Taxable Persons and Registration under GST

Taxable Persons and Registration under GST

Levy of GST

GST is levied on the supply of goods or services or both. This means that the taxable event under GST is the act of supplying goods or services.

- Time of Supply: The time of supply determines when the liability to pay GST arises. This can be the date of invoice, date of payment, or date of delivery, depending on the specific transaction.

- Place of Supply: The place of supply determines which state's GST laws apply to the transaction. It is generally the location where the goods or services are consumed.

- Value of Supply: The value of supply is the transaction value, which is the price paid or payable for the goods or services.

Exemptions

While GST applies to most goods and services, certain items are exempt. These include:

- Essential goods: Food grains, fruits, vegetables, milk, salt, etc.

- Healthcare services: Medical treatment, medicines, and healthcare services.

- Education services: School and college education, vocational training.

- Social welfare services: Services provided by charitable institutions, religious institutions, etc.

- Financial services: Certain financial services like interest on loans.

- Public transport: Public transport services like buses and trains.

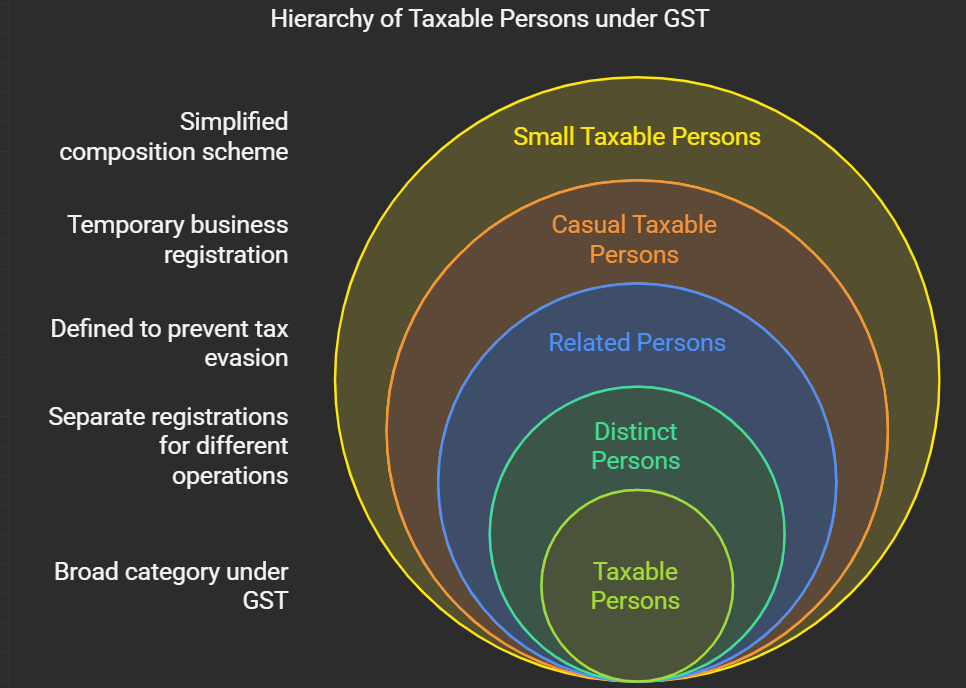

Taxable Person

A taxable person is any person who is liable to pay GST. This includes:

- Individuals

- Hindu Undivided Families (HUFs)

- Companies

- Firms

- Limited Liability Partnerships (LLPs)

- Associations of Persons (AOPs)

- Body of Individuals (BOIs)

- Local authorities

- Government agencies

- Any other person as notified by the government

Threshold Limit and Aggregate Turnover

Not every person supplying goods or services needs to register for GST. There is a threshold limit for registration based on aggregate turnover.

- Aggregate Turnover: Includes the value of all taxable supplies, exempt supplies, exports, and inter-state supplies. It excludes the value of inward supplies on which reverse charge is applicable.

-

Threshold Limit: The current threshold limit for GST registration is:

- ₹20 lakhs for most states

- ₹10 lakhs for special category states (North Eastern states, Himachal Pradesh, Jammu and Kashmir, and Uttarakhand)

If a person's aggregate turnover exceeds the threshold limit, they are required to register for GST.

Casual Taxable Person

A casual taxable person is someone who occasionally undertakes business activities in a state where they do not have a fixed place of business.

- Registration: They are required to register for GST even if their turnover is below the threshold limit.

- Validity: Their registration is typically valid for a limited period, such as 90 days.

- Examples: Event organizers, exhibition participants, seasonal businesses.

Small Taxable Person

A small taxable person is someone whose aggregate turnover is below a certain limit. They have the option to register under the composition scheme.

- Composition Scheme: A simplified scheme with lower tax rates and compliance requirements.

- Eligibility: Aggregate turnover must be below ₹1.5 crore (₹75 lakhs for special category states).

- Restrictions: Cannot make inter-state supplies, cannot supply exempt goods, and cannot claim input tax credit.

Distinct Person

The concept of a distinct person is important for determining whether separate registrations are required under GST. A person can be considered a distinct person if they have:

- Separate Business Verticals: Different business verticals in the same state may be treated as distinct persons if they have separate registrations, maintain separate accounts, and are independently engaged in business activities.

- Different States of Operation: A person operating in different states is considered a distinct person in each state and is required to obtain separate registrations in each state.

Threshold Limit and Aggregate Turnover

Not every person supplying goods or services needs to register for GST. There is a threshold limit for registration based on aggregate turnover.

- Aggregate Turnover: Includes the value of all taxable supplies, exempt supplies, exports, and inter-state supplies. It excludes the value of inward supplies on which reverse charge is applicable.

-

Threshold Limit: The current threshold limit for GST registration is:

- ₹20 lakhs for most states

- ₹10 lakhs for special category states (North Eastern states, Himachal Pradesh, Jammu and Kashmir, and Uttarakhand)

If a person's aggregate turnover exceeds the threshold limit, they are required to register for GST.

Related Person

Under GST, certain persons are considered to be related persons due to their close relationship. This is important because transactions between related persons may be subject to scrutiny to prevent tax evasion. Related persons include:

- Persons who are officers or directors of one another's businesses.

- Persons who are legally recognized partners in business.

- Persons who hold 25% or more common shares in a company.

- Persons who have a controlling interest in one another's businesses.

- Members of the same family.