Understanding Mutual Funds: An Introduction

Introduction

A mutual fund is essentially a trust that pools the savings of numerous investors who share a common financial goal. Instead of each investor managing their own portfolio, the mutual fund invests these pooled funds in the stock and debt markets. This provides investors with two key advantages:

- Expertise in Investments: Mutual funds employ professional fund managers with in-depth knowledge of the market, helping investors make informed decisions.

- Diversification: By investing in a variety of securities across different sectors, mutual funds reduce risk compared to investing in individual stocks or bonds.

This structure is particularly beneficial for smaller investors who may lack the resources or expertise to effectively manage their own portfolios. For example, an investor with just ₹10,000 annually might struggle to achieve diversification or gain access to professional financial advice without a mutual fund. By joining a mutual fund, investors not only pursue a shared financial goal but also collectively share the costs of expert management and diversification.

Mutual funds typically aim for various objectives for their investors, including:

- Attractive Yields: Generating income through dividends and interest payments.

- Capital Appreciation: Increasing the value of investments over time.

- Safety and Liquidity: Balancing returns with the need for secure and easily accessible funds.

This unit will introduce the fundamental concepts of mutual funds, their advantages, a brief historical overview, how they are organized, and the typical investment process involved.

Concepts and Advantages of Investing in Mutual Funds

Institutional and Managed Portfolios

As mentioned, mutual funds gather funds from numerous small investors and invest in shares and bonds of various companies. The income generated through these investments, along with capital appreciation, is distributed among unit holders based on the number of units they own. This makes mutual funds a highly suitable investment option for the general public, offering a chance to participate in a diversified, professionally managed portfolio at a relatively low cost.

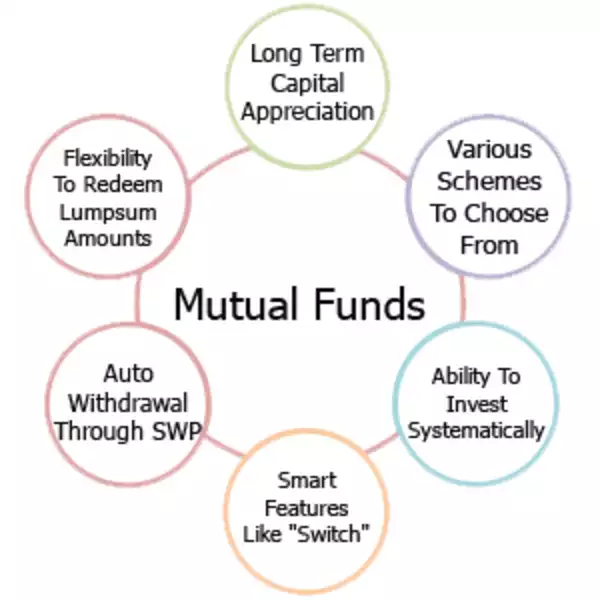

Advantages of Investing in Mutual Fund Schemes

Compared to other investment options, investing in mutual fund schemes offers several key advantages, particularly for small and medium-income investors:

-

Professional Management:

- Fund managers with expertise and access to real-time market information make informed investment decisions, eliminating impulsive buying or selling based on emotions.

-

Diversification:

- Investment is spread across a wide range of industries and sectors, reducing the risk associated with concentrating investments in a single area.

-

Convenient Administration:

- Investors are relieved of paperwork, accounting, and the day-to-day hassles of managing investments.

-

Return Potential:

- Dividends and capital gains are often reinvested, maximizing the potential for growth through the power of compounding.

-

Low Costs:

- Economies of scale allow mutual funds to operate at lower costs, which are passed on to the investors in the form of lower expense ratios.

-

Liquidity:

- Mutual funds offer liquidity through buyback programs or by being listed on stock exchanges after a specified lock-in period, enabling investors to access their money when needed.

-

Transparency:

- Fund performance and holdings are generally disclosed regularly, ensuring investors are aware of how their money is being used.

-

Flexibility:

- Investors can choose from a variety of schemes that match their individual risk tolerance and investment objectives.

-

Choice of Schemes:

- Mutual funds offer diverse types of schemes (e.g., equity, debt, hybrid) to cater to various needs and goals of investors.

-

Tax Benefits:

- Mutual fund investments often come with tax benefits related to the amount invested, returns earned, dividends, and capital gains. (Note: Specific tax benefits can vary by jurisdiction).

-

Well-Regulated:

- Mutual fund operations are heavily regulated by governing bodies, ensuring transparency, accountability, and safety for investors.

-

Capital Appreciation:

- Investors can benefit from potential capital appreciation without needing to closely monitor the daily fluctuations of individual stock prices.

Mechanism and Characteristics of Mutual Funds

Mutual funds have become a popular investment vehicle globally, offering a unique combination of features that cater to a wide range of investors. Let's delve into the mechanism and key characteristics of mutual funds:

Mechanism of Mutual Funds

Mutual funds operate on a relatively simple principle: pooling money from multiple investors to invest in a diversified portfolio of securities. Here's a step-by-step breakdown of the mechanism:

-

Pooling of Funds:

- A mutual fund collects money from numerous investors, both individual and institutional, who share a common investment objective.

