Joint and By-products

Joint Products & By‑Product Costing

1. Definitions & Context

- Joint Products: Two or more products of significant value emerging simultaneously from a single production process (e.g., petrol & diesel in oil refinery).

- By‑Products: Secondary outputs of relatively low value (e.g., molasses from sugar). May become joint products if values shift.

- Scrap: Insignificant‐value remnants (e.g., sawdust, rice bran), often credited to overhead or “other income.”

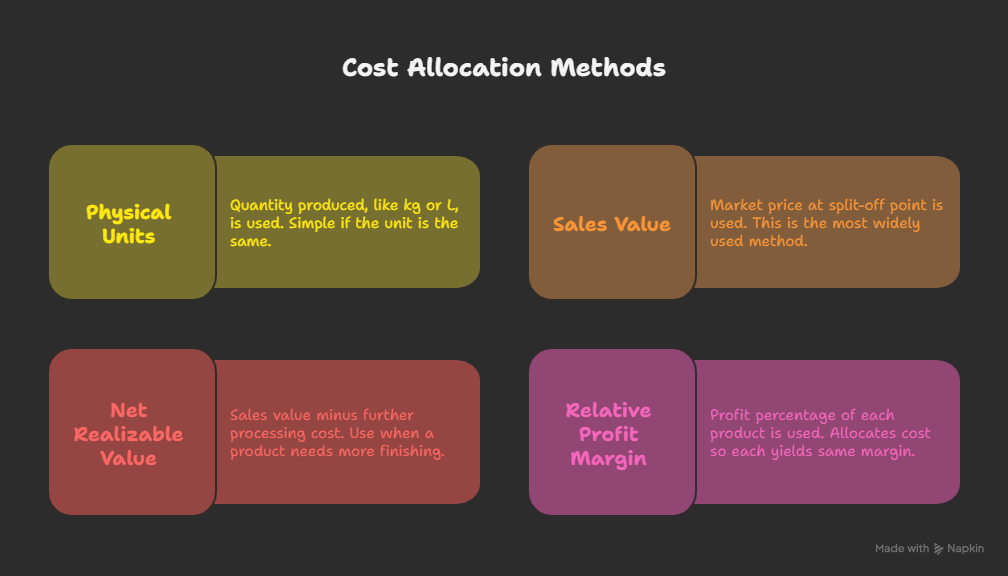

2. Cost‐Allocation Methods

3. Example: Superfine Chemical

Process inputs:

- Raw material introduced: 1,000 kg @ ₹5,000/kg → ₹5 million

- Joint process expenses: ₹10 million

- Total joint cost: ₹15 million

Outputs:

- C1: 600 kg (sold at ₹20,000/kg → ₹12 million)

- C2: 400 kg (further processing ₹2 million; sold at ₹30,000/kg → ₹12 million)

3.1 Quantity Basis

- Allocate ₹15 m by weight (600:400 → 9 m : 6 m)

- Add C2 extra cost: 6 m + 2 m = 8 m

- Unit costs:

- C1: ₹9 m ÷ 600 = ₹15,000/kg

- C2: ₹8 m ÷ 400 = ₹20,000/kg

3.2 Sales‑Value Basis

- Split ₹15 m by sales value at split‑off (12 m : 12 m → 7.5 m : 7.5 m)

- Add C2 extra cost: 7.5 m + 2 m = 9.5 m

- Unit costs:

- C1: ₹7.5 m ÷ 600 = ₹12,500/kg

- C2: ₹9.5 m ÷ 400 = ₹23,750/kg

3.3 NRV Basis

- Compute realizable value at split‑off:

- C1: ₹12 m (sold immediately)

- C2: ₹12 m – ₹2 m further cost = ₹10 m

- Allocate ₹15 m in 12 m:10 m → ₹8.18 m : ₹6.82 m

- Add C2 extra cost: 6.82 m + 2 m = 8.82 m

- Unit costs:

- C1: ₹8.18 m ÷ 600 ≈ ₹13,636/kg

- C2: ₹8.82 m ÷ 400 ≈ ₹22,045/kg

3.4 Profit‑Margin Basis

- Total sales = ₹24 m; total cost (joint + extra) = ₹17 m → profit = ₹7 m

- Profit margin% = 7 m ÷ 24 m ≈ 29.17%

- Allocate cost = sales × (1 – 29.17%) = ₹12 m × 70.83% ≈ ₹8.5 m each

- Unit costs:

- C1: ₹8.5 m ÷ 600 ≈ ₹14,167/kg

- C2: ₹8.5 m + 2 m extra = ₹10.5 m ÷ 400 ≈ ₹21,250/kg

4. Summary of Unit Costs

| Method | C1 (₹/kg) | C2 (₹/kg) |

|---|---|---|

| Quantity | 15,000 | 20,000 |

| Sales‐Value | 12,500 | 23,750 |

| NRV | 13,636 | 22,045 |

| Profit‐Margin | 14,167 | 21,250 |