Theories of dividend decision , determinants , companies act 2013

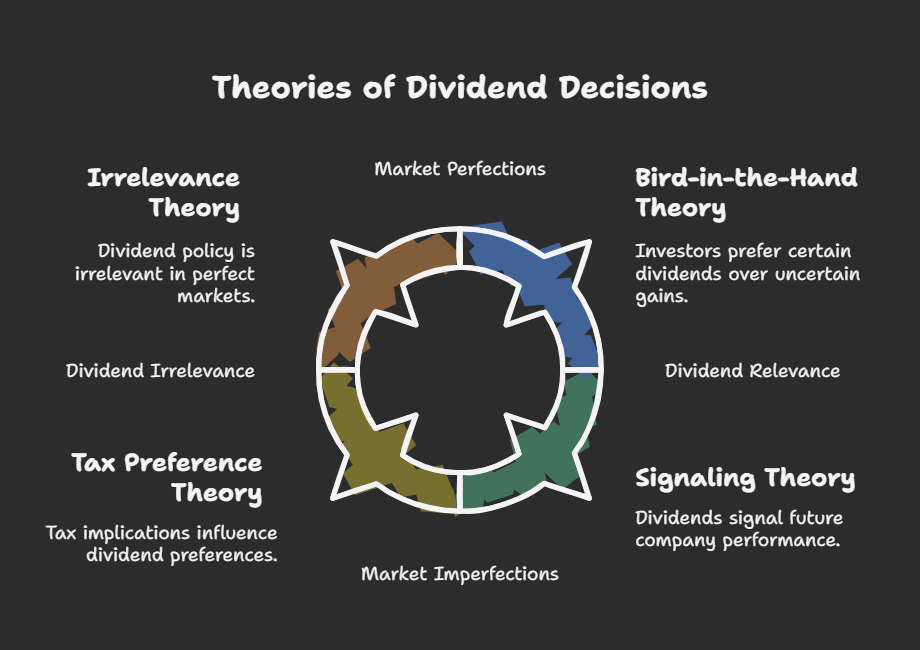

V. Theories of Dividend Decisions

A. Irrelevance Theory (Modigliani and Miller - MM):

A. Irrelevance Theory (Modigliani and Miller - MM):

- Core Idea: Dividend policy is irrelevant under perfect market conditions (no taxes, transaction costs, perfect information). Investors can create "homemade dividends."

- Assumptions: Perfect markets, rational investors, no taxes, no transaction costs, fixed investment policy.

- Criticisms: Real world is not perfect; taxes, transaction costs, and information asymmetry exist.

B. Relevance Theories: Dividend policy matters.

-

Walter's Model:

- Core Idea: Optimal dividend policy depends on the relationship between the firm's internal rate of return (r) and the cost of capital (k).

- If r > k: Growth firm; retain earnings (0% payout).

- If r = k: Indifference; dividend policy doesn't matter.

- If r < k: Declining firm; pay out all earnings (100% payout).

-

Formula: P = (D + (E-D) * (r/ke)) / ke

- P = Market Price per share

- D = Dividend per share

- E = Earnings per share

- r = firm's rate of return

- ke = Cost of Equity Capital

-

Gordon's Model (Dividend Discount Model - DDM):

- Core Idea: Value of stock is the present value of expected future dividends.

-

Formula: P0 = D1 / (ke - g)

- P0 = Current price

- D1 = Expected dividend next year

- ke = Required rate of return

- g = Constant growth rate of dividends

- Implication: Higher dividends and growth = higher stock price.

- Criticisms: Assumes constant growth rate, sensitive to inputs (ke and g).

-

Bird-in-the-Hand Theory (Myron Gordon and John Lintner):

- Core Idea: Investors prefer current dividends ("bird in the hand") over uncertain future capital gains.

- Rationale: Dividends reduce uncertainty.

- Implication: Higher dividends = higher stock price.

- Criticisms: Contradicts MM irrelevance theory.

C. Tax Preference Theory:

- Core Idea: Dividend policy influenced by tax implications for investors.

- Rationale: If dividends taxed higher than capital gains, investors prefer retained earnings.

- Empirical Evidence: Mixed, tax laws vary.

D. Signaling Theory (Dividend Signaling):

- Core Idea: Dividends convey information about future prospects.

- Rationale: Management has inside information.

- Implication: Dividend increase is a credible signal of higher future earnings. Dividend decrease is negative.

V. Determinants of Dividend Policy Decisions

- Profitability: Sufficient profits to pay dividends.

- Liquidity: Sufficient cash for distribution.

- Investment Opportunities: Attractive projects may lead to retaining earnings.

- Financial Leverage (Debt): High debt may restrict dividend payments.

- Growth Rate: High-growth companies often retain earnings.

- Shareholder Preferences: Consider preferences for dividends vs. capital gains.

- Legal Restrictions: Companies Act and other regulations.

- Contractual Restrictions: Loan agreements may restrict payments.

- Inflation: High inflation reduces real value of dividends, restricting policy.

- Stability of Earnings: Stable earnings lead to higher payouts.

- Access to Capital Markets: Easy access encourages distribution.

- Control Objective: Stock dividends maintain control.

- Taxation: Significant effect on dividend policy.

VI. Companies Act, 2013 and SEBI Guidelines on Dividend Distribution (Theory Only)

A. Companies Act, 2013 (Key Provisions):

-

Section 123: Declaration of dividends.

- Out of current profits, past accumulated profits, or money from government.

- Depreciation must be provided for.

- Board can transfer profits to reserves.

- Inadequacy of profits: dividends can be declared from accumulated profits subject to rules.

-

Section 124: Unpaid Dividend Account.

- Unpaid/unclaimed dividends within 30 days go to Unpaid Dividend Account.

- Unclaimed for 7 years, transferred to Investor Education and Protection Fund (IEPF).

- Interim Dividend: Board can declare interim dividends.

B. SEBI (Securities and Exchange Board of India) Guidelines on Dividend Distribution (Listed Companies):

- Listing Agreement/Regulations: Mandates disclosures and procedures.

-

Disclosure Requirements:

- Dividend amount, record date, payment date.

- Reasons for changes in policy.

- Record Date: Announce record date for eligibility.

- Payment Timeline: Adhere to timeline after declaration.

- Dividend Warrants/Electronic Transfer: Payment methods.

- Compliance with Accounting Standards: Dividend distribution must comply.

- Regulations for Bonus Issues: Specific regulations.

Important Considerations:

- Practical Application: Complex area; consider financial situation, opportunities, and shareholder preferences.

- Dynamic Nature: Review and adjust periodically.

- Consultation: Consult with advisors and legal counsel.

No Comments