teories of dividend decision , determinants , companies act 2013

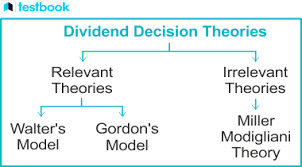

IV. Theories of Dividend Decisions

These theories attempt to explain the relationship between dividend policy and the value of the firm.

A. Irrelevance Theory (Modigliani and Miller - MM):

Core Idea: Under perfect market conditions (no taxes, no transaction costs, perfect information), dividend policy is irrelevant to the value of the firm. Investors can create their own "homemade dividends" by selling shares if they need cash, or reinvest dividends if they don't.

Assumptions: Perfect markets, rational investors, no taxes, no transaction costs, fixed investment policy.

Criticisms: The real world is not perfect. Taxes, transaction costs, and information asymmetry exist, making the theory less applicable.

B. Relevance Theories: These theories argue that dividend policy does matter.

- Walter's Model:

Core Idea: The optimal dividend policy depends on the relationship between the firm's internal rate of return (r) and the cost of capital (k).

If r > k: Growth firm; retain earnings (0% dividend payout ratio is optimal).

If r = k: Indifference; dividend policy doesn't matter.

If r < k: Declining firm; pay out all earnings as dividends (100% dividend payout ratio is optimal).

Formula: P = (D + (E-D) * (r/ke)) / ke

Where: P = Market Price per share, D = Dividend per share, E = Earnings per share, r = firm's rate of return, ke = Cost of Equity Capital

- Gordon's Model (Dividend Discount Model - DDM):

Core Idea: The value of a stock is the present value of its expected future dividends.

Formula: P0 = D1 / (ke - g)

Where: P0 = Current price, D1 = Expected dividend next year, ke = Required rate of return, g = Constant growth rate of dividends.

Implication: Higher dividends and a higher growth rate of dividends lead to a higher stock price.

Criticisms: Assumes a constant growth rate, which is not always realistic. Also very sensitive to the inputs (ke and g).

- Bird-in-the-Hand Theory (Myron Gordon and John Lintner):

Core Idea: Investors prefer current dividends (a "bird in the hand") over uncertain future capital gains.

Rationale: Dividends reduce uncertainty about future returns.

Implication: Higher dividends lead to a higher stock price, even if the total return is the same.

Criticisms: Contradicts the MM irrelevance theory.

C. Tax Preference Theory:

Core Idea: Dividend policy is influenced by the tax implications for investors.

Rationale: If dividends are taxed at a higher rate than capital gains, investors may prefer companies that retain earnings and generate capital gains. Conversely, if dividends are taxed at a lower rate, investors may prefer higher dividend payouts.

Empirical Evidence: Evidence is mixed, as tax laws vary across countries and over time.

D. Signaling Theory (Dividend Signaling):

Core Idea: Dividends convey information about a company's future prospects.

Rationale: Management has inside information about the company's profitability.

Implication: A dividend increase is a credible signal that management expects higher future earnings. A dividend decrease is a negative signal.

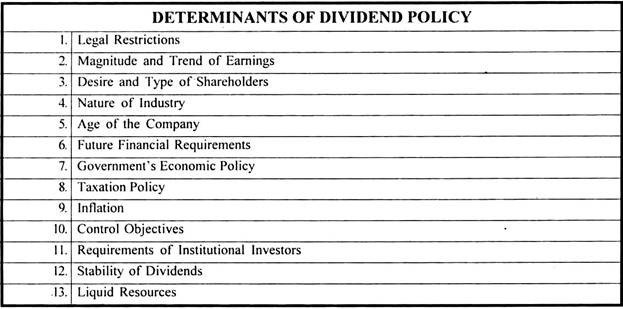

V. Determinants of Dividend Policy Decisions

Factors that influence a company's dividend policy:

Profitability: A company needs sufficient profits to pay dividends.

Liquidity: Even if profitable, a company must have sufficient cash to distribute dividends.

Investment Opportunities: Companies with attractive investment opportunities may choose to retain earnings to fund those projects.

Financial Leverage (Debt): High debt levels may restrict a company's ability to pay dividends. Creditors may impose restrictions on dividend payments.

Growth Rate: High-growth companies often retain earnings to finance growth.

Legal Restrictions: Companies Act and other regulations may restrict dividend payments.

Contractual Restrictions: Loan agreements or bond indentures may restrict dividend payments.

Inflation: High inflation will reduce the real value of dividends and hence dividend policy becomes restrictive.

Stability of Earnings: Stable earning companies tend to pay a high dividend payout ratio.

Access to Capital Markets: Companies with ready access to capital markets tend to distribute earnings in the form of dividend.

Control Objective: If management wants to maintain control of the company, they may declare stock dividend instead of cash dividends.

Taxation: Taxation policy has a significant effect on the dividend policy of the company.

VI. Companies Act, 2013 and SEBI Guidelines on Dividend Distribution (Theory Only)

A. Companies Act, 2013 (Key Provisions):

Section 123: Deals with the declaration of dividends.

Dividends can only be declared out of:

Current profits.

Past accumulated profits (undistributed profits).

Money provided by the Central or State Government for the payment of dividends.

Depreciation must be provided for before declaring dividends.

Transfer to Reserves: The Board may decide to transfer a portion of the profits to reserves before declaring dividends.

In case of inadequacy of profits, dividends can be declared out of accumulated profits subject to certain conditions and rules.

Section 124: Deals with the Unpaid Dividend Account.

Dividends that remain unpaid or unclaimed within 30 days must be transferred to an Unpaid Dividend Account.

If the amount remains unclaimed for 7 years, it must be transferred to the Investor Education and Protection Fund (IEPF).

Interim Dividend: The Board of Directors may declare interim dividends during the financial year.

B. SEBI (Securities and Exchange Board of India) Guidelines on Dividend Distribution (Listed Companies):

Listing Agreement/Regulations: SEBI regulations mandate certain disclosures and procedures for dividend distribution by listed companies.

Disclosure Requirements:

Companies must disclose the dividend amount, record date, payment date, and other relevant information to the stock exchanges.

Must disclose the reasons for any changes in the dividend policy.

Record Date: The company must announce the record date for determining shareholders eligible to receive dividends.

Payment Timeline: Companies must adhere to a prescribed timeline for dividend payments after declaration.

Dividend Warrants/Electronic Transfer: Dividends can be paid via dividend warrants or electronic transfer to shareholders' bank accounts.

Compliance with Accounting Standards: Dividend distribution must be in compliance with applicable accounting standards.

Regulations for Bonus Issues: SEBI has specific regulations governing the issuance of bonus shares, including eligibility criteria, disclosure requirements, and timelines.

Important Considerations:

Practical Application: Dividend policy is a complex area. Companies must consider a wide range of factors, including their financial situation, investment opportunities, and shareholder preferences.

Dynamic Nature: Dividend policy is not static. Companies should review their dividend policy periodically and make adjustments as needed.

Consultation: Companies should consult with financial advisors and legal counsel when making dividend policy decisions.

This detailed overview should provide a comprehensive understanding of dividend policy decisions. Remember to consult specific legal and regulatory documents for the most up-to-date information. Good luck!

18.0s Type something