Understanding Mutual Funds: An Introduction

Introduction

In the previous unit, we explored investment companies that offer savings facilities along with special services like life insurance and pensions. This unit delves into another popular investment vehicle: mutual funds.

A mutual fund is essentially a trust that pools the savings of numerous investors who share a common financial goal. Instead of each investor managing their own portfolio, the mutual fund invests these pooled funds in the stock and debt markets. This provides investors with two key advantages:

A mutual fund is essentially a trust that pools the savings of numerous investors who share a common financial goal. Instead of each investor managing their own portfolio, the mutual fund invests these pooled funds in the stock and debt markets. This provides investors with two key advantages:

- Expertise in Investments: Mutual funds employ professional fund managers with in-depth knowledge of the market, helping investors make informed decisions.

- Diversification: By investing in a variety of securities across different sectors, mutual funds reduce risk compared to investing in individual stocks or bonds.

This structure is particularly beneficial for smaller investors who may lack the resources or expertise to effectively manage their own portfolios. For example, an investor with just ₹10,000 annually might struggle to achieve diversification or gain access to professional financial advice without a mutual fund. By joining a mutual fund, investors not only pursue a shared financial goal but also collectively share the costs of expert management and diversification.

Mutual funds typically aim for various objectives for their investors, including:

- Attractive Yields: Generating income through dividends and interest payments.

- Capital Appreciation: Increasing the value of investments over time.

- Safety and Liquidity: Balancing returns with the need for secure and easily accessible funds.

This unit will introduce the fundamental concepts of mutual funds, their advantages, a brief historical overview, how they are organized, and the typical investment process involved.

Concepts and Advantages of Investing in Mutual Funds

Institutional and Managed Portfolios

As mentioned, mutual funds gather funds from numerous small investors and invest in shares and bonds of various companies. The income generated through these investments, along with capital appreciation, is distributed among unit holders based on the number of units they own. This makes mutual funds a highly suitable investment option for the general public, offering a chance to participate in a diversified, professionally managed portfolio at a relatively low cost.

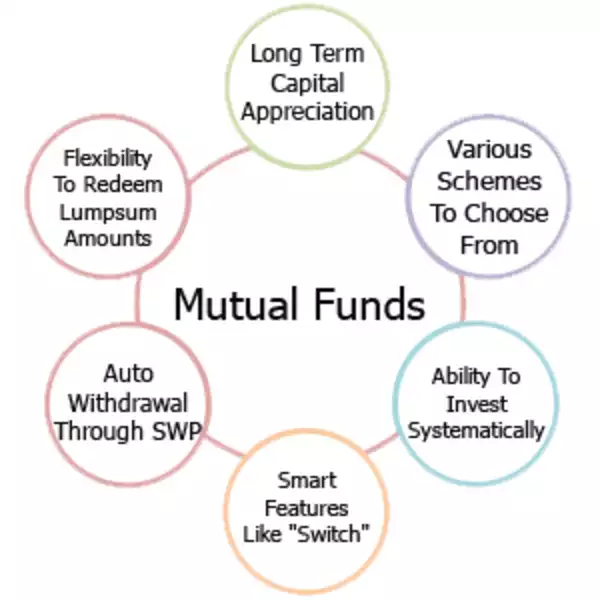

Advantages of Investing in Mutual Fund Schemes

Compared to other investment options, investing in mutual fund schemes offers several key advantages, particularly for small and medium-income investors:

-

Professional Management:

- Fund managers with expertise and access to real-time market information make informed investment decisions, eliminating impulsive buying or selling based on emotions.

-

Diversification:

- Investment is spread across a wide range of industries and sectors, reducing the risk associated with concentrating investments in a single area.

-

Convenient Administration:

- Investors are relieved of paperwork, accounting, and the day-to-day hassles of managing investments.

-

Return Potential:

- Dividends and capital gains are often reinvested, maximizing the potential for growth through the power of compounding.

-

Low Costs:

- Economies of scale allow mutual funds to operate at lower costs, which are passed on to the investors in the form of lower expense ratios.

-

Liquidity:

- Mutual funds offer liquidity through buyback programs or by being listed on stock exchanges after a specified lock-in period, enabling investors to access their money when needed.

-

Transparency:

- Fund performance and holdings are generally disclosed regularly, ensuring investors are aware of how their money is being used.

-

Flexibility:

- Investors can choose from a variety of schemes that match their individual risk tolerance and investment objectives.

-

Choice of Schemes:

- Mutual funds offer diverse types of schemes (e.g., equity, debt, hybrid) to cater to various needs and goals of investors.

-

Tax Benefits:

- Mutual fund investments often come with tax benefits related to the amount invested, returns earned, dividends, and capital gains. (Note: Specific tax benefits can vary by jurisdiction).

-

Well-Regulated:

- Mutual fund operations are heavily regulated by governing bodies, ensuring transparency, accountability, and safety for investors.

-

Capital Appreciation:

- Investors can benefit from potential capital appreciation without needing to closely monitor the daily fluctuations of individual stock prices.

Conclusion

In essence, mutual funds provide a convenient, affordable, and professionally managed way for investors to participate in the financial markets. By pooling resources, sharing costs, and leveraging expertise, mutual funds empower even small investors to achieve their financial goals through diversified and well-regulated investment strategies.