Market Opportunity Navigator

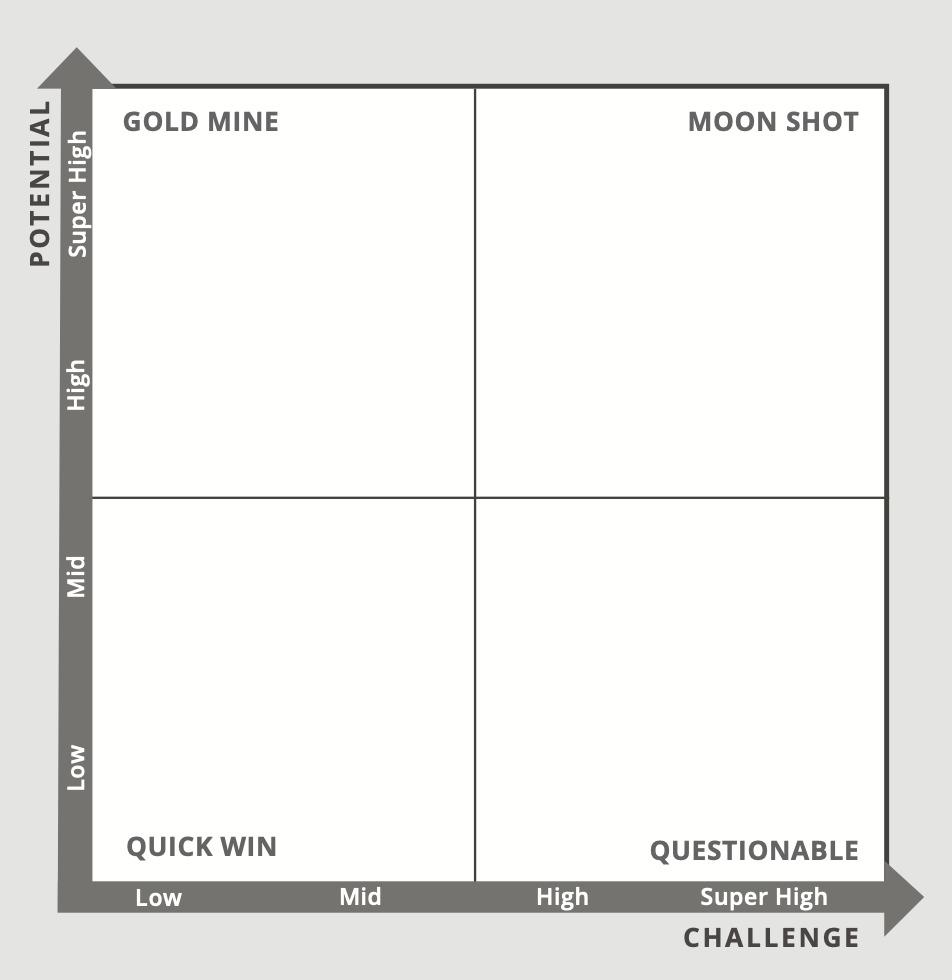

Core Framework: The 2×2 Grid

Evaluates ideas based on Potential (economic/social impact) vs. Challenge (implementation difficulty).

| Quadrant | Characteristics | Recommendation |

|---|---|---|

| Gold Mine | High Potential, Low Challenge | Pursue immediately (e.g., scalable SaaS). |

| Moonshot | High Potential, High Challenge | Pursue with caution; secure resources (e.g., deep-tech innovation). |

| Questionable | Low Potential, High Challenge | Re-evaluate timing/feasibility (e.g., niche product in saturated market). |

| Quick Win | Low Potential, Low Challenge | Low-risk but limited upside; easily replicated (e.g., simple app). |

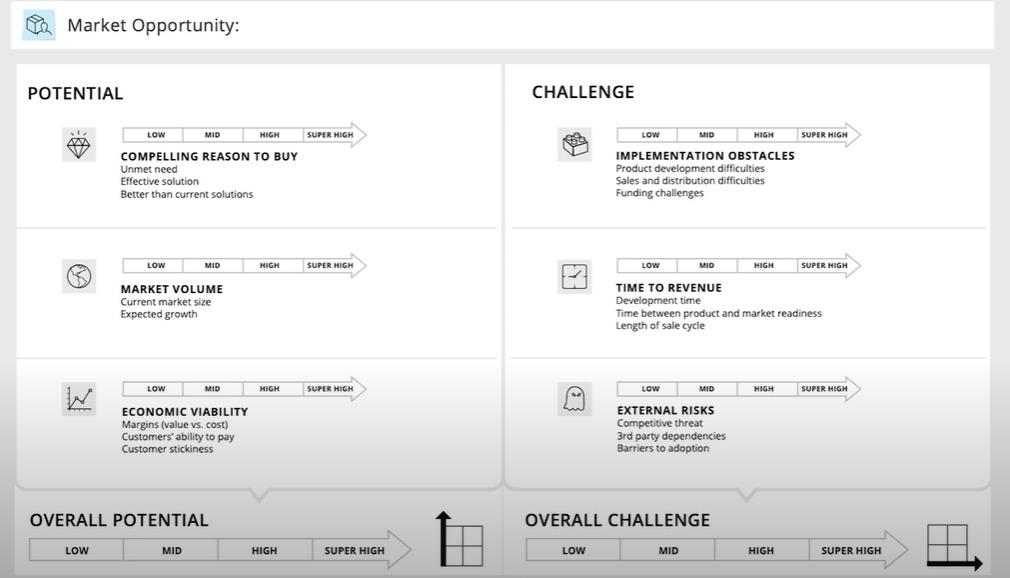

Market Opportunity Attractiveness Evaluator

I. Evaluating Potential

Three dimensions with sub-factors (rated Low → Super High).

