Dividend policy decisions - meaning and significance , kinds of dividends, bonus shares.

Dividend Policy Notes

I. Dividend Policy Decisions: Meaning and Significance

Definition: Dividend policy refers to the decisions madeDecisions by a company's board of directors regardingon the amount, form, and timing of cash distributions to its shareholders out of itsfrom profits. It's about determiningDetermines how much of the company's earnings will beis paid out as dividends versus retained for reinvestment in the business.reinvestment.

Significance:

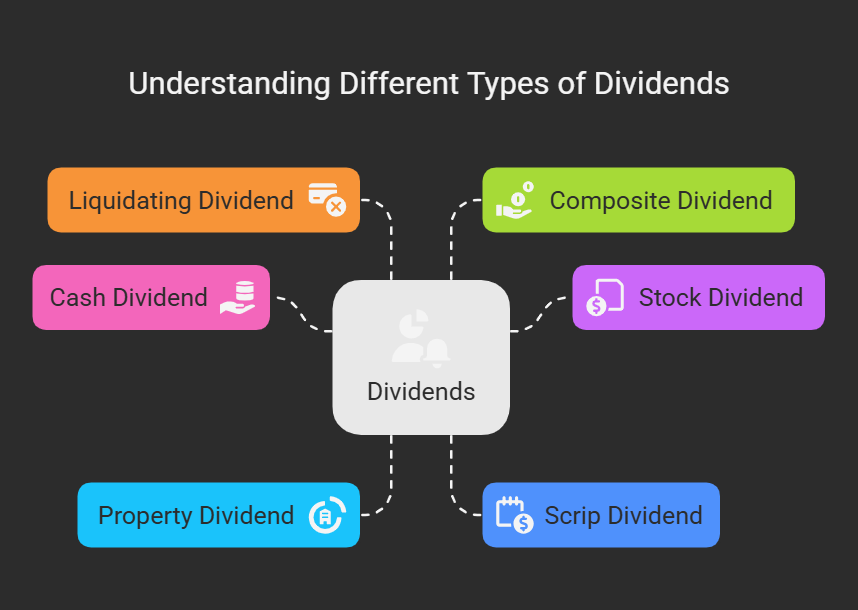

II. Kinds of Dividends

-

Cash Dividend:

TheMostmostcommon,common type. Paidpaid inthe form ofcash. Requiresthe company to havesufficientcashcash. -

Stock Dividend (Bonus Shares):

Paid in

the form ofadditionalsharesshares.ofNothecashcompany's stock. Does not involve an outflow of cash.outflow. Increasesthe number ofoutstandingshares andshares, reducestheper-sharepriceprice. -

proportionally, though market reactions can vary).Property Dividend:

Paid in

the form ofassets other thancash (e.g., marketable securities, inventory).cash. Rarein practicedue tovaluation andvaluation/tax complications. -

Scrip Dividend (Deferred Dividend):

A promissoryPromissory noteissued to shareholders promisingto payadividendat a future date.later. Used whenacashcompany lacks sufficient cashis currently lacking butexpects to have itexpected in the future. -

Liquidating Dividend:

A returnReturn of capital toshareholders, typicallyshareholders duringaliquidation.company's liquidation or winding-up. Represents a distributionDistribution oftheassets,company's assets rather thannot earnings. -

Composite Dividend:

Some companies declare dividend partly inPartly cash and partly in kind.

III. Bonus Shares (Stock Dividends)

Meaning: A distributionDistribution of a company's accumulated profits in the form ofas free additional shares to existing shareholders, in proportionproportionally to their holdings.

Merits:

-

Preserves Cash:

Allows the company to conserveConserves cash forreinvestmentreinvestment. -

other purposes.Signaling Effect:

Can signal management'sSignals confidence inthe company'slong-term prospects. -

bonus shares is often seen as a positive signal.Increased Marketability:

Can reduce theReduces per-share price, makingthestockmore affordable for smaller investors,affordable, potentially increasing tradingvolumevolume. -

liquidity.Enhanced Investor Confidence:

Investors who hold a fixed number of sharesShareholders can profit fromtheprice riseof sharesaftertheannouncement. -

dividend announcement.May Prevent Hostile Takeovers:

Helps to expand theExpands ownership base.

Demerits:

Demerits:

-

Dilution of Earnings per Share (EPS): Increases

thesharesnumber of outstanding shares,outstanding, potentially reducing EPS. -

Psychological Impact:

Investors may perceive a bonus issue negativelyNegative iftheunderlying performanceof the companyis not strong. -

Tax Implications:

While the receiptSale of bonus sharesis generally not taxable at the time of issuance, the subsequent sale of those shares will besubject to capital gains tax. -

No Real Value Creation:

Bonus shares don't fundamentally change the company's value; they just divide theDivides existing equity among more shares.The marketMarket price shouldadjustadjust.

Accounting Treatment: Bonus shares are issuedIssued by capitalizing reserves (e.g., retained earnings, general reserve, security premium).

Legal Requirements (India):