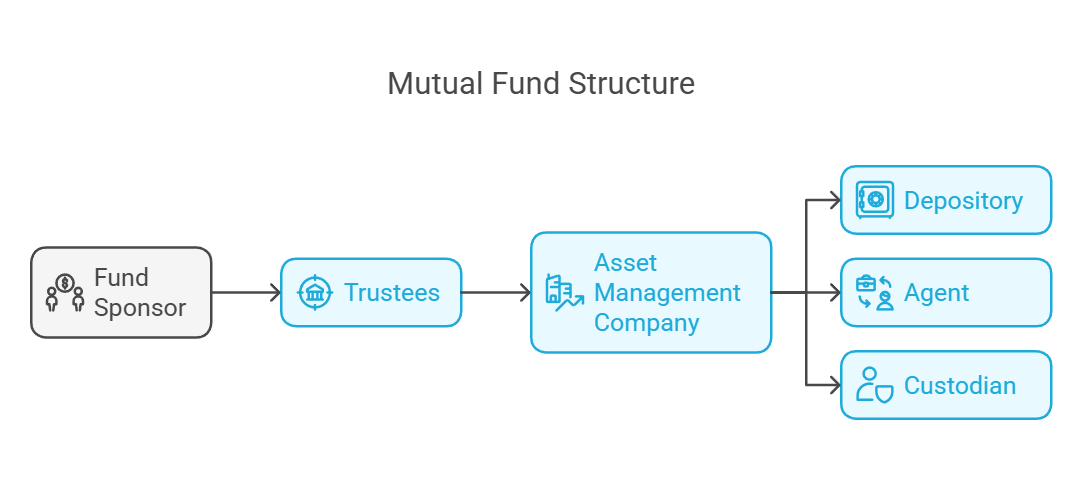

Mutual Funds Structure

Fund Structure of Mutual Funds

1. Fund Sponsor

- Any person or corporate body that establishes the fund and registers it with SEBI.

- Forms a trust and appoints a Board of Trustees.

- Appoints the Custodian and Asset Management Company (AMC) directly or through the trust as per SEBI regulations.

- SEBI regulations require the sponsor to contribute at least 40% of the net worth of the AMC.

2. Trustees

- Created through a legal document called the Trust Deed, executed by the Fund Sponsor and registered with SEBI.

- The mutual fund may be managed by a Board of Trustees, a Trustee Company, or a Corporate Body.

- Act as protectors of unit holders' interests.

- At least 2/3 of the trustees must be independent and not associated with the sponsor.

Rights of Trustees

- Approve each scheme launched by the AMC.

- Request necessary information from the AMC.

- Take corrective action if the fund business is not conducted as per SEBI regulations.

- Dismiss the AMC if required.

- Ensure that the AMC maintains the required net worth.

**Obligations of Trustees**

* Enter into an Investment Management Agreement with the AMC.

* Furnish half-yearly reports to SEBI about fund activities.

* Ensure no fundamental changes occur in the scheme without informing unit holders.

* Review investor complaints and ensure proper redressal by the AMC.

3. Asset Management Company (AMC)

- Acts as the principal manager of the fund under the supervision of the Trustees.

- Must be approved and registered with SEBI.

- Manages and launches different investment schemes under the trust’s name as per SEBI regulations.

- Acts as a fiduciary for unit holders and reports to the trustees.

- At least 50% of AMC board members must be independent.

Obligations of the AMC:

- Launch investment schemes only after SEBI and Trustee approval.

- Send quarterly reports to trustees.

- Provide disclosures to investors, including NAV and repurchase price.

- Maintain a minimum net worth of ₹10 crore.

- Avoid transactions through brokers exceeding 5% of total transactions.

- AMC cannot act as a trustee for any other mutual fund.

- Must not undertake any conflicting business activities.

4. Custodian

- Responsible for the physical handling and safekeeping of securities.

- Must be independent of the sponsor and registered with SEBI.

5. Depository

- Holds dematerialized securities of the mutual fund.

- As Indian capital markets move away from physical certificates, securities are stored electronically.

6. Agents & Distributors

- Agents help sell mutual fund units to investors.

- Distributors act as intermediaries between the AMC and investors.