Introduction

Goods and Services Tax (GST)

Introduction

The Goods and Services Tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption. It is a comprehensive, multi-stage, destination-based tax that has replaced many indirect taxes in India. The GST is levied at every stage of the supply chain, but the consumer bears only the final GST paid.

Concept

The GST is based on the concept of "One Nation, One Tax". It aims to create a unified common market by eliminating the cascading effect of taxes, promoting transparency, and increasing compliance. The GST is levied on the supply of goods and services, including imports. Exports are zero-rated.

Key features of GST:

- Destination-based taxation: GST is levied where the goods or services are consumed.

- Dual GST: It comprises two components: Central GST (CGST) and State GST (SGST).

- Input Tax Credit: Businesses can claim credit for the GST paid on inputs used in the supply of goods or services.

Benefits of GST:

- Reduced tax burden: Eliminates cascading effect of taxes.

- Simplified tax structure: Replaces multiple indirect taxes with a single tax.

- Increased compliance: Easier to comply with a single tax.

- Improved efficiency: Streamlines the tax administration process.

- Boost to economic growth: Promotes a unified common market and encourages investment.

GST Council:

The GST Council is a constitutional body that makes recommendations to the Union and State Governments on GST related matters. It comprises the Union Finance Minister, the Union Minister of State in charge of Revenue, and the Ministers in charge of finance or taxation of all the States.

Pre-GST and Post-GST Regime in India

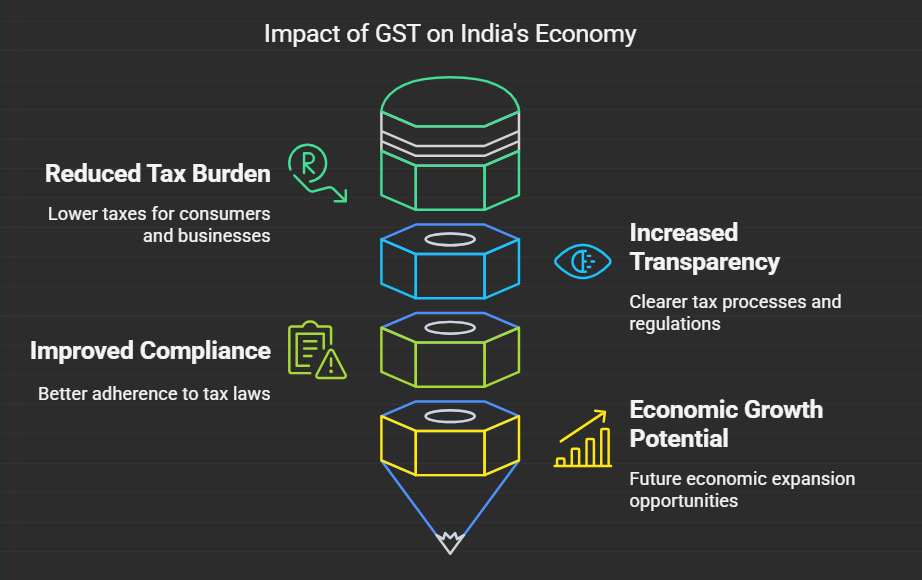

The implementation of GST has been a landmark reform in India's indirect tax system. While there have been some challenges, the benefits of GST in terms of reduced tax burden, increased transparency, and improved compliance are significant. The GST system is continuously evolving, and it is expected to play a crucial role in India's economic growth in the years to come.

Pre-GST Era

Before the implementation of GST in 2017, India's indirect tax system was a complex web of multiple taxes levied by both the central and state governments. This led to various challenges:

- Cascading effect of taxes: Taxes were levied at multiple stages of production and distribution, leading to an increase in the final price of goods and services.

- Tax evasion: The complex tax structure made it easier for businesses to evade taxes.

- Increased compliance burden: Businesses had to comply with multiple tax laws and regulations, leading to increased compliance costs.

- Barriers to interstate trade: Different tax rates and regulations across states hindered the free flow of goods and services.

Key taxes in the pre-GST regime:

- Central Excise Duty: Levied on the manufacture of goods.

- Service Tax: Levied on the provision of services.

- Value Added Tax (VAT): Levied on the sale of goods within a state.

- Central Sales Tax (CST): Levied on interstate sales.

- Octroi: A local tax levied on goods entering a municipal area.

Post-GST Era

The implementation of GST in 2017 marked a significant shift in India's indirect tax system. It aimed to address the challenges of the pre-GST regime by introducing a single, unified tax system.

Key features of the post-GST regime:

- One Nation, One Tax: A single tax levied on the supply of goods and services across India.

- Destination-based taxation: GST is levied where the goods or services are consumed.

- Input tax credit: Businesses can claim credit for the GST paid on inputs.

- Simplified tax structure: Reduced the number of taxes and simplified compliance procedures.

- Online procedures: GST registration, return filing, and other procedures are done online.

Benefits of the post-GST regime:

- Reduced tax burden: Elimination of cascading effect of taxes has led to lower prices for consumers.

- Increased transparency: The online GST system has improved transparency and accountability.

- Improved compliance: Simplified tax structure and online procedures have encouraged compliance.

- Boost to economic growth: GST has promoted a unified common market and facilitated interstate trade.

Challenges in the post-GST regime:

- Technological glitches: The initial rollout of the GST system faced some technological challenges.

- Compliance burden for small businesses: Small businesses faced difficulties in adapting to the new system.

- Rate rationalization: There have been ongoing discussions on rationalizing GST rates for various goods and services.