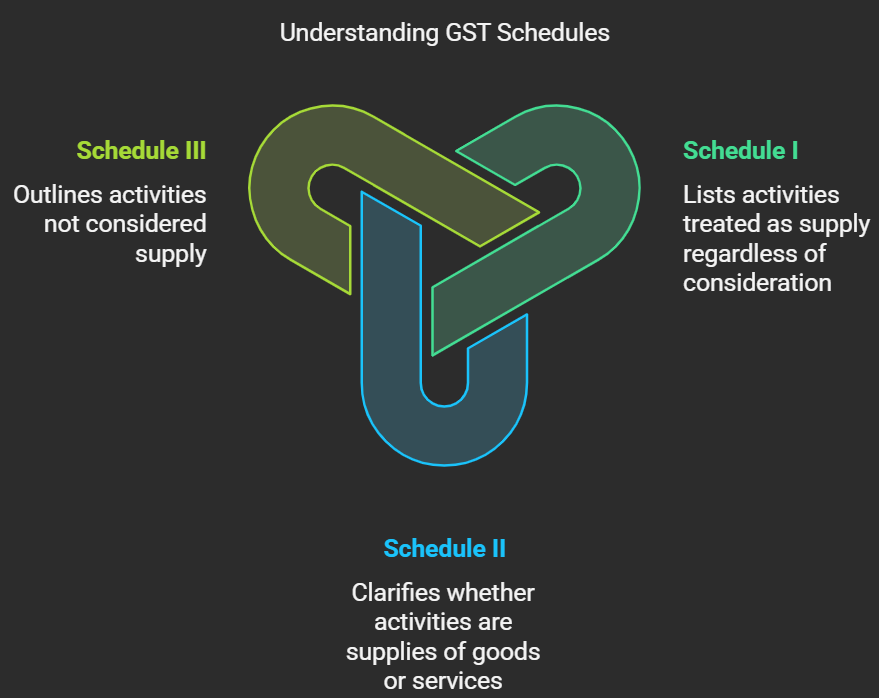

Schedules Related to Supply

Schedules Related to Supply Under GST

The GST law uses schedules to clarify the scope of "supply" and provide specific treatments for certain activities. These schedules help determine whether an activity qualifies as a supply and, if so, whether it's a supply of goods or services.

Schedule I: Activities Treated as Supply Even Without Consideration

Schedule I of the CGST Act lists specific activities that are treated as supply even if they are made without consideration. This means that even if there is no payment or exchange of value involved, these activities are still considered taxable supplies under GST.

Examples of activities listed in Schedule I:

- Permanent transfer or disposal of business assets where input tax credit has been availed.

- Supply of goods or services between related persons or distinct persons.

- Import of services by a taxable person from a related person or from any of his other establishments outside India, in the course or furtherance of business.

Rationale:

These activities are considered supplies even without consideration to prevent businesses from avoiding GST by transferring assets or providing services to related parties without any payment. It ensures that GST is levied on the value of these transactions, even if no money changes hands.

Schedule II: Activities Treated as Supply of Goods or Services

Schedule II clarifies whether certain activities should be treated as a supply of goods or a supply of services. This is important because different GST rates and rules may apply to goods and services.

Examples of activities listed in Schedule II:

- Supply of goods: Transfer of title in goods, activities involving transfer of ownership of goods, etc.

- Supply of services: Declaring a person as a winner in a lottery, agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act, etc.

Rationale:

This schedule helps avoid ambiguity and ensures consistent treatment of specific activities under GST. It clarifies the nature of the supply (goods or services) for the purpose of determining tax liability and applying the correct GST rates.

Schedule III: Negative List (Activities Not Considered as Supply)

Schedule III lists activities that are not considered as supply under GST. This means that these activities are outside the scope of GST and are not subject to tax.

Examples of activities listed in Schedule III:

- Services by an employee to the employer in the course of or in relation to his employment.

- Services by any court or Tribunal established under any law for the time being in force.

- Functions performed by the Members of Parliament, Members of the Legislative Assembly, Members of the Legislative Council or Members of a Panchayat or a Municipality or a Regional Council or a District Council.

Rationale:

This schedule excludes certain activities from the GST ambit to avoid taxing essential services, government functions, and personal activities. It helps define the boundaries of GST and ensures that it is applied only to activities that are genuinely in the nature of commercial transactions.