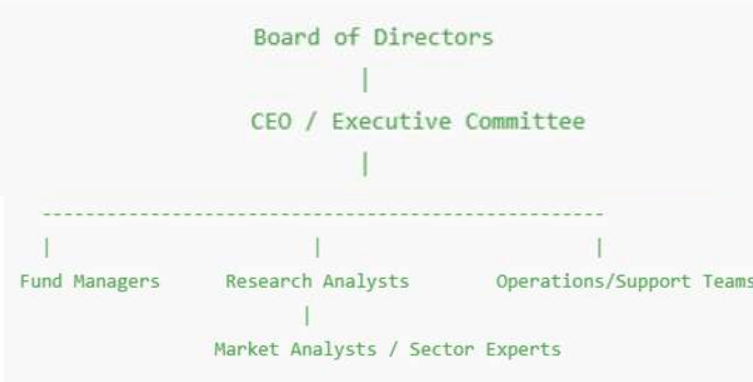

Structure of an Asset Management Company (AMC)

An Asset Management Company (AMC) is structured to effectively manage investments, ensure compliance, and deliver value to its clients. The structure typically includes several key departments and roles, each with specific responsibilities. Here's a breakdown of the typical organizational structure of an AMC:

1. Board of Directors

-

Role:

- The Board of Directors sits at the apex of the AMC's governance structure.

- It is responsible for providing strategic oversight and ensuring that the AMC operates in compliance with legal, regulatory, and ethical standards.

- The board sets the overall strategic direction for the company and ensures that the interests of investors and other stakeholders are protected.

-

Responsibilities:

- Approving major corporate decisions, such as the launch of new funds, changes in investment policies, and significant financial transactions.

- Overseeing the AMC's risk management framework and ensuring that adequate controls are in place.

- Monitoring the performance of the executive management team and holding them accountable.

- Ensuring compliance with corporate governance best practices.

- Appointing and evaluating the CEO and other senior executives.

2. CEO / Executive Committee

-

Role:

- The CEO (Chief Executive Officer) or the Executive Committee provides executive leadership and is responsible for the day-to-day management of the AMC.

- They are responsible for implementing the strategies approved by the Board of Directors.

- The CEO acts as the primary link between the Board and the various functional teams within the AMC.

-

Responsibilities:

- Developing and executing the AMC's business plan to achieve growth and profitability targets.

- Overseeing the operations of all departments and ensuring operational efficiency.

- Managing the overall risk profile of the AMC.

- Building and maintaining relationships with key stakeholders, including regulators, distributors, and institutional clients.

- Representing the AMC in external forums and industry events.

3. Investment Management Team

a) Fund Managers

-

Role:

- Fund managers are the core of the investment management function.

- They are responsible for making investment decisions for the specific mutual fund schemes or portfolios they manage.

- They create and execute investment strategies designed to achieve the stated objectives of each fund.

-

Responsibilities:

- Selecting securities (stocks, bonds, etc.) that align with the fund's investment objectives and risk profile.

- Monitoring the performance of the portfolio and making adjustments to asset allocation as needed.

- Conducting regular reviews of the portfolio to ensure it remains in line with the fund's strategy.

- Staying informed about market developments and economic trends that could impact the portfolio.

- Balancing risk and return to optimize portfolio performance.

b) Research Analysts

-

Role:

- Research analysts provide the analytical foundation for investment decisions.

- They conduct in-depth research on financial markets, industries, and individual companies.

- They provide fund managers with insights and recommendations to support their investment decisions.

-

Responsibilities:

- Performing fundamental analysis of companies, including financial statement analysis, valuation, and assessment of competitive positioning.

- Developing and maintaining financial models to forecast company performance and estimate intrinsic value.

- Conducting industry and sector analysis to identify trends, opportunities, and risks.

- Preparing research reports and making buy/sell/hold recommendations to fund managers.

- Monitoring news and events that could impact the companies or industries they cover.

-

Market Analysts / Sector Experts (Subgroup of Research Analysts):

- Role: These analysts specialize in specific sectors (e.g., technology, healthcare, energy) or asset classes (e.g., equities, fixed income, commodities). They have deep expertise in their assigned areas.

-

Responsibilities:

- Provide specialized insights and analysis on their sector or asset class to fund managers.

- Identify investment opportunities and risks within their area of expertise.

- Monitor industry trends, regulatory changes, and competitive dynamics.

- Contribute to the development of investment strategies for funds focused on their sector or asset class.

4. Operations/Support Teams

-

Role:

- These teams handle the essential back-office and support functions that ensure the smooth operation of the AMC.

- They are responsible for a wide range of activities, including fund accounting, compliance, legal, customer service, and technology.

-

Responsibilities:

- Fund Accounting: Calculating the Net Asset Value (NAV) of mutual fund schemes, maintaining accurate records of fund transactions, and preparing financial reports.

- Compliance: Ensuring that the AMC and its funds comply with all applicable regulations and internal policies. Monitoring regulatory changes and implementing necessary compliance procedures.

- Legal: Providing legal advice to the AMC on various matters, including fund documentation, contracts, and regulatory issues.

- Customer Service: Handling investor inquiries, processing transactions, and providing account information.

- Technology: Managing the AMC's IT infrastructure, including trading platforms, data management systems, and cybersecurity.

- Risk Management: Developing and implementing risk management frameworks to identify, assess, monitor, and mitigate risks across the AMC.