositories:

- Central Securities Depositories (CSDs)

- Depository Trust & Clearing Corporation (DTCC)