New Page

Introduction

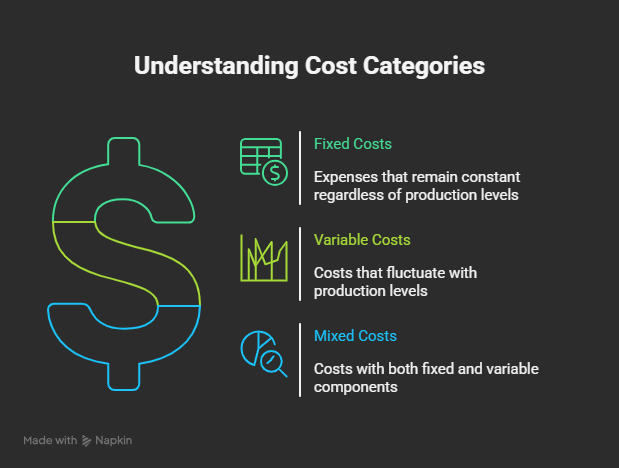

- We started our discussion on fixed and variable costs and how they influence cost.

- Let's explore further into the behavior of costs.

Cost Items in a Cost Sheet

Material Cost (Variable Cost)

- Varies based on volume.

- No production → no material cost.

- If material cost = ₹100/unit:

- 1000 units → ₹1,00,000

- 2000 units → ₹2,00,000

- Employee wages based on units produced also considered variable.

Rent (Fixed Cost)

- Constant regardless of production.

- Examples: Depreciation, insurance, management salaries.

Repairs & Maintenance (Mixed Cost)

- Even with no production, basic maintenance required.

- More production → more maintenance cost.

Cost Classification Approaches

1. Accounting Analysis

- Manager manually classifies each item.

- Subjective, based on experience.

- Example: 30% of repairs = fixed, 70% = variable.

- Pros: Manager insight.

- Cons: Needs frequent review, may miss cost structure changes.

2. High-Low Method

- Based on highest and lowest activity level data.

- Assume linear relationship between cost and volume.

Example:

-- Lowest: 100 units → ₹50,000

-- Highest: 300 units → ₹1,20,000

-- ΔCost = ₹70,000; ΔVolume = 200

-- Variable Cost/Unit = ₹350 (₹70,000 / 200)

-- Fixed Cost = Total Cost - (Variable Cost × Units)

- For 100 units → ₹50,000 - ₹35,000 = ₹15,000

-- Pros: Simple, objective. -- Cons: Ignores other monthly data.

3. Scatter Graph Method

- Plot cost vs volume on XY chart (Excel).

- Y-axis: Total Cost

- X-axis: Volume

- Draw line through data points:

- Slope = Variable cost/unit

- Y-intercept = Fixed cost

4. Regression Analysis

- Uses all data points (e.g., 10 years of data).

- Equation:

Cost = a + b × Volume-

a= Fixed Cost -

b= Variable Cost (% of sales)

-

Real Company Example (10-Year Data)

Kansai Nerolac:

-

High-Low Method:

- Sales: ₹2731 lakh → Cost: ₹429 lakh

- Variable Cost: 14.28% of revenue

- Fixed Cost: ₹39.36 crore

-

Regression:

- Variable Cost: 14.76%

- Fixed Cost: ₹44.64 crore

ACC:

- Variable Cost: 23.57%

- Fixed Cost: ₹47 crore

Hindalco, Sterlite:

- Applied same methods.

Ultratech:

- Used 2004 data (2003 not available)

- Variable Cost: 22.46%

- Fixed Cost: ₹125 lakh

Asian Paints (Special Case):

- Revenue: ₹1650 → ₹8335 crore (5x increase)

- Cost: ₹280 → ₹1636 crore (>5x increase)

- Branding increased significantly → high variable component

- Negative fixed cost appears → indicates assumption flaw

Revised Regression (Intercept = 0):

- Equation:

S&D Cost = 0 + b × Sales - Variable Cost: 19.86%

- Fixed Cost: 0

- R² ~ 0.99: High reliability