- Each investor contributes a certain amount and, in return, receives units of the fund.

- These units represent a proportionate ownership in the fund's underlying assets.

-

Professional Management:

- The pooled funds are managed by professional fund managers who have expertise in investment research, analysis, and portfolio management.

- Fund managers are typically employed by an Asset Management Company (AMC), which is responsible for operating the mutual fund.

-

Investment in Securities:

- Fund managers invest the pooled money in a diversified portfolio of securities, such as:

- Stocks (Equities): Shares of publicly traded companies.

- Bonds (Fixed Income): Debt instruments issued by governments or corporations.

- Money Market Instruments: Short-term, low-risk debt instruments.

- Other Assets: Some funds may also invest in real estate, commodities, or other alternative assets.

- The specific mix of securities depends on the fund's investment objective and strategy.

- Fund managers invest the pooled money in a diversified portfolio of securities, such as:

-

Diversification:

- Mutual funds typically invest in a wide range of securities across different sectors, industries, and geographies.

- Diversification helps to reduce the risk associated with investing in a single security or asset class.

-

Net Asset Value (NAV):

- The Net Asset Value (NAV) represents the per-unit market value of the fund's assets.

- It is calculated by subtracting the fund's liabilities from the market value of its assets and dividing the result by the total number of outstanding units.

- NAV is typically calculated and disclosed daily.

-

Buying and Selling Units:

- Investors can buy or sell units of a mutual fund at the prevailing NAV, subject to any applicable entry or exit loads.

- Transactions can be made directly with the AMC or through distributors, brokers, or online platforms.

-

Income and Capital Gains:

- Mutual funds generate returns in two ways:

- Income: Dividends from stocks, interest from bonds, or other income earned on the fund's investments.

- Capital Gains: Profits realized from selling securities at a higher price than the purchase price.

- Funds may distribute income and capital gains to investors periodically (dividend option) or reinvest them back into the fund (growth option).

- Mutual funds generate returns in two ways:

-

Regulation:

- Mutual funds are regulated by a regulatory authority (e.g., SEBI in India, SEC in the US) to ensure transparency, investor protection, and fair practices.

Characteristics of Mutual Funds

Mutual funds possess several key characteristics that make them an attractive investment option:

-

Professional Management:

- Investors benefit from the expertise of professional fund managers who have the knowledge, experience, and resources to make informed investment decisions.

- Fund managers conduct in-depth research, analyze market trends, and actively manage the portfolio to achieve the fund's objectives.

-

Diversification:

- Mutual funds offer instant diversification by investing in a wide range of securities. This helps to reduce the risk associated with putting all your eggs in one basket.

- Diversification can mitigate the impact of poor performance by a single security or sector on the overall portfolio.

-

Affordability and Accessibility:

- Mutual funds allow investors to start with relatively small amounts, making them accessible to a wide range of people.

- Systematic Investment Plans (SIPs) further enhance affordability by enabling investors to invest fixed amounts regularly.

-

Liquidity:

- Most mutual funds, particularly open-ended funds, offer high liquidity, meaning investors can easily buy or sell units at the prevailing NAV on any business day.

- This provides investors with easy access to their invested capital.

-

Variety of Schemes:

- Mutual funds offer a wide variety of schemes catering to different investment objectives, risk profiles, and time horizons.

- Investors can choose from equity funds, debt funds, hybrid funds, index funds, sector funds, and various other categories based on their needs.

-

Transparency:

- Mutual funds are subject to strict disclosure requirements, providing investors with regular information about the fund's portfolio holdings, performance, fees, and other relevant details.

- The daily disclosure of NAV ensures transparency in pricing.

-

Regulation and Investor Protection:

- Mutual funds are regulated by regulatory authorities, which helps to protect investor interests and ensure fair practices.

- Regulations cover areas such as investment restrictions, disclosure requirements, valuation norms, and investor grievance redressal.

-

Tax Benefits:

- Certain types of mutual funds, such as Equity Linked Savings Schemes (ELSS) in India, offer tax benefits to investors.

- Tax benefits can enhance the overall returns from mutual fund investments.

-

Flexibility:

- Mutual funds offer flexibility in terms of investment amount, frequency, and strategy.

- Investors can choose to invest lump sum or through SIPs, switch between different schemes, and adjust their investment strategy as needed.

-

Economies of Scale:

- Mutual funds benefit from economies of scale, as they pool money from a large number of investors.

- This allows them to negotiate lower transaction costs and access a wider range of investment opportunities compared to individual investors.

Conclusion

Mutual funds provide a convenient, efficient, and regulated way for investors to participate in the financial markets. Their mechanism of pooling funds, professional management, diversification, and transparency, combined with characteristics like affordability, liquidity, and variety, make them an attractive investment option for individuals and institutions alike. Understanding the mechanism and characteristics of mutual funds is essential for investors to make informed decisions and choose funds that align with their financial goals, risk tolerance, and investment horizon.

No Comments