Compulsory Registration Under GST

Compulsory Registration Under GST: Cases Where Turnover Doesn't Matter

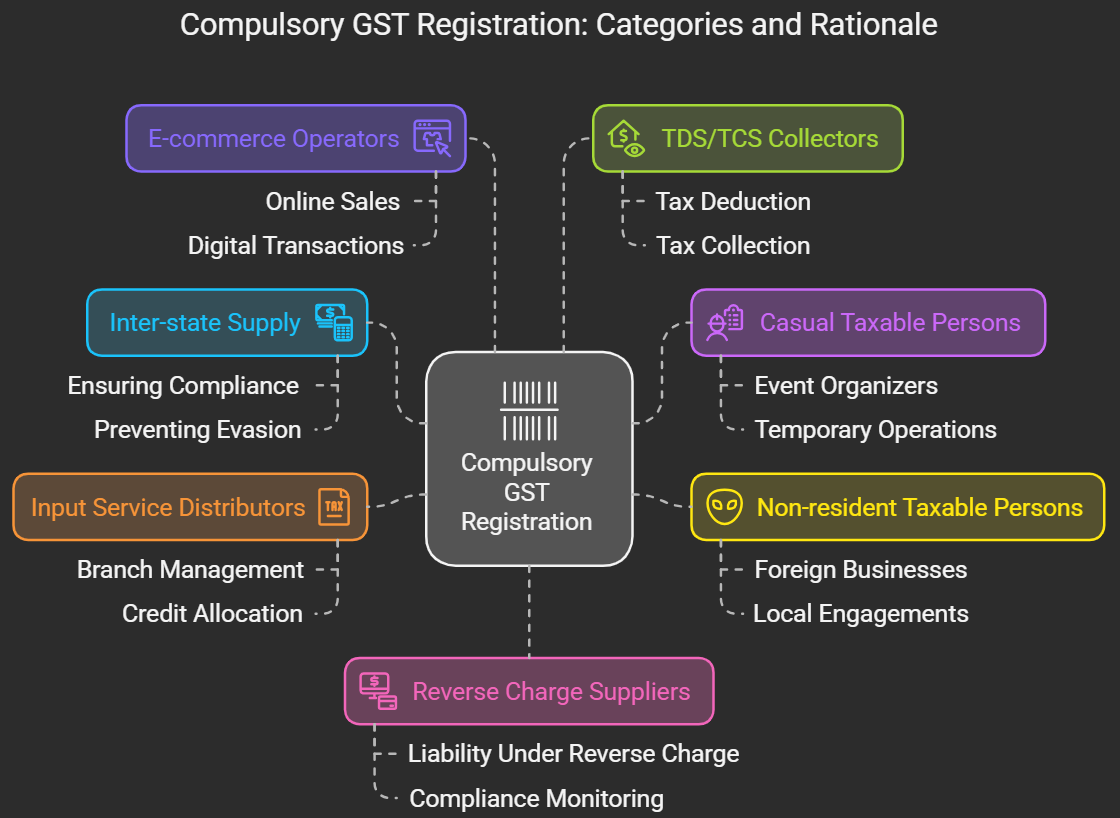

While the general rule for GST registration is based on exceeding the threshold limit of aggregate turnover, there are specific situations where registration is mandatory, irrespective of how much a business earns. This is because these categories of businesses either pose a higher risk of tax evasion or require special monitoring to ensure proper tax collection.

These compulsory registration provisions ensure that businesses engaged in specific activities that might pose higher risks of tax evasion or require special monitoring are brought under the GST framework, regardless of their turnover. This helps maintain the integrity of the tax system and ensures wider tax compliance.

These are the key cases where GST registration is compulsory:

1. Inter-State Supply of Goods or Services

- Mandatory Registration: Any business making inter-state supplies (transactions involving movement of goods or services across state borders) must register for GST, even if its turnover is below the threshold limit.

- Why it's Compulsory: GST is a destination-based tax, meaning the tax revenue goes to the state where the goods or services are consumed. Mandatory registration for inter-state suppliers ensures that the correct state receives the tax revenue and prevents revenue leakage.

2. Casual Taxable Person

- Mandatory Registration: A casual taxable person is someone who occasionally undertakes business activities in a state where they do not have a fixed place of business (e.g., event organizers, exhibition participants). They must register even if their turnover is below the threshold.

- Why it's Compulsory: Casual taxable persons often operate for a limited duration. Mandatory registration ensures that they are brought under the GST ambit and pay taxes on their supplies, preventing tax evasion.

3. Non-Resident Taxable Person

- Mandatory Registration: Similar to casual taxable persons, non-resident taxable persons who occasionally undertake business in India but don't have a fixed place of business here must register regardless of turnover.

- Why it's Compulsory: This ensures that businesses operating temporarily in India contribute their fair share of taxes and prevents them from escaping tax liability.

4. Input Service Distributor (ISD)

- Mandatory Registration: An ISD receives invoices for services used by its branches in different states and distributes the input tax credit to those branches. Registration is mandatory for ISDs.

- Why it's Compulsory: Registration allows for proper accounting and distribution of input tax credit across different branches of a business, ensuring compliance and accurate tax accounting.

5. E-commerce Operators

- Mandatory Registration: Operators of e-commerce platforms are liable for registration, irrespective of their turnover.

- Why it's Compulsory: This brings online transactions under the GST framework, ensuring that e-commerce activities are taxed correctly and contribute to tax revenue. It also creates a level playing field for online and offline businesses.

6. TDS/TCS Deductors/Collectors

- Mandatory Registration: Entities required to deduct or collect tax at source (TDS/TCS) under GST must register.

- Why it's Compulsory: This allows the government to track tax deducted or collected at source, ensuring that taxpayers fulfill their tax obligations and preventing tax evasion.

7. Suppliers Liable under Reverse Charge

- Mandatory Registration: If a business is liable to pay tax under the reverse charge mechanism (where the recipient pays the tax), it must register, regardless of turnover.

- Why it's Compulsory: This ensures that businesses receiving goods or services from unregistered suppliers fulfill their tax obligations by paying GST under the reverse charge mechanism.

No Comments