Democratizing the market

The Delicate Nature of Market Development

The analogy of a market as a garden aptly illustrates the need for constant care and attention. Just as a garden requires nurturing to cultivate flowers and remove weeds, markets necessitate ongoing effort to flourish and remain open.

Essential Elements for Market Growth

Two fundamental aspects underpin a thriving market:

-

Strong Incentives for Disruption: A dynamic market encourages the challenging of established, traditional elites. This disruption paves the way for broader participation and the inclusion of new individuals and businesses in economic activities.

-

Formalization: The establishment of clear rules, regulations, and institutions provides a framework for fair and transparent transactions, fostering trust and enabling market participants to engage with greater confidence.

The Persistent Challenge of Elites

Even when initial disruptions remove old elites, new ones can emerge. These new elites, akin to weeds in the market garden, can hinder the market's ability to sustain itself by potentially capturing a disproportionate share of profits and limiting opportunities for others. Therefore, continuous effort from various stakeholders is crucial to ensure ongoing market development and maintain relative openness.

Progress is Not Inevitable

Drawing on the insights of economic historian Joel Mokyr, it's important to recognize that economic progress is not a natural or guaranteed phenomenon. The growth of a city or region at a particular time does not automatically ensure its continued prosperity. History demonstrates that until around 1500, economic growth across different parts of the world was relatively similar, highlighting that sustained development requires deliberate action.

The Non-Linear Trajectory of Market Development

The evolution of markets and finance is not a unidirectional process of constant improvement. Markets in the past were not necessarily less developed than those of today, and progress can indeed be reversed in certain regions. The example of Kolkata, once a significant global hub of commerce and finance that has since experienced a decline, underscores this point. Various historical examples illustrate that commercial progress can suffer setbacks.

Factors Leading to Market Setbacks

A key reason for such setbacks can be the emergence of elites who act as intermediaries rather than fostering a truly free market where strangers can interact directly. These emergent elites can gradually capture more and more of the economic benefits, reducing the vibrancy of the market and limiting opportunities for broader participation.

The Necessity of Sustained Effort

For robust financial and market development, a fundamental requirement is sustained effort from a diverse range of stakeholders. The specific roles and responsibilities of these stakeholders are critical aspects to consider in ensuring the long-term health and openness of markets.

