Technological Advances and Other Developments

Technological Advances

Technology and the demand for greener solutions are fundamentally reshaping the financial services sector.

Advances in technology have radically altered how we use the internet and communicate, leading to the disruption of traditional industries, including finance.

Financial technology, known as FinTech, is significantly impacting traditional banking, wealth management, and insurance, necessitating the development of new digital services and platforms.

China's fund management industry serves as a prime example of rapid transformation, moving from a nascent state to a global leader in digital fund purchases.

In 2012, online fund purchases were minimal, while a recent survey from the Asset Management Association of China indicates that over two-thirds of investors now utilize mobile phone apps for fund subscriptions.

Specific Technological Advancements and Their Impacts

Mobile Technology: * The proliferation of smartphones and mobile internet access has enabled widespread adoption of mobile banking, payments, and investment apps. * Mobile platforms offer convenient and accessible financial services, especially in regions with limited branch infrastructure. * Examples: Mobile payment systems, mobile banking apps, mobile investment platforms.

Artificial Intelligence (AI) and Machine Learning (ML): * AI and ML are being used for fraud detection, risk assessment, algorithmic trading, and personalized financial advice. * Robo-advisors utilize algorithms to provide automated portfolio management services. * AI-powered chatbots offer customer support and handle routine inquiries.

Blockchain Technology: * Blockchain, the technology underpinning cryptocurrencies, is being explored for applications beyond cryptocurrencies, such as: * Secure and transparent record-keeping for financial transactions. * Streamlining supply chain finance. * Facilitating smart contracts.

Cloud Computing: * Cloud infrastructure provides scalability, flexibility, and cost-effectiveness for financial institutions. * Cloud-based services enable access to data analytics tools, software, and platforms, fostering innovation.

Impacts on the Financial Industry

Increased Efficiency: Automation and digitalization reduce operational costs and improve processing speeds.

Enhanced Customer Experience: Personalized services, 24/7 access, and seamless digital interfaces improve customer satisfaction.

Financial Inclusion: Technology enables access to financial services for underserved populations.

Disruption of Traditional Business Models: FinTech companies are challenging traditional banking and financial service providers.

Innovation and New Product Development: Technology enables the creation of new financial products and services.

Increased Competition: New technology allows more firms to compete in the financial sector.

Cybersecurity Concerns: Increased digitalization raises concerns about data privacy and security.

Environmental, Social, and Governance (ESG) Investment

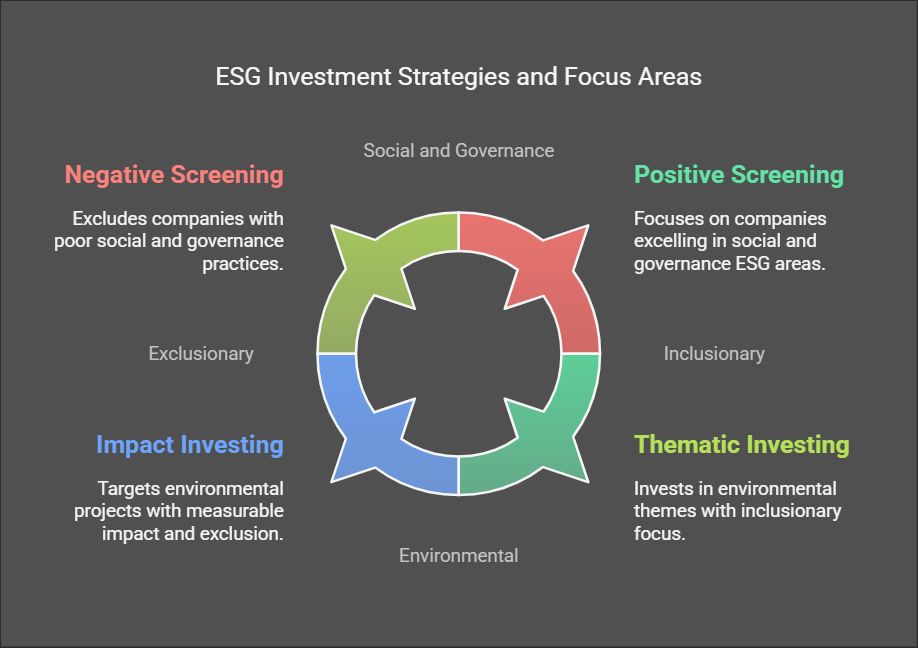

Definition: ESG investment refers to incorporating environmental, social, and governance factors into investment decision-making to generate long-term financial returns and positive societal impacts.

Component Focus Areas

Environmental: Sustainability, resource use, and ecological impact. * Examples: Reducing carbon footprints, renewable energy projects, pollution control, water conservation.

Governance: Corporate governance, ethical conduct, and transparency in operations. * Examples: Board diversity, executive compensation, anti-corruption policies, shareholder rights.

-

Why ESG Matters in Investment:

- Risk Mitigation: Helps identify companies with sustainable business practices and lower operational risks.

- Performance: ESG-compliant companies often demonstrate resilience and long-term financial stability.

- Stakeholder Expectations: Investors, customers, and governments increasingly demand responsible corporate behavior.

- Regulatory Pressure: Governments worldwide are implementing regulations promoting ESG practices.

-

Strategy Description Examples:

-

Negative Screening: Excludes companies or sectors that do not align with ESG criteria.

- Examples: Avoiding investments in tobacco, fossil fuels, or weapons industries.

-

Positive Screening: Focuses on companies excelling in specific ESG areas.

- Examples: Investing in companies leading in renewable energy or carbon neutrality.

-

Impact Investing: Targets investments with measurable social or environmental benefits alongside financial returns.

- Examples: Financing affordable housing projects or renewable energy plants.

-

Thematic Investing: Invests in themes or trends that align with ESG principles.

- Examples: Green bonds, water infrastructure funds, or clean technology ETFs.

- ESG Integration: Incorporates ESG criteria into traditional financial analysis.

-

Negative Screening: Excludes companies or sectors that do not align with ESG criteria.

-

Challenges in ESG Investment:

- Lack of Standardization: Varying ESG criteria and reporting frameworks.

- Greenwashing: Companies overstating or misrepresenting their ESG practices.

- Data Quality: Limited or inconsistent ESG data availability.

- Short-Term Costs: Transitioning to sustainable practices may initially require significant capital.

-

Global ESG Trends:

- Increased Adoption: Institutional investors and pension funds are prioritizing ESG-aligned portfolios.

- Regulation: Initiatives like the EU’s Sustainable Finance Disclosure Regulation (SFDR) are setting standards for ESG reporting.

- Technology Integration: AI and data analytics are being used to evaluate ESG metrics.

- ESG Bonds: Growth in green, social, and sustainability-linked bond markets.