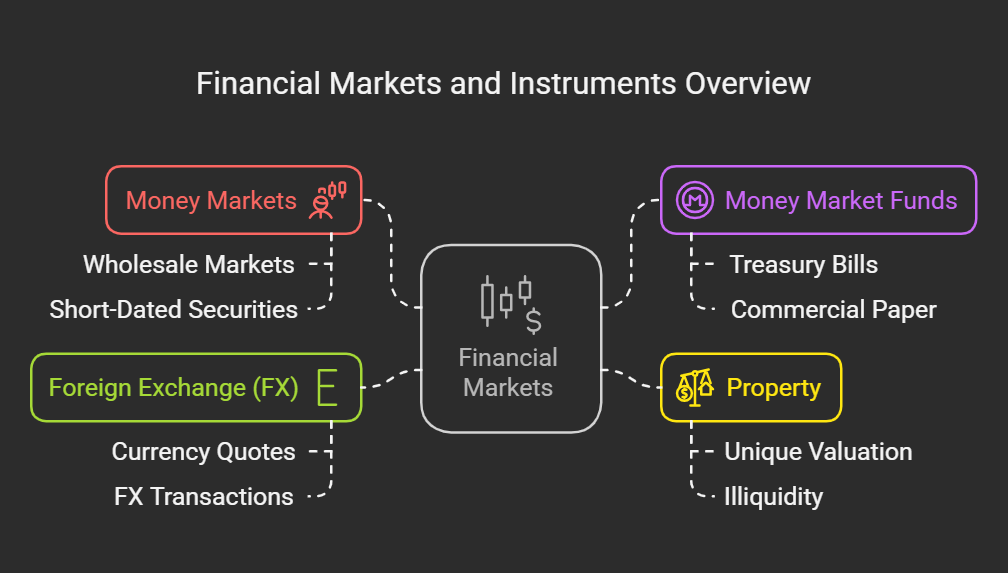

Money market, Property and FX

Money Markets

- Wholesale/institutional markets for cash.

- Issue, trading, and redemption of short-dated negotiable securities.

- Maturity up to one year (typically three months or less).

- Instruments issued at a discount to face value.

Money Market Funds

- Money market mutual fund, a collective investment scheme (CIS).

- Pools investors’ money to invest in short-term debt instruments (Treasury bills, CP).

- Pooling of funds, investor access to assets not otherwise available.

- Returns tend to be greater than a simple money market account.

Advantages and Disadvantages

- Short-term home for cash balances.

- Alternative to bonds and equities (in uncertain times).

- Disadvantage: Higher returns usually require larger investments.

- Money market funds: Invest in range of instruments, AAA-rated.

- Investment may be at risk and may not be suitable for all investors.

- Exchange rate risk.

Property

-

Unique asset class.

- Individual properties are unique.

- Subjective valuation.

- Complex legal considerations and high transaction costs.

- Relatively illiquid (can't sell parts of it easily).

- Diversification is difficult.

- Supply of land is finite.

-

Many private investors have chosen to become involved in the property market through the buy-to-let market or simply by buying a second home.

-

Other investors wanting to include property within a diversified portfolio generally seek indirect exposure via a mutual fund, property bonds issued by insurance companies, or shares in publicly quoted property companies.

Foreign Exchange (FX)

- Trading of one currency for another.

- Largest market in the world.

- Trading currencies became 24-hour because it could take place in the various time zones of Asia, Europe and America. London, being located between the Asian and American time zones, was well placed to take advantage of this and has grown to become the world’s largest forex market.

Currency Quotes

-

When currencies are quoted, the first currency is the base currency and the second is the counter or quote currency.

-

The base currency is always equal to one unit of that currency, in other words, one pound, one dollar or one euro.

-

For example, the EUR:USD exchange rate may be quoted as 1:1.1250, which means that €1 is worth US$1.125.

-

When the exchange rate is going up, it means that the value of the base currency is rising relative to the other currency and is referred to as the currency strengthening, and, when the opposite is the case, the currency is said to be weakening.

-

OTC Market, brokers and dealers negotiate directly with one another.

-

The main participants are large international banks which continually provide the market with both bid (buy) and ask (sell) prices.

-

Central banks are also major participants in FX markets, which they use to try to control money supply, inflation, and interest rates.

FX Transactions

- Spot transactions - the spot rate is the rate quoted by a bank for the exchange of one currency for another with immediate effect.

- Forward transactions - A buyer and seller agree on an exchange rate for any date in the future, for a fixed sum of money, and the transaction occurs on that date, regardless of what the market rates are then.

- Futures - standardized versions of forward transactions that are traded on derivatives exchanges in standard sizes and maturity dates.

- Swaps - two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date. These are not exchange-traded contracts and, instead, are negotiated individually between the parties to a swap.