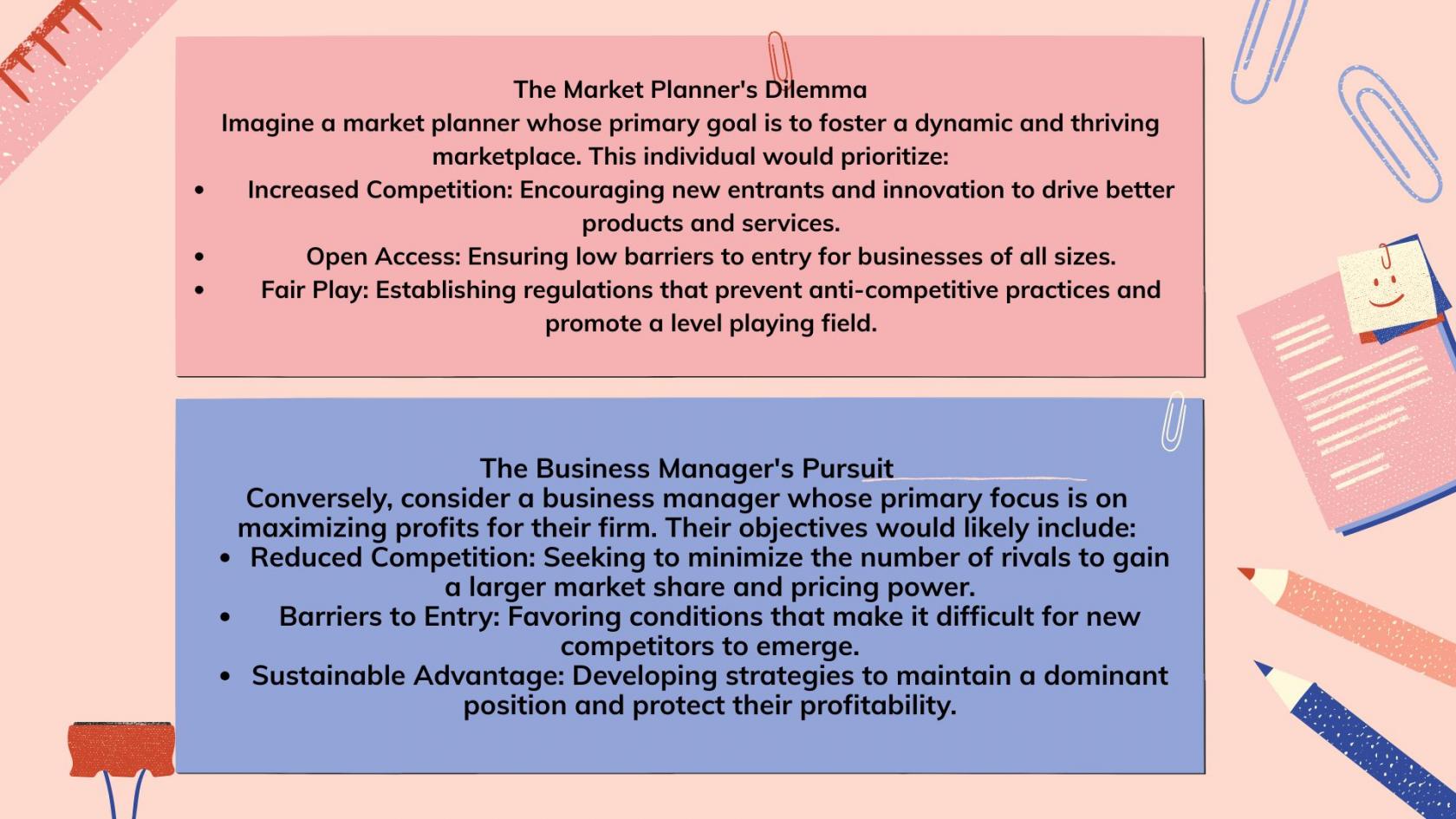

The Perpetual Tension: Markets vs. Market Players

The inherent nature of market systems harbors a fundamental tension between the goals of maintaining healthy, vibrant markets and the objectives of individual businesses operating within them. While markets are often equated with capitalism, the relationship between the overarching system and the capitalists who actively participate in it is complex and, at times, adversarial.

The Inherent Conflict

This divergence in incentives creates a fundamental dichotomy within the market system. Those responsible for overseeing and regulating markets aim to promote competition, while the businesses operating within those markets often seek to limit it. This tension necessitates constant vigilance to prevent markets from becoming stagnant and dominated by a few powerful incumbents.

The Risk of Market Maturation

Without active intervention, markets tend to naturally drift towards reduced competition. Successful incumbents may leverage their advantages to create barriers to entry, stifle innovation from newcomers, and ultimately consolidate their power. This can lead to:

- Reduced Consumer Choice: Fewer options and potentially higher prices for consumers.

- Slower Innovation: Less incentive for established players to disrupt the status quo.

- Emergence of Elites: The concentration of wealth and power in the hands of a few dominant players.

"Saving Capitalism from Capitalists"

This inherent conflict is powerfully captured by the sentiment expressed by economists Raghuram Rajan and Luigi Zingales: "We need to save capitalism from capitalists themselves." This idea highlights that the very actors who drive capitalist activity can, if left unchecked, undermine the competitive forces that are essential for a healthy capitalist system.

Historical Parallels

History offers examples of this dynamic. The emergence of free market capitalism in North Western Europe was partly contingent on dismantling the power of existing merchant guilds that stifled competition. Similarly, a truly free economy often requires the ability to challenge and compete against established business groups, allowing new innovators and entrepreneurs to thrive.

The Ongoing Need for Market Stewardship

Understanding this fundamental tension between the drive for free markets and the profit-seeking motives of businesses is crucial. It underscores the ongoing need for active measures to ensure markets remain open, competitive, and dynamic. This requires a commitment to fostering an environment where new entrants can challenge incumbents and where the pursuit of profit does not come at the expense of overall market health and consumer welfare.

