Internationalization of Business and Finance

Internationalization of Business and Finance

This section focuses on the broader trends of internationalization in business and finance.

Defining Internationalization

- Internationalization of Business: The process of expanding business activities across national borders. Includes exporting, FDI, strategic alliances, and other forms of cross-border activity.

- Internationalization of Finance: The increasing integration of financial markets globally. Characterized by cross-border capital flows, global financial instruments, and interaction of international financial institutions.

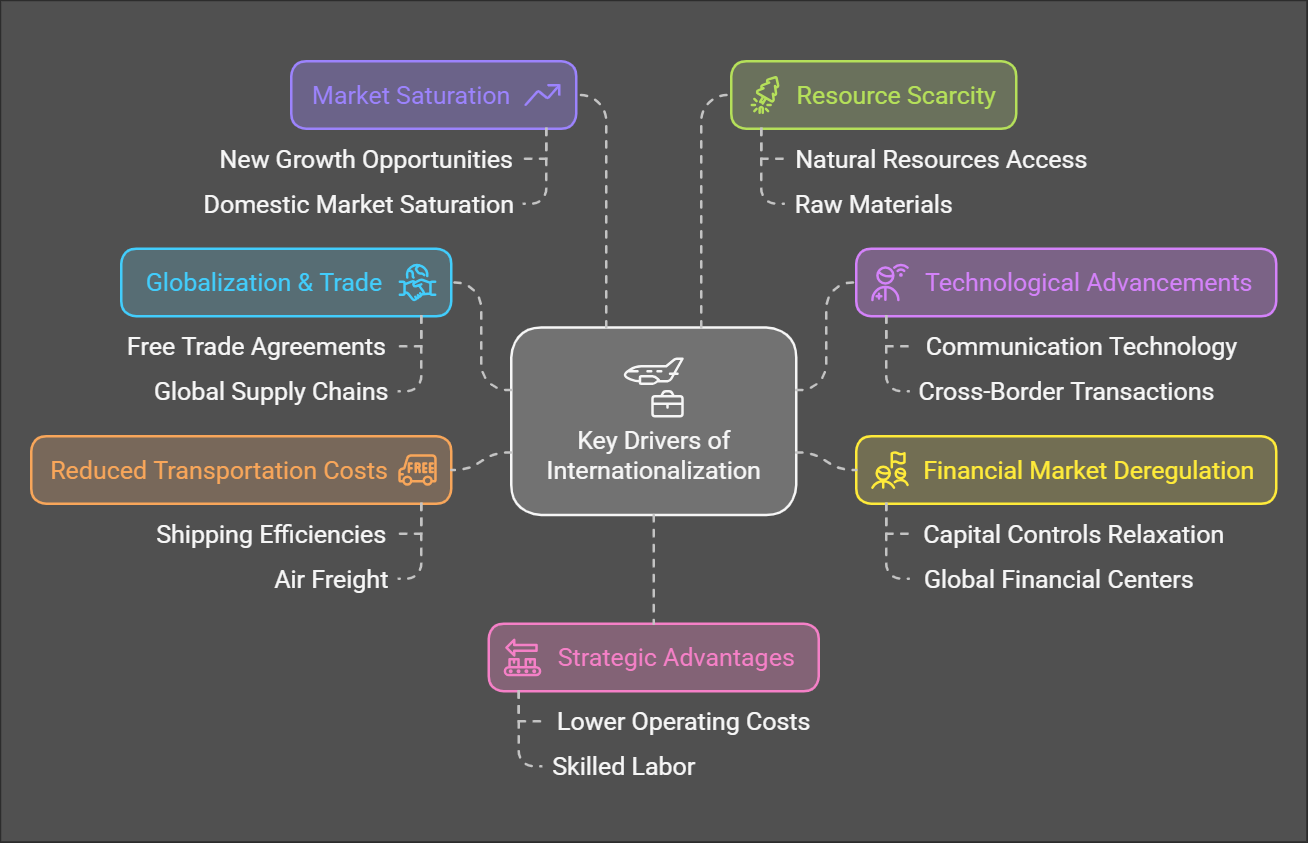

Key Drivers of Internationalization

-