1. Compelling Reason to Buy

-

Unmet Need

- High rating: Severe unsolved problem (e.g., life-saving tech).

- Low rating: Well-served market (e.g., food delivery apps).

-

Effective Solution

- Does it deliver promised value?

- Example: AI diagnostics vs. manual processes.

- Does it deliver promised value?

-

Competitive Edge

- Unique advantage (e.g., cost, speed, quality).

2. Market Volume

-

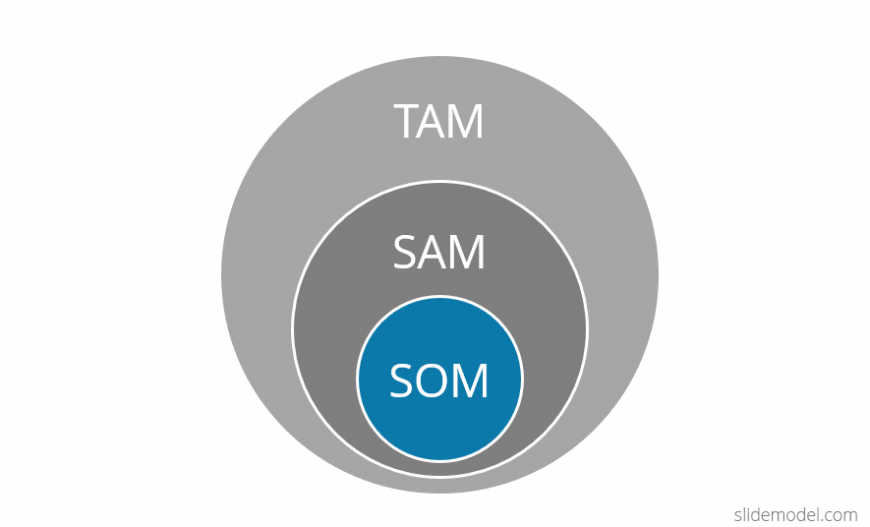

TAM (Total Addressable Market)

- Overall revenue opportunity (e.g., $5 B Indian EV market).

-

SAM (Serviceable Addressable Market)

- Target segment (e.g., $1 B for EV scooters within TAM).

-

SOM (Serviceable Obtainable Market)

-

Growth Rate

- CAGR (e.g., 15% for eco-friendly products).

Key Tip: Validate data via multiple sources (e.g., industry reports, GPT cross-checks).

3. Economic Viability

-

Margins

- Gross margin = (Revenue – COGS) / Revenue. Target > 40% for scalability.

-

Customer Ability to Pay

- Affordability vs. premium positioning (e.g., ₹2,300 smart bottle limits adoption in India).

-

Customer Stickiness

- Retention strategies (e.g., subscriptions, consumables, brand loyalty).

II. Evaluating Challenges

Rated Low → Super High (lower = better).

1. Implementation Obstacles

-

Product Development Difficulty

- Tech maturity, sourcing complexity, R&D timeline (e.g., nascent AI in EdTech).

-

Sales/Distribution Hurdles

- Brick-and-mortar vs. online (e.g., EV showrooms vs. D2C e-commerce).

2. Time to Revenue

-

Development Time

- Prototype → market readiness (e.g., biotech approvals take years).

-

Sales Cycle Length

- B2B: 6 – 12 months

- B2C: Immediate (e.g., Amazon listings)

3. External Risks

-

Competitive Threat

- Crowded markets = high risk (e.g., fitness apps with 50+ competitors).

-

Third-Party Dependencies

- Supply chain/regulatory risks (e.g., drone materials shortage).

-

Adoption Barriers

- Cultural resistance, pricing, complexity (e.g., smart bottles vs. ₹500 alternatives).

Case Study Insights

Ashana (Fitness Coaching Service)

- Mistake: Overestimated market volume by citing entire wellness industry (₹ 2.6 B) without segmenting for coaching.

- Economic Viability: Mid -rated due to subscription retention challenges.

- Feedback: Focus on service design to boost stickiness (e.g., personalized experiences).

Arithra (Eco-Friendly Smart Water Bottle)

- Market Volume: Rated high based on $60 M India market but corrected to mid – too small for VC funding.

- Economic Viability: Low margins (25 – 30%), high price barrier (₹2,300), low stickiness.

- External Risks: High competition and dependency on local manufacturers.

Key Takeaways & Best Practices

-

Bias Mitigation

- Entrepreneurs often overestimate potential. Use third-party evaluators for objectivity.

-

Revolutionary Ideas (e.g., SpaceX)

- Framework limitations: Market size unknown, challenges extremely high.

- Solution: Validate through action (prototypes, early adopters, co-founder buy-in).

-

Data Triangulation

- Cross-verify market numbers from ≥ 2 sources (e.g., reports + GPT + expert interviews).

-

Social Enterprises

- Adapt “Potential” to include social impact + financial sustainability.

-

Ultimate Validation

- Desk analysis is preliminary; real-world testing (e.g., MVP sales) is critical.

“The ultimate evaluation for any idea is action itself.”

No Comments