The Government's Choice: Pro-Business vs. Pro-Market Policies

While business development and market development might appear synonymous on the surface, their underlying objectives often diverge significantly. As previously discussed, businesses primarily aim to maximize profits, whereas healthy markets thrive on robust competition. Governments play a crucial role in shaping the trajectory of both markets and businesses through the policies they enact, facing a fundamental question: whose interests will they prioritize?

Pro-Business Policies: Favoring Incumbents

A government that leans towards supporting existing, established businesses within a market adopts what can be termed Pro-Business policies. These policies are typically designed to enhance the profitability and strengthen the position of incumbent firms. Examples of such policies might include:

- Tax breaks and subsidies for existing businesses.

- Regulations that create barriers to entry for new competitors.

- Looser environmental or labor standards that reduce operating costs.

- Limited oversight and transparency requirements.

While Pro-Business policies can lead to increased profits for established companies, they may come at the expense of:

- Consumer Welfare: Reduced competition can lead to higher prices, lower quality, and less innovation.

- Market Dynamism: Fewer new entrants and less competitive pressure can stifle innovation and long-term growth.

- Externalities: Lack of oversight can result in negative consequences like increased pollution or unfair labor practices.

- Opportunities for Outsiders: High barriers to entry prevent new businesses with potentially better products or services from entering the market.

Pro-Market Policies: Fostering Competition

Conversely, a government focused on developing a competitive and efficient marketplace will implement Pro-Market policies. These policies aim to attract new entrants, increase transparency, and reduce friction within the market. Examples of Pro-Market policies include:

- Deregulation to lower barriers to entry for new businesses.

- Strong antitrust enforcement to prevent monopolies and anti-competitive practices.

- Policies promoting transparency and information sharing.

- Regulations to mitigate negative externalities like pollution.

- Measures to reduce transaction costs and streamline business processes.

Pro-Market policies, while potentially challenging for established incumbents, generally lead to:

- Increased Competition: More players in the market drive innovation and efficiency.

- Greater Consumer Choice: A wider range of products and services at competitive prices.

- Enhanced Transparency: More information available to consumers and businesses, leading to better decision-making.

- Reduced Negative Externalities: Regulations can minimize harmful impacts on the environment and society.

- Level Playing Field: Easier entry for new businesses fosters innovation and economic dynamism.

However, Pro-Market policies can make it more difficult for incumbent businesses to maintain high profit margins due to increased competition and transparency.

The Balancing Act: Which Path to Choose?

The question of whether to prioritize Pro-Business or Pro-Market policies presents a complex challenge for governments. While the general consensus often favors Pro-Market policies to foster long-term economic health and consumer welfare, there are nuances to consider.

Generally, policies that promote transparency and competition are desirable as they encourage innovation, efficiency, and better outcomes for consumers. A transparent and competitive market incentivizes businesses to constantly improve their offerings and operate efficiently to remain profitable.

The Case for Nurturing Infant Industries

However, specific circumstances might warrant temporary protection for nascent industries. For example, in the early stages of development, domestic "infant industries" may lack the scale, experience, and technological capabilities to compete with established foreign players. In such cases, governments might consider temporary measures to support their growth, such as:

- Strategic partnerships or joint ventures: Requiring foreign companies to collaborate with domestic firms to facilitate technology transfer and knowledge sharing.

- Targeted subsidies or tax incentives: Providing temporary support to help domestic industries become competitive.

- Carefully calibrated tariffs or trade barriers: Offering temporary protection from intense foreign competition while the industry matures.

It is crucial that such protections are temporary and clearly defined, with a roadmap for gradual liberalization to avoid creating long-term dependencies and stifling innovation.

Conclusion: A Dynamic Equilibrium

Ultimately, the optimal approach involves finding a dynamic equilibrium between supporting business growth and fostering a competitive market environment. While Pro-Market policies generally serve the long-term interests of the economy and consumers by promoting efficiency and innovation, there may be specific instances where temporary, well-defined Pro-Business measures are justified to nurture strategic infant industries. The key lies in ensuring that such interventions are carefully considered, transparent, and designed to ultimately promote a more competitive and vibrant marketplace in the long run.

