Features and Advantages of GST

Features and Advantages of GST

The implementation of GST has been a landmark reform in India's indirect tax system. While there have been some challenges in its implementation, the benefits of GST in terms of reduced tax burden, increased transparency, and improved compliance are significant.

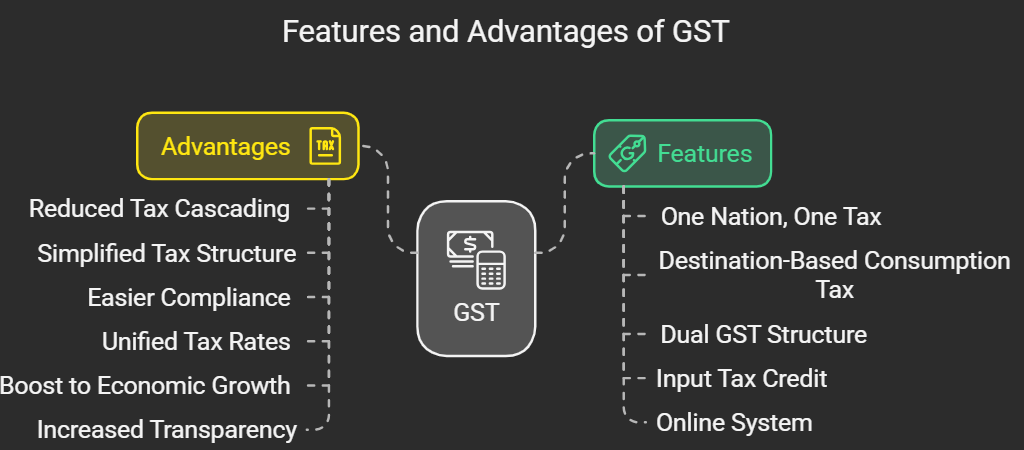

Features of GST

The Goods and Services Tax (GST) is a comprehensive indirect tax system with several key features that distinguish it from the previous tax regime:

- One Nation, One Tax: GST has created a unified common market in India by replacing multiple indirect taxes levied by the central and state governments with a single, comprehensive tax. This eliminates confusion and simplifies interstate trade.

- Destination-Based Consumption Tax: GST is levied on the consumption of goods and services at the point of consumption, meaning the tax is collected by the state where the goods or services are ultimately consumed.

- Dual GST Structure: GST comprises two components: Central GST (CGST) levied by the central government and State GST (SGST) levied by the state government. In the case of inter-state transactions, Integrated GST (IGST) is levied.

- Input Tax Credit (ITC): Businesses can claim credit for the GST paid on their inputs (raw materials, services, etc.) used in the production and distribution of goods and services. This eliminates the cascading effect of taxes, where taxes are paid on taxes.

- Online System: GST is implemented through an online system, making registration, return filing, and other processes more efficient and transparent.

Advantages of GST

The implementation of GST has brought about numerous advantages for businesses, consumers, and the Indian economy as a whole:

- Reduced Tax Cascading: The input tax credit mechanism eliminates the cascading effect of taxes, reducing the overall tax burden on businesses and consumers. This leads to lower prices for goods and services.

- Simplified Tax Structure: GST replaces a complex web of multiple indirect taxes with a single, unified tax system. This makes it easier for businesses to understand and comply with tax laws.

- Easier Compliance: The online GST system simplifies tax compliance procedures, making it easier for businesses to register, file returns, and pay taxes. This reduces the administrative burden on businesses and encourages tax compliance.

- Unified Tax Rates: GST has brought about uniformity in tax rates across the country, eliminating the disparity in tax rates between different states. This creates a level playing field for businesses and promotes a unified national market.

- Boost to Economic Growth: By simplifying the tax system and promoting a unified national market, GST has created a more conducive environment for businesses to operate and invest. This has contributed to economic growth and development.

- Increased Transparency: The online GST system has improved transparency and accountability in tax administration. This helps to reduce corruption and tax evasion.