Basic Cost Terms and Concepts

R&D Project Decision Example

- Project cost: 100 m

- Estimated benefits (original): 160 m

- Amount already spent: 40 m (this year)

- Remaining spend: 60 m (next year)

- Revised estimated benefit: 90 m

Decision point:

- If you include the total cost (100 m), revenue (90 m) < cost ⇒ conclude “do not continue.”

- If you abandon now, loss = amount spent = 40 m.

- If you continue, total spend = 100 m, revenue = 90 m ⇒ loss = 10 m.

The 40 m already spent is a sunk cost (irrelevant for decision going forward).

What Is “Cost”?

Monetary measure of resources given up in acquiring goods or services.

3. Cost Classification

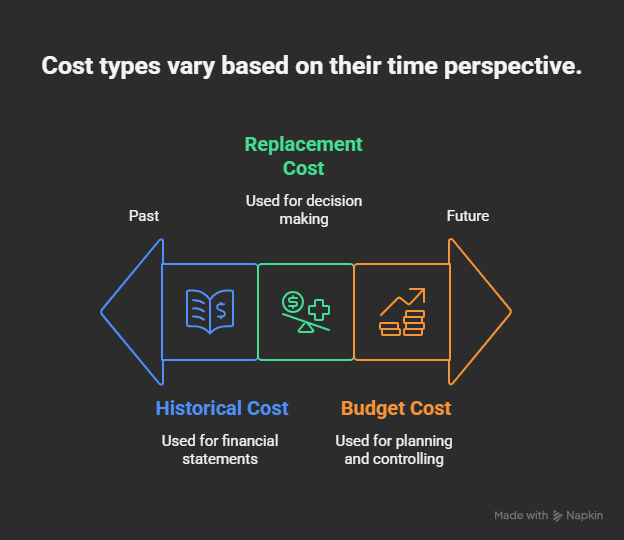

A. On the Basis of Time

| Term | Definition | Typical Use |

|---|---|---|

| Historical Cost (Past) | Cost actually incurred | Financial statements |

| Replacement Cost (Present) | Cost to replace resource now | Decision making, insurance computation |

| Budgeted Cost (Future) | Planned or standard cost | Planning and control |

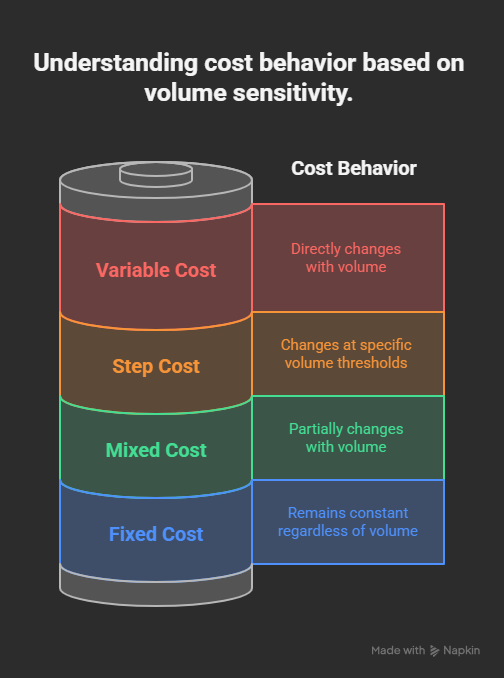

B. On the Basis of Volume

-

Variable Costs

- Change in total with volume.

- Examples: Material cost (manufacturing), Employee cost (software).

-

Fixed Costs

- Remain constant over relevant range.

- Example: Office rent.

-

Mixed Costs

- Have both fixed and variable elements.

- Example: Salary + commission for sales staff.

-

Step Costs

- Stay fixed over small ranges, then “step up” when capacity threshold exceeded.

- Example: Depreciation & maintenance on machines—if capacity > 1,000 units, need a second machine ⇒ costs double.

