Cash Budget

Cash Budget

What is a Cash Budget?

A cash budget is like a plan that businesses use to track:

- How much cash is coming in (receipts) and

- How much cash is going out (payments) during a specific time (like a week, month, or year).

Why do we Need a Cash Budget?

Just like you plan how to use your pocket money to avoid running out, businesses also need to plan their money. A cash budget helps a business:

- Pay Bills on Time: Things like salaries, rent, or buying materials.

- Avoid Borrowing Too Much: By knowing how much money they'll have, they can plan better and borrow less.

- Save for the Future: It helps businesses figure out when they'll have extra cash to invest or expand.

- Prepare for Emergencies: A cash budget helps keep money ready for unexpected expenses

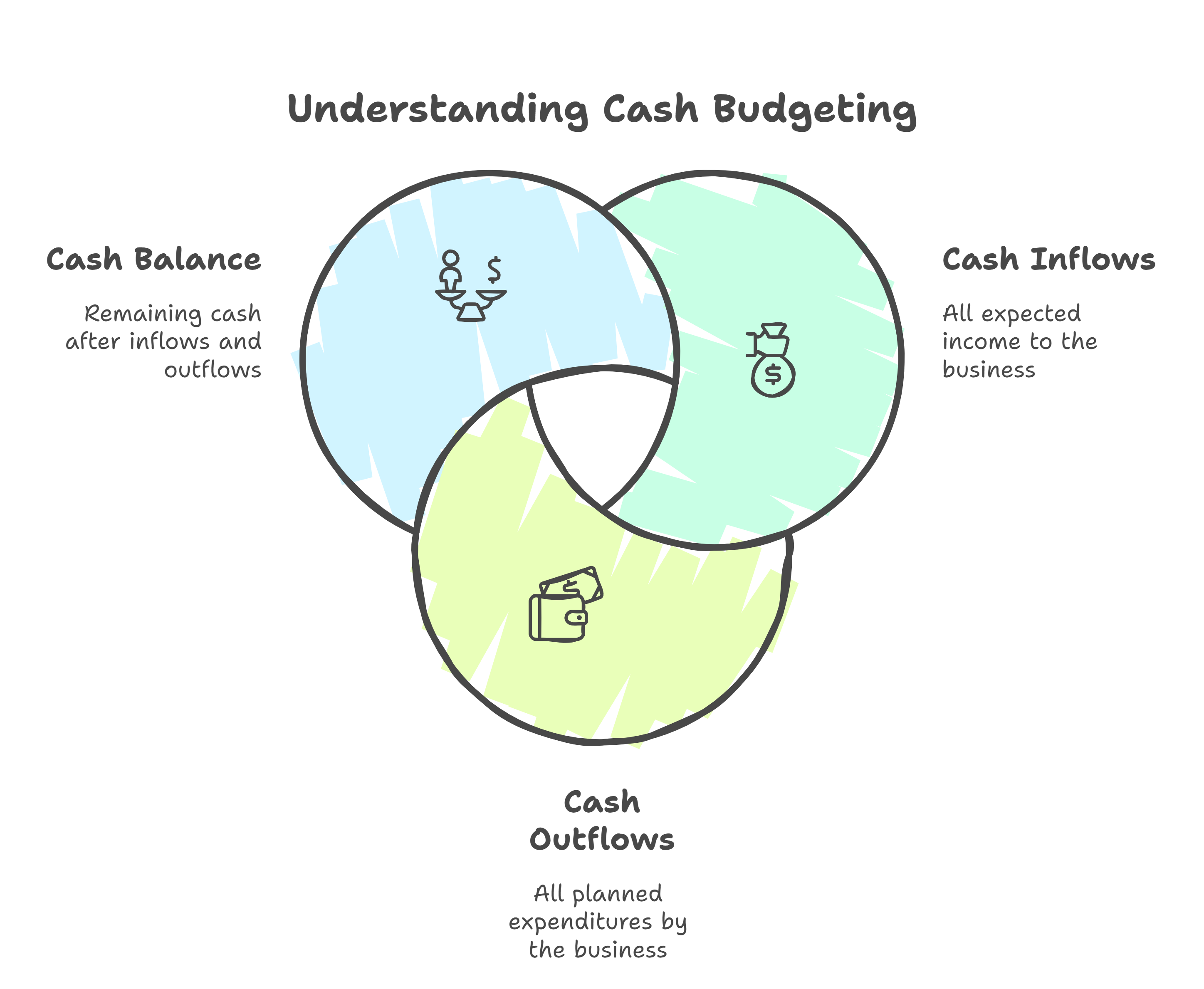

A cash budget has 3 main parts

-

Cash Inflows: This is all the money a business expects to receive.

