Mechanisms and Schemes under GST

Mechanisms and Schemes under GST

GST employs different mechanisms for collecting tax and offers specific schemes for different types of businesses. Here's a breakdown:

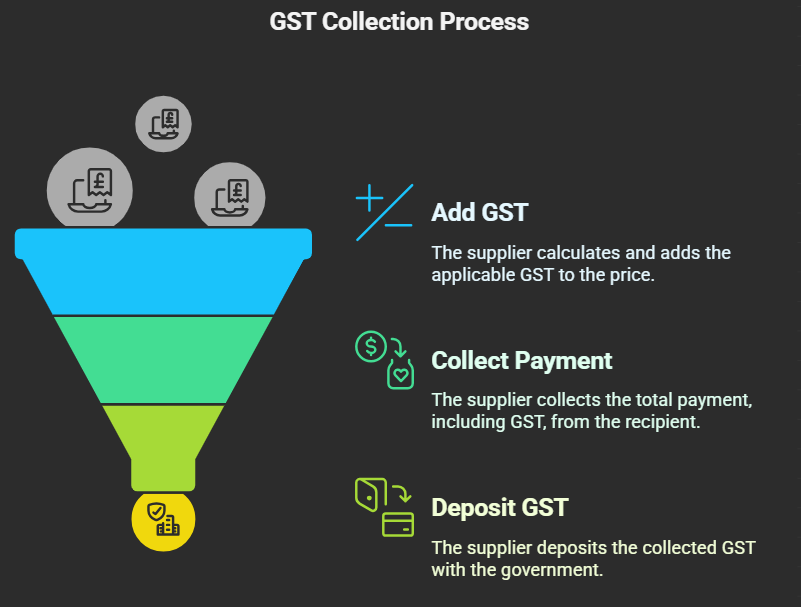

Forward Charge Mechanism

The forward charge mechanism is the standard way GST is collected. In this mechanism, the supplier of goods or services is responsible for collecting the GST from the recipient and depositing it with the government.

-

How it Works:

- The supplier adds the applicable GST to the price of the goods or services.

- The recipient pays the GST amount along with the price of the goods or services to the supplier.

- The supplier then deposits the collected GST to the government.

-

Example: If you buy a laptop from a store, the store will add GST to the price of the laptop. You pay the total amount (including GST) to the store, and the store is responsible for depositing the GST portion to the government.

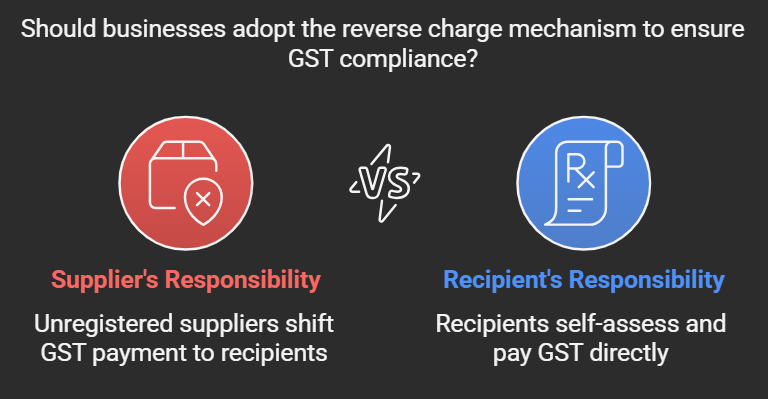

Reverse Charge Mechanism

The reverse charge mechanism shifts the liability to pay GST from the supplier to the recipient of the goods or services. This mechanism is applied in specific situations to prevent tax evasion and ensure compliance.

-

When it Applies:

- Supply of goods or services by an unregistered supplier to a registered person.

- Supply of specific goods or services as notified by the government (e.g., legal services from an individual advocate to a business entity).

- Import of services.

-

How it Works:

- The recipient of the goods or services is liable to pay the GST.

- The recipient needs to self-assess the GST and deposit it with the government.

- The recipient can then claim input tax credit for the GST paid, if eligible.

-

Example: If a registered company receives legal services from an unregistered advocate, the company will be liable to pay the GST under the reverse charge mechanism.

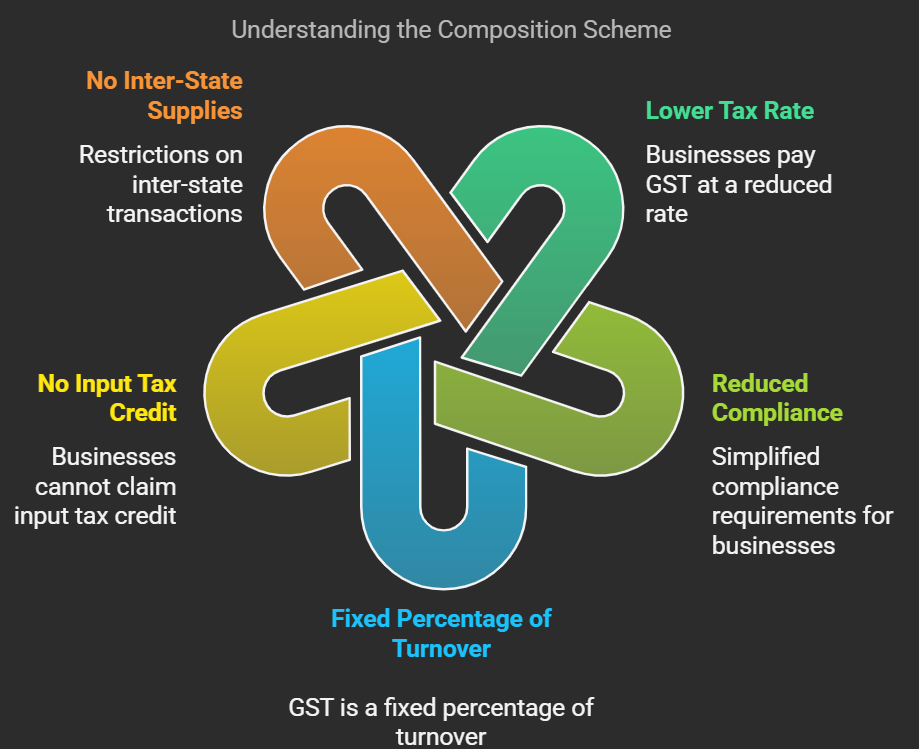

Composition Scheme

The composition scheme is a simplified tax scheme designed for small businesses. It allows eligible businesses to pay GST at a lower rate and comply with fewer formalities.

-

Eligibility:

- Businesses with an aggregate turnover of up to ₹1.5 crore (₹75 lakhs for special category states).

- Businesses must not be engaged in inter-state supply of goods.

- Businesses must not be engaged in the supply of exempt goods.

-

Features:

- Lower Tax Rates: Businesses pay GST at a fixed percentage of their turnover (1% for manufacturers and traders, 5% for restaurants).

- Limited Compliance: Businesses need to file only quarterly returns.

- No Input Tax Credit: Businesses cannot claim input tax credit under the composition scheme.

-

Benefits:

- Reduced tax burden.

- Simplified compliance procedures.

- Less paperwork.

-

Drawbacks:

- Cannot claim input tax credit.

- Cannot make inter-state supplies.

- Limited to specific types of businesses.