Dividend policy decisions - meanin and sinificance , kinds of dividends, bonus sares.

I. Dividend Policy Decisions: Meaning and Significance

Definition: Dividend policy refers to the decisions made by a company's board of directors regarding the amount, form, and timing of cash distributions to its shareholders out of its profits. It's about determining how much of the company's earnings will be paid out as dividends versus retained for reinvestment in the business.

Significance:

Investment Decisions: Investors use dividend information to assess the profitability and risk of a company. Some investors (e.g., retirees) rely on dividends as a source of income.

Capital Budgeting: Dividend policy is intertwined with capital budgeting. Retained earnings are a primary source of financing for new projects.

Signaling: Dividends can signal management's confidence in the company's future earnings. A dividend increase is usually interpreted positively.

Market Valuation: Dividend policy influences the market value of the company's shares. There are theories (which we'll cover later) that explore this relationship.

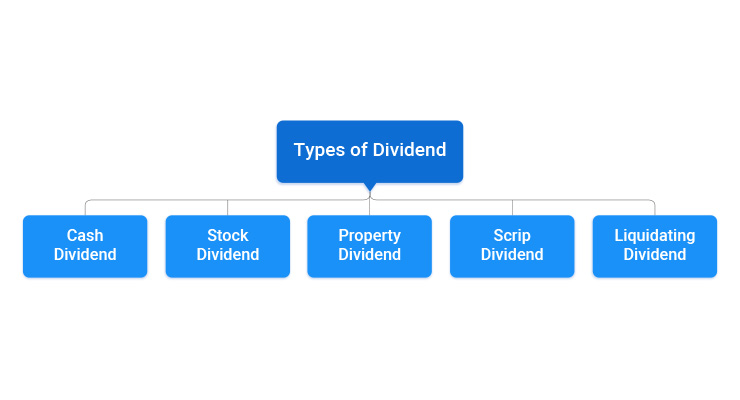

II. Kinds of Dividends

Cash Dividend:

The most common type.

Paid in the form of cash.

Requires the company to have sufficient cash available.

Stock Dividend (Bonus Shares):

Paid in the form of additional shares of the company's stock.

Does not involve an outflow of cash.

Increases the number of outstanding shares and reduces the per-share price (ideally proportionally, though market reactions can vary).

Property Dividend:

Paid in the form of assets other than cash (e.g., marketable securities, inventory).

Rare in practice due to valuation and tax complications.

Scrip Dividend (Deferred Dividend):

A promissory note issued to shareholders promising to pay a dividend at a future date.

Used when a company lacks sufficient cash currently but expects to have it in the future.

Liquidating Dividend:

A return of capital to shareholders, typically during a company's liquidation or winding-up.

Represents a distribution of the company's assets rather than earnings.

Composite Dividend:

Some companies declare dividend partly in cash and partly in kind.

Meaning: A distribution of a company's accumulated profits in the form of free additional shares to existing shareholders, in proportion to their holdings.

Merits:

Preserves Cash: Allows the company to conserve cash for reinvestment or other purposes.

Signaling Effect: Can signal management's confidence in the company's long-term prospects. Issuing bonus shares is often seen as a positive signal.

Increased Marketability: Can reduce the per-share price, making the stock more affordable for smaller investors, potentially increasing trading volume and liquidity.

Enhanced Investor Confidence: Investors who hold a fixed number of shares can profit from the price rise of shares after the stock dividend announcement.

May Prevent Hostile Takeovers: Helps to expand the ownership base.

Demerits:

Dilution of Earnings per Share (EPS): Increases the number of outstanding shares, potentially reducing EPS.

Psychological Impact: Investors may perceive a bonus issue negatively if the underlying performance of the company is not strong.

Tax Implications: While the receipt of bonus shares is generally not taxable at the time of issuance, the subsequent sale of those shares will be subject to capital gains tax.

No Real Value Creation: Bonus shares don't fundamentally change the company's value; they just divide the existing equity among more shares. The market price should adjust accordingly.

Accounting Treatment: Bonus shares are issued by capitalizing reserves (e.g., retained earnings, general reserve, security premium)

Legal Requirements (India):

No default: Company must not have defaulted in payment of interest or principal in respect of fixed deposits or debt securities issued by it.

Utilizing Reserves: Bonus shares can be issued out of free reserves, security premium account, or capital redemption reserve account.