Procedure for GST Registration

Procedure for GST Registration: A Step-by-Step Guide

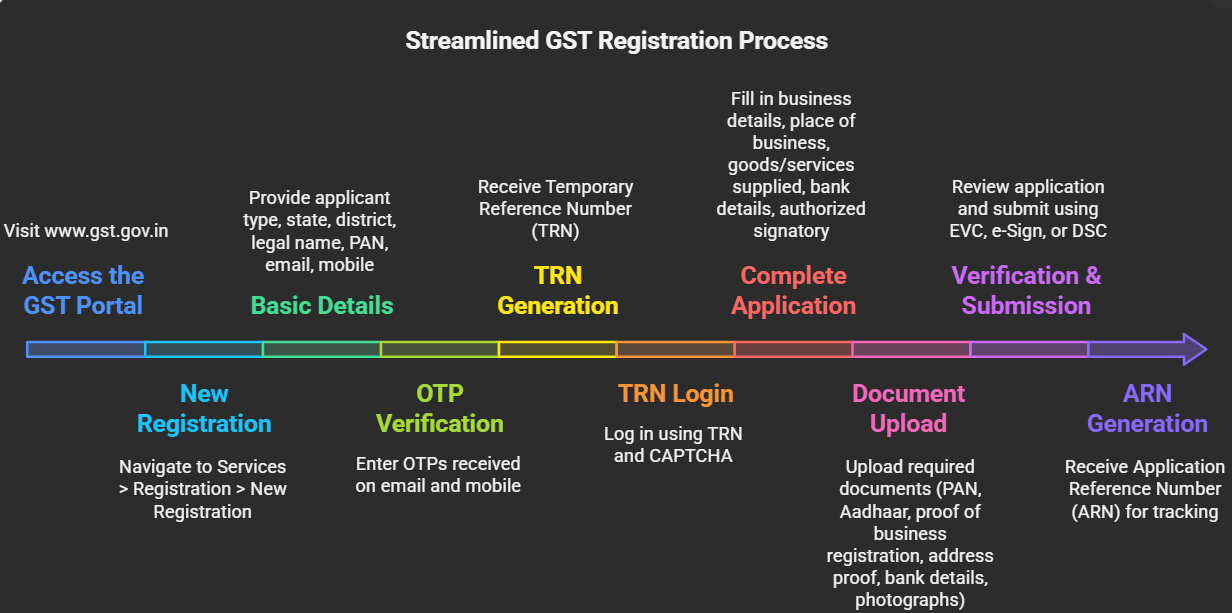

Registering for GST in India is a straightforward online process. By following these steps and ensuring all required documents are in order, businesses can smoothly complete the GST registration process and obtain their GSTIN.

Here's a comprehensive guide outlining the steps involved, required documents, and timelines:

Step 1: Access the GST Portal

- Visit the official GST portal: www.gst.gov.in.

Step 2: New Registration

- On the homepage, under 'Services,' select 'Registration' > 'New Registration.'

Step 3: Basic Details

- Select your applicant type (taxpayer, TDS deductor, etc.).

- Enter your state and district.

- Provide your legal name and PAN.

- Enter your email address and mobile number.

- Enter the CAPTCHA code and click 'Proceed.'

Step 4: OTP Verification

- You'll receive OTPs on your email and mobile. Enter them for verification.

Step 5: TRN Generation

- A Temporary Reference Number (TRN) will be generated. This is valid for 15 days.

Step 6: TRN Login

- Use your TRN and CAPTCHA to log in to the portal.

Step 7: Complete the Application

- Fill in the remaining details in the application form, including:

- Business details (constitution, commencement date, etc.)

- Place of business (principal place, additional places)

- Goods and services supplied (HSN/SAC codes)

- Bank account details

- Authorized signatory details

Step 8: Document Upload

- Upload the required documents (see list below). Ensure they are in the prescribed format and size.

Step 9: Verification and Submission

- Review the application carefully.

- Submit the application using one of the following methods:

- Electronic Verification Code (EVC): Sent to your registered mobile number.

- e-Sign: Using Aadhaar OTP.

- Digital Signature Certificate (DSC): For companies and LLPs.

Step 10: ARN Generation

- Upon successful submission, an Application Reference Number (ARN) will be generated. Use this to track your application status on the portal.

Step 11: GSTIN Allotment

- Within 3 working days (if the application is complete and correct), you will receive your GSTIN (Goods and Services Tax Identification Number).

Required Documents

The documents required may vary depending on the type of applicant. Generally, you'll need:

- PAN Card: For all applicants.

- Aadhaar Card: For Indian citizens.

- Proof of Business Registration: Registration certificate, partnership deed, etc.

- Proof of Address of Business: Electricity bill, rent agreement, etc.

- Bank Account Details: Cancelled cheque or bank statement.

- Photographs: Of the authorized signatory.

Timelines

- TRN Validity: 15 days from generation.

- GSTIN Allotment: Within 3 working days of successful application submission.