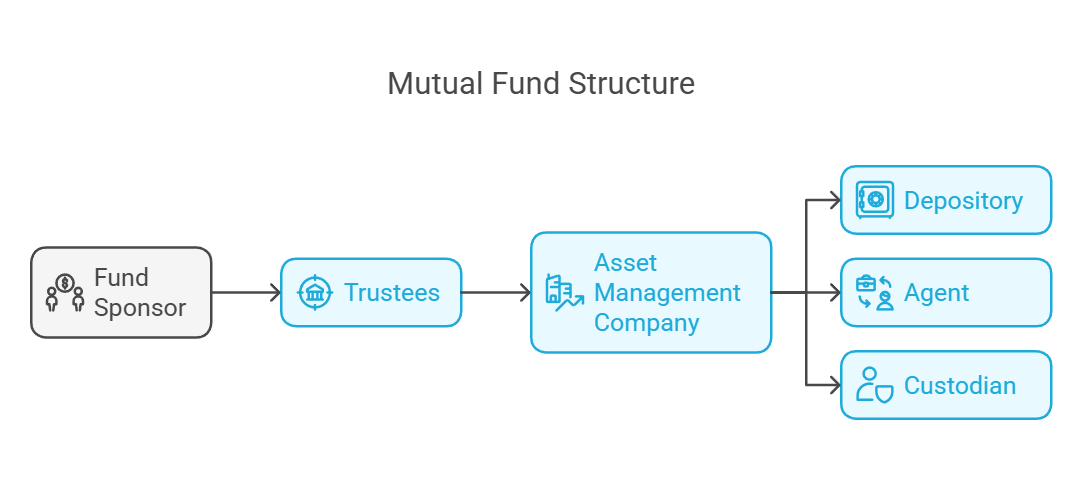

Mutual Funds Structure

Fund Structure of Mutual Funds

1. Fund Sponsor

- Any person or corporate body that establishes the fund and registers it with SEBI.

- Forms a trust and appoints a Board of Trustees.

- Appoints the Custodian and Asset Management Company (AMC) directly or through the trust as per SEBI regulations.

- SEBI regulations require the sponsor to contribute at least 40% of the net worth of the AMC.

2. Trustees

Created through a legal document called the Trust Deed, executed by the Fund Sponsor and registered with SEBI.

The mutual fund may be managed by a Board of Trustees, a Trustee Company, or a Corporate Body.

Act as protectors of unit holders' interests.

At least 2/3 of the trustees must be independent and not associated with the sponsor.

Rights of Trustees

- Approve each scheme launched by the AMC.

- Request necessary information from the AMC.

- Take corrective action if the fund business is not conducted as per SEBI regulations.

- Dismiss the AMC if required.

- Ensure that the AMC maintains the required net worth.

Obligations of Trustees

- Enter into an Investment Management Agreement with the AMC.

- Furnish half-yearly reports to SEBI about fund activities.

- Ensure no fundamental changes occur in the scheme without informing unit holders.

- Review investor complaints and ensure proper redressal by the AMC.

3. Asset Management Company (AMC)

Acts as the principal manager of the fund under the supervision of the Trustees.

Must be approved and registered with SEBI.

Manages and launches different investment schemes under the trust’s name as per SEBI regulations.

Acts as a fiduciary for unit holders and reports to the trustees.

At least 50% of AMC board members must be independent.

Obligations of the AMC

- Launch investment schemes only after SEBI and Trustee approval.

- Send quarterly reports to trustees.

- Provide disclosures to investors, including NAV and repurchase price.

- Maintain a minimum net worth of ₹10 crore.

- Avoid transactions through brokers exceeding 5% of total transactions.

- AMC cannot act as a trustee for any other mutual fund.

- Must not undertake any conflicting business activities.

4. Custodian

- Responsible for the physical handling and safekeeping of securities.

- Must be independent of the sponsor and registered with SEBI.

5. Depository

- Holds dematerialized securities of the mutual fund.

- As Indian capital markets move away from physical certificates, securities are stored electronically.

6. Agents & Distributors

- Agents help sell mutual fund units to investors.

- Distributors act as intermediaries between the AMC and investors.