Balance of Payments (BoP) and Exchange Rates

Balance of Payments (BoP) and Exchange Rates

Balance of Payments (BoP)

What is the BoP?

- Definition: A record of all economic transactions between a country and the rest of the world over a specific period (usually a year).

- Key Purpose: Summarizes a country's international financial dealings.

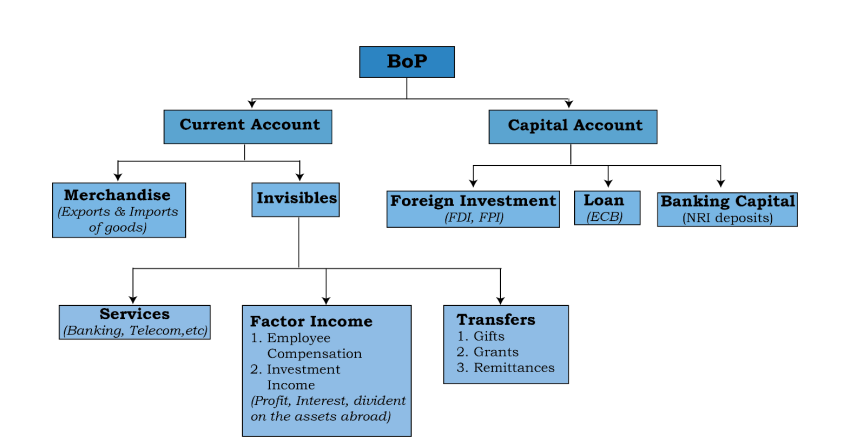

Components of the BoP

-

Current Account:

- Definition: Records transactions related to trade in goods and services, income, and current transfers.

-

Key Elements:

-

Trade Balance: Difference between a country's exports and imports of goods.

- Trade Surplus: Exports > Imports

- Trade Deficit: Imports > Exports

- Services: Trade in services (e.g., tourism, financial services, transportation).

- Income: Payments of income from abroad and vice-versa (e.g., wages, dividends, interest).

- Current Transfers: Unilateral transfers (e.g., foreign aid, remittances).

-

Trade Balance: Difference between a country's exports and imports of goods.

- Significance: Often considered the most important part of the BoP as it reflects a country's competitiveness.

-

Capital Account:

- Definition: Records transactions related to capital flows.

-

Key Elements:

- Foreign Direct Investment (FDI): Investment made by a company in a foreign country.

- Portfolio Investment: Purchase of financial assets (e.g., bonds and shares) in a foreign country.

- Other Investments: Loans, bank deposits, etc.

- Significance: Indicates how a country is financing its current account balance.

-

Financial Account

- Definition: Records transactions related to financial assets and liabilities.

-

Key Elements:

- Direct investment (same as capital account)

- Portfolio Investment (same as capital account)

- Reserve Assets - foreign assets controlled by central banks

-

Balancing Item (Errors and Omissions):

- Purpose: Account for errors and omissions made while compiling the BoP.

- Significance: Ensures the BoP always balances, as in theory, the total inflows and outflows must be equal.

- Central Bank Foreign Currency Reserves:

Balance of Payments Equilibrium

- Key Principle: For the BoP to balance, the sum of the Current Account Balance must equal the Financial Account Balance ( plus or minus the balancing item, and changes in the central bank foreign currency reserves).

- Implications: A current account deficit (more imports than exports) must be financed by a net capital and financial inflow, and vice versa.

Exchange Rates

What is an Exchange Rate?

- Definition: The price of one currency in terms of another.

- Significance: Critical for international trade, competitiveness, and a country's economic position.

Impact of Exchange Rate Fluctuations

-

Currency Appreciation (Value Rises):

- Effect on Exports: Exports become more expensive for foreign buyers, potentially reducing demand (unless domestic producers lower prices).

- Effect on Imports: Imports become cheaper, increasing their competitiveness in the domestic market.

- Impact on Trade Balance: Reduces a trade surplus or worsens a trade deficit.

- Overall Impact: Makes domestic products less competitive internationally, impacting businesses that rely on exports.

-

Currency Depreciation (Value Falls):

- Effect on Exports: Exports become cheaper for foreign buyers, potentially increasing demand.

- Effect on Imports: Imports become more expensive, decreasing their competitiveness in the domestic market.

- Impact on Trade Balance: Improves a trade surplus or reduces a trade deficit.

- Overall Impact: Makes domestic products more competitive internationally, potentially helping businesses reliant on exports.

Factors Influencing Exchange Rates:

- Relative Inflation Rates: Higher inflation typically leads to currency depreciation.

- Interest Rates: Higher interest rates can attract foreign investment, causing appreciation.

- Economic Growth: Stronger economic growth can strengthen a currency.

- Political Stability: Political instability can weaken a currency.

- Speculation: Market expectations can influence short-term fluctuations.

- Government Intervention: Central banks can intervene in the foreign exchange market to manage exchange rates.

The "Right" Exchange Rate

- Key Idea: There is no single "right" exchange rate, as different levels can benefit different industries or objectives.

-

Considerations:

- Competitiveness: A weaker exchange rate can boost exports but hurt consumers through higher import prices.

- Inflation: A weaker exchange rate can lead to higher inflation by raising import costs.

- Capital Flows: A strong exchange rate can attract foreign investment but might harm exporters.

- Economic Goals: Governments need to balance these factors to achieve their economic goals.

In Summary

The Balance of Payments (BoP) is a crucial record of a country's financial interactions with the rest of the world. Exchange rates play a key role in international competitiveness and a country's economic standing, with a currency's value affecting export demand and import costs. Understanding how these two interact is essential for informed economic analysis and policy decisions.

No Comments