New Page

Asset Management Companies (AMCs)

What are Asset Management Companies (AMCs)?

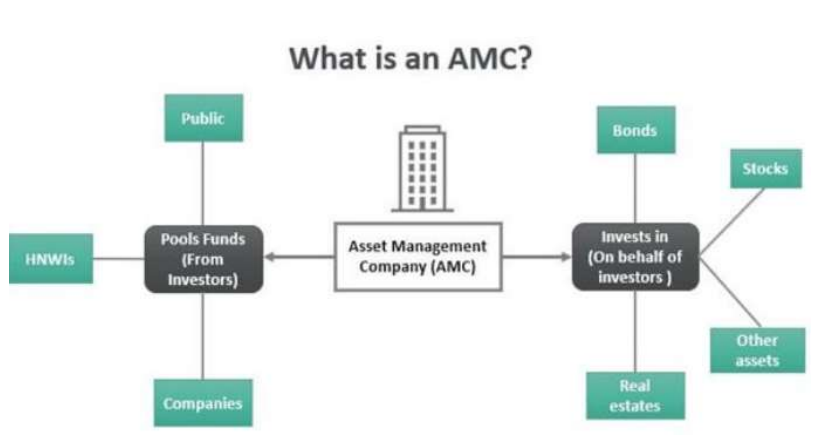

Asset Management Companies (AMCs) are professional financial institutions that specialize in managing investments on behalf of their clients. They act as intermediaries between investors and the financial markets, providing expertise and services to help investors achieve their financial objectives.

Here's how they work:

- Pooling of Funds: AMCs collect funds from a large number of investors, both individuals and institutions (like pension funds, insurance companies, and corporations). This creates a substantial pool of capital.

- Investment Management: They employ teams of experienced professionals (fund managers, analysts, economists) who research, analyze, and select investments based on specific investment strategies and objectives.

-

Diversification: AMCs invest the pooled funds in a diversified portfolio of financial instruments, such as:

- Stocks (Equities): Shares of publicly traded companies.

- Bonds (Fixed Income): Debt instruments issued by governments or corporations.

- Money Market Instruments: Short-term, low-risk debt instruments.

- Real Estate: Commercial or residential properties.

- Commodities: Raw materials like gold, oil, and agricultural products.

- Alternative Investments: Hedge funds, private equity, venture capital.

-

Risk Management: AMCs actively manage the risk associated with investments by:

- Diversifying across asset classes and sectors.

- Monitoring market conditions and adjusting the portfolio accordingly.

- Using hedging strategies to mitigate potential losses.

-

Achieving Financial Goals: The ultimate aim of an AMC is to help investors achieve their financial goals, which may include:

- Capital Appreciation: Growing the value of investments over time.

- Income Generation: Providing a regular stream of income through dividends or interest.

- Capital Preservation: Protecting the initial investment from significant losses.

Importance of AMCs in the Financial Ecosystem

AMCs play a vital role in the financial ecosystem, contributing to its stability and growth. Here are some key aspects of their importance:

-

Efficient Capital Allocation:

- AMCs channel savings from investors to businesses and governments that need capital for growth and development.

- By directing funds towards productive investments, they contribute to economic growth and job creation.

- They help in efficient price discovery by actively participating in the markets.

-

Professional Expertise:

- AMCs provide access to professional investment management expertise that individual investors may not have.

- Their teams of experts conduct in-depth research, analyze market trends, and make informed investment decisions.

- This expertise helps investors navigate the complexities of the financial markets and potentially achieve better returns.

-

Risk Diversification:

- AMCs diversify investments across various asset classes, sectors, and geographies, reducing the risk associated with concentrating investments in a single asset or market.

- Diversification helps to mitigate losses during market downturns and enhances the potential for long-term growth.

-

Liquidity:

- Many investment vehicles managed by AMCs, such as mutual funds, offer high liquidity.

- Investors can typically buy or sell units of mutual funds on any business day, providing easy access to their invested capital.

- This liquidity is crucial for investors who may need to access their funds quickly.

-

Market Development:

- AMCs contribute to the development and deepening of financial markets by:

- Increasing trading activity.

- Promoting transparency and efficiency.

- Facilitating price discovery.

- Developing new financial products and services.

- AMCs contribute to the development and deepening of financial markets by:

-

Financial Inclusion:

- AMCs, particularly through products like mutual funds, enable smaller investors to participate in the financial markets.

- Mutual funds allow individuals to invest with relatively small amounts of money, making investments accessible to a wider segment of the population.

- This promotes financial inclusion and helps individuals build wealth over time.

Conclusion

Asset Management Companies (AMCs) are essential players in the financial world. They provide valuable services to investors by professionally managing their investments, diversifying risk, and offering liquidity. Their activities contribute to efficient capital allocation, market development, and financial inclusion, ultimately supporting economic growth and helping individuals achieve their financial aspirations. By understanding the role and importance of AMCs, investors can make more informed decisions about their investment strategies and potentially benefit from the expertise and services these institutions offer.