The Interplay of Power: Politics, Business, and the Non-Market

The development of markets is significantly influenced by government policies, a fact intertwined with the long-standing relationship between politicians and businesses. Incumbent businesses often wield considerable power and influence over governmental decisions due to their role as funders and their established presence.

The Pro-Business Bias

Governments heavily reliant on financial or political support from incumbent businesses may find it challenging to implement Pro-Market policies that foster competition. Instead, they might lean towards Pro-Business policies that favor existing players, even if it hinders overall market development. This can manifest as:

- Regulatory capture: Incumbent businesses influencing regulations to their advantage.

- Lobbying efforts: Businesses actively persuading politicians to adopt favorable policies.

- Mercantilistic approaches: Prioritizing domestic incumbents over open markets and trade, potentially hindering long-term economic growth.

This close relationship can create a political nexus where the interests of powerful businesses overshadow the broader interests of market development, consumers, and potential new entrants. Disrupting established elites becomes difficult when they hold sway over political decision-making.

The Crucial Role of Non-Market Actors

To counter this potential bias and foster a less crony capitalist society, a vibrant and competitive non-market arena is essential. Non-market actors encompass entities outside the traditional market dynamics of firms, customers, and labor, including:

- Non-Governmental Organizations (NGOs): Advocating for public interests, environmental protection, and consumer rights.

- Media: Providing independent scrutiny, exposing malpractices, and informing the public.

- Activist Politicians: Championing policies that promote market fairness and accountability.

Just as competition is vital for healthy markets, a robust and diverse non-market landscape is crucial for holding both businesses and politicians accountable.

Examples of Non-Market Influence

Consider a powerful, polluting incumbent business that uses its influence to weaken environmental regulations. In such a scenario, NGOs and the media can play a critical role by:

- Exposing the pollution: Informing the public about the environmental damage.

- Advocating for stricter regulations: Pressuring politicians to act in the public interest.

- Mobilizing public opinion: Encouraging citizens to demand accountability from both the business and the government.

Similarly, regarding businesses with questionable data practices, journalists and NGOs can raise awareness and advocate for policies that ensure greater transparency and protect user privacy.

Sustaining Markets Through Non-Market Strength

A strong and active non-market serves as a vital check on the potential excesses of both businesses and politically motivated policies. By advocating for consumer interests, environmental protection, and ethical practices, these entities contribute to a more sustainable and equitable marketplace. Without a robust non-market, unchecked business power and political favoritism can undermine the very principles of competition and fairness that underpin a healthy market system. Therefore, the long-term sustainability of markets relies, paradoxically, on the strength and independence of non-market actors.

The Indispensable Role of Media in Society and Markets

Media serves as a crucialInformant, providing insights into societal events that might otherwise remain concealed. Investigative journalism plays a vital role in uncovering facts and exposing malpractices. The Bhopal Gas Tragedy and the Chernobyl disaster, two major industrial catastrophes that occurred in environments with underdeveloped media landscapes, underscore the importance of a robust and mature media in holding power accountable.

Media as a Catalyst for Responsibility

The presence of an active media fosters greater responsibility among businesses and politicians alike. By shedding light on issues such as food adulteration, environmental pollution, and substandard services, the media ensures that stakeholders are informed. This transparency acts as a check on incumbent businesses, discouraging them from prioritizing profits at the expense of ethical conduct and public welfare.

Empowering Consumers and New Entrants

Furthermore, media plays a significant role in amplifying consumer discontent regarding inadequate products or services. By exposing these issues, the media can create opportunities for new companies to enter the market and offer better alternatives, thus fostering competition and benefiting consumers.

Keeping Power in Check

In essence, media acts as a vital watchdog, informing the public, NGOs, and other stakeholders. This informed scrutiny keeps both businesses and politicians, who might be inclined to favor established interests, accountable. A vibrant and independent media is therefore essential for maintaining a healthy and responsible ecosystem within both society and the marketplace.

No Comments