- Examples: Sales made to customers (cash sales), Payments from customers who bought on credit, Loans or money invested by the owners.

-

Cash Outflows: This is all the money a business plans to spend.

- Examples: Paying salaries, rent, or bills, Buying raw materials or inventory. Paying back loans or interest.

- Cash Balance: After adding up the inflows and outflows, the business checks how much money is left. Understanding Cash Budgeting Cash Balance Cash Inflows Remaining cash after inflows and outflows All expected income to the business Cash Outflows

Formula: Cash Balance = Cash Inflows – Cash Outflows.

Understanding Cash Budgeting

Cash Balance

Cash Inflows

Remaining cash after inflows and outflows

All expected income to the business

Cash Outflows

All planned expenditures by the business

How to Make a Cash Budget?

Here are the simple steps to create a cash budget:

- List All Your Cash Inflows: Write down all the money the business expects to receive during a specific period.

- List All Your Cash Outflows: Write down all the expenses the business expects to pay during that same time.

- Calculate the Cash Balance: Subtract the outflows from the inflows to see if the business will have extra cash (surplus) or not enough cash (deficit).

- Plan for Surpluses or Deficits: If there's extra cash, the business can save or invest it. If there's not enough, the business can plan to borrow money or cut back on spending.

Challenges in Making a Cash Budget

- Unexpected Changes: Sometimes, things don't go as planned, like customers paying late.

- Overestimating Income or Underestimating Expenses: If the estimates are wrong, the budget won't be accurate.

- Seasonal Fluctuations: Some businesses earn more in certain seasons and less in others, which can complicate budgeting.

Summary

- A cash budget is a simple but powerful tool to manage a business's money.

- It tracks what's coming in, what's going out, and how much is left.

- By planning ahead, businesses can avoid running out of cash and prepare for both opportunities and emergencies.

Let us solve a question for better understanding

Q1 - From the following Data Forecast the cash position at the end of April, May, June 2024

| Month 2024 | Sales | Purchase | Wages | Sales Expense |

|---|---|---|---|---|

| February | 1,00,000 | 90,000 | 10,500 | 2,500 |

| March | 1,10,000 | 1,00,000 | 11,000 | 2,600 |

| April | 60,000 | 1,10,000 | 7,000 | 2,000 |

| May | 1,20,000 | 1,15,000 | 10,500 | 3,000 |

| June | 80,000 | 90,000 | 8,500 | 2,200 |

Further information

- Sales at 10% realized in the month of sales, Balance Equally realized in two subsequent months

- Purchases: creditors are paid in the month following the month of supply

- Wages: 20% Paid in arrears in the following month

- Sales Expense paid in the month itself.

- Income tax 30000 Payable in June

- Dividend 12000 payable in June

- Income from investment 5000 received half yearly in march and September

- Cash balance in hand as on 1st April 2025 is 50000

Cash Budget For Three Months Ending June 2024

Date: ...

| Particular | April | May | June |

|---|---|---|---|

| Opening Balance of Cash | 50000 | 40700 | 6400* |

| + Receipts of Cash | |||

| Cash Sales 10% | 6000 | 12000 | 8000 |

| Cash Received From Debtor (WN) | 94,500 | 76,500 | 81,000 |

| Total Receipts (a) | 150,500 | 129,200 | 95,400 |

| - Payments | |||

| Creditor for Purchase | 1,00,000 | 1,10,000 | 1,15,000 |

| Wages: Current 80% | 5,600 | 8,400 | 6,800 |

| arrears 20% | 2,200 | 1,400 | 2,100 |

| Sales Expense | 2,000 | 3,000 | 2,200 |

| Income Tax | - | - | 30,000 |

| Dividend | - | - | 12,000 |

| Total Payments (b) | 109,800 | 122,800 | 168,100 |

| Closing Balance (a-b) | 40700 | 6400* | -72,700 (cash deficit) |

* Note the asterisk on the number 6400 is to denote it is carried forward from the previous month as opening balance.

Working Note 1 - Collection of Sales

Date: ...

| Particular | Feb | March | April | May | June |

|---|---|---|---|---|---|

| Total Sales | 1,00,000 | 1,10,000 | 60,000 | 1,20,000 | 80,000 |

| - Cash Sales (10%) | 10,000 | 11,000 | 6,000 | 12,000 | 8,000 |

| Credit Sales | 90,000 | 99,000 | 54,000 | 108,000 | 72,000 |

| Installment (Next 2 months) | - | 45,000 | 49,500 | 27,000 | 54,000 |

| 45,000 | 49,500 | 27,000 | |||

| 45,000 | 49,500 | 27,000 | |||

| Total Realized Sales | 94,500 | 76,500 | 81,000 |