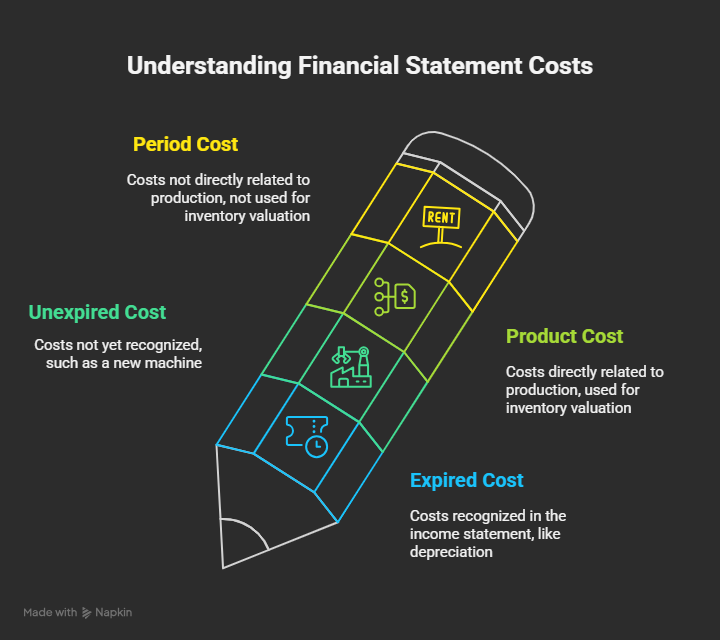

C. On the Basis of Financial-Statement Classification

-

Unexpired (Deferred) Costs

- Capitalized on balance sheet initially.

- Example: Full machine cost on acquisition day.

-

Expired Costs

- Portions of unexpired cost allocated to current period.

- Example: Depreciation.

- Reported on the income statement.

-

Product (Inventoriable) Costs

- Directly related to manufacturing the product.

- Included in inventory valuation.

- Examples: Raw materials, direct labour, factory overhead.

-

Period (Non‑inventoriable) Costs

- Not tied to production volume; expensed immediately.

- Examples: Office rent, administrative salaries, sales‑dept. depreciation.

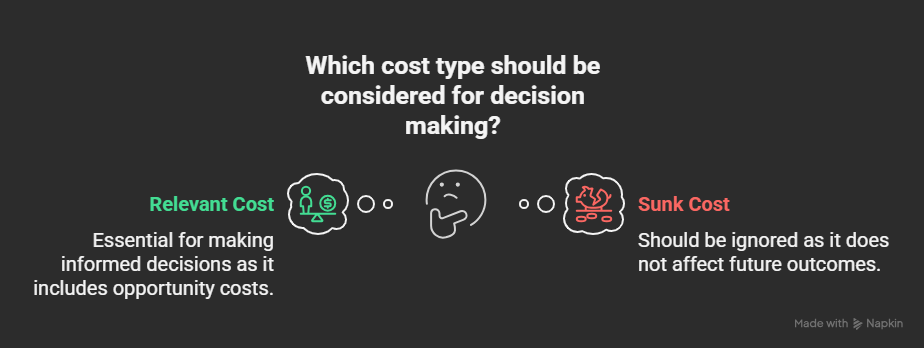

D. On the Basis of Decision‑Making Relevance

-

Relevant (Incremental / Opportunity) Costs

- Future costs or benefits that differ between alternatives.

- Example: Discount offered ⇒ explicit cost; extended credit period ⇒ foregone interest income or extra borrowing cost.

-

Irrelevant (Sunk) Costs

- Already incurred, cannot be recovered.

- Example: The 40 m spent on R&D so far.

4. Cost Flow & Cost Sheet Example (Room Air Conditioner)

| Item | Amount (₹ per unit) |

|---|---|

| Direct Material Cost | 10,815 |

| Direct Labour Cost | 1,646 |

| → Prime Cost (Material + Labour) | 12,461 |

| Manufacturing Overhead | 2,970 |

| → Cost of Goods Manufactured | 15,431 |

| Administrative Overhead | 2,028 |

| Selling & Distribution Overhead | 3,640 |

| → Total Cost of Sales (COGM + Admin + SDO) | 21,099 |

| Net Income per Unit | 3,801 |

| Average Sales Price | 24,900 |

| Profit Margin (3,801 ÷ 24,900 x 100) ≈ 15.27% | |

| Conversion Cost (Labour + Mfg OH) | 4,616 |

| Conversion Margin (3,801 ÷ 4,616 x 100) ≈ 82% |