RBI Functions

The Reserve Bank of India (RBI) is the central bank of India. Established in 1935, it plays a crucial role in the country's economic and financial stability. Here are its key functions:

1. Monetary Policy

- Objective: Maintain price stability while keeping in mind the objective of growth.

-

Tools:

- Repo Rate: The rate at which the RBI lends money to commercial banks.

- Reverse Repo Rate: The rate at which the RBI borrows money from commercial banks.

- Cash Reserve Ratio (CRR): The percentage of a bank's deposits that must be kept with the RBI.

- Statutory Liquidity Ratio (SLR): The percentage of a bank's deposits that must be invested in government securities.

- Open Market Operations (OMO): Buying and selling government securities in the open market to influence liquidity.

2. Financial Supervision and Regulation

- Objective: Ensure the stability and soundness of the financial system.

-

Functions:

- Banking Regulation: Licensing and regulating banks, setting prudential norms, and supervising their operations.

- Non-Banking Financial Companies (NBFCs) Regulation: Regulating and supervising NBFCs to ensure their financial health.

- Payment and Settlement Systems: Overseeing payment and settlement systems to ensure efficiency and security.

- Consumer Protection: Protecting the interests of bank customers and promoting financial literacy.

3. Currency Management

- Objective: Issue and manage currency, ensuring its availability and integrity.

-

Functions:

- Currency Issue: Issuing and distributing banknotes and coins.

- Currency Chest Management: Maintaining currency chests across the country for efficient distribution.

- Soiled Note Exchange: Exchanging soiled and mutilated notes for new ones.

- Counterfeit Currency Detection: Taking measures to prevent counterfeiting and detect fake currency.

4. Foreign Exchange Management

- Objective: Manage foreign exchange reserves and regulate foreign exchange transactions.

-

Functions:

- Maintaining Forex Reserves: Holding and managing India's foreign exchange reserves.

- Regulating Forex Transactions: Monitoring and regulating foreign exchange transactions to ensure stability.

- Intervention in Forex Market: Intervening in the foreign exchange market to manage exchange rate volatility.

5. Developmental Role

- Objective: Promote financial inclusion and support economic development.

-

Functions:

- Financial Inclusion: Promoting access to financial services for all segments of society.

- Priority Sector Lending: Mandating banks to lend a certain percentage of their loans to priority sectors like agriculture and small businesses.

- Rural Development: Supporting initiatives for rural development and agricultural finance.

6. Other Functions

- ** Banker to the Government:** Acting as the banker and financial advisor to the central and state governments.

- ** Lender of Last Resort:** Providing emergency liquidity support to banks facing financial difficulties.

- ** Debt Management:** Managing the government's public debt.

- ** Data Collection and Research:** Collecting and analyzing economic and financial data, conducting research, and publishing reports.

The RBI plays a multifaceted role in the Indian economy, contributing to its stability, growth, and development.

Key Functions of the Reserve Bank of India

Monetary Policy

Focuses on maintaining price stability and economic growth through various financial tools.

Financial Supervision

Ensures the stability of the financial system by regulating banks and financial entities.

Reserve Bank of India

Currency Management

Manages the issuance and integrity of currency in India.

Foreign Exchange

Regulates foreign exchange reserves and transactions to maintain stability.

Developmental Role

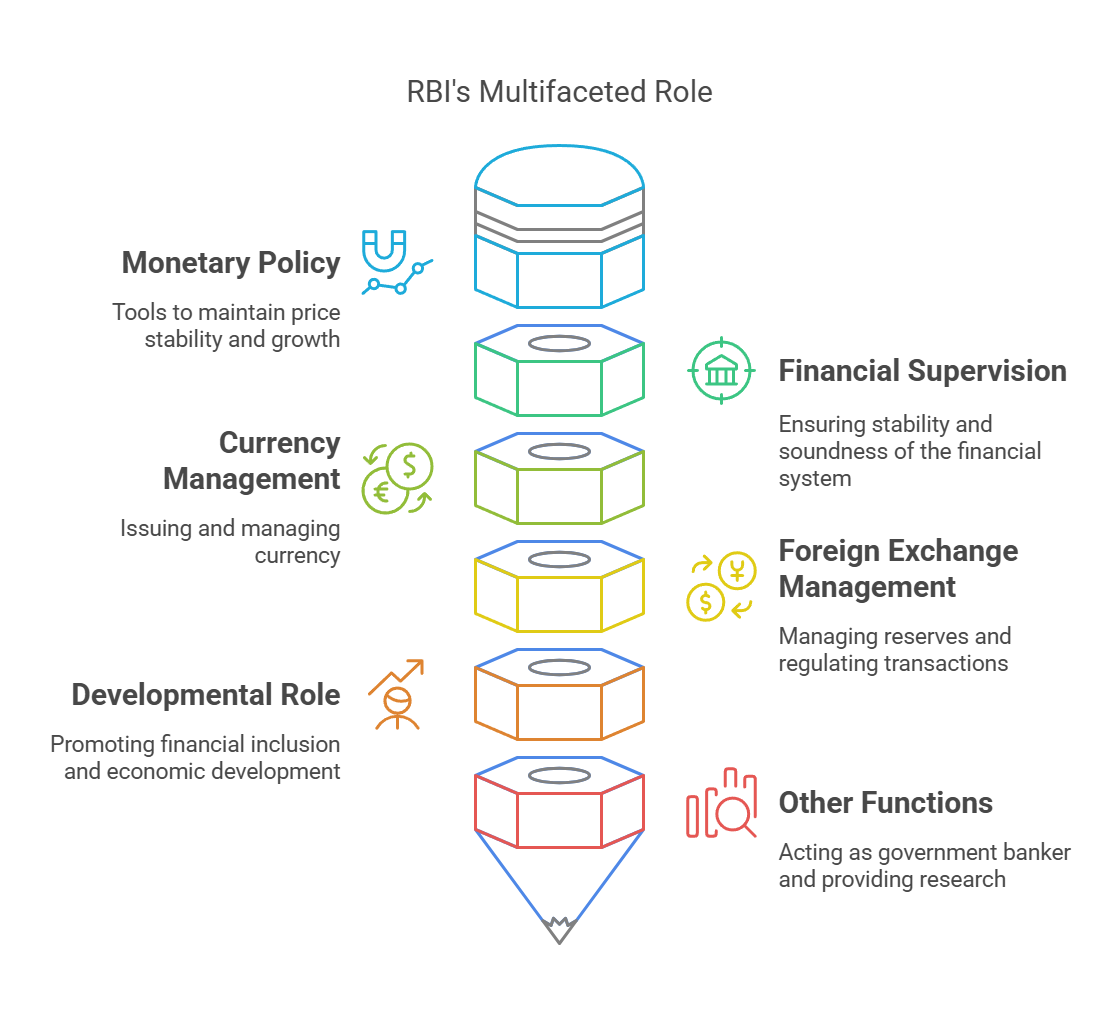

RBI's Multifaceted Role

Monetary Policy

Tools to maintain price stability and growth

Financial Supervision

Currency Management

Ensuring stability and soundness of the financial system

Issuing and managing currency

Foreign Exchange Management

Managing reserves and regulating transactions

Developmental Role

Promoting financial inclusion and economic development

Other Functions

Acting as government banker and providing researchR[](https://notes.collegehive.in/uploads/images/gallery/2025-01/image-1737740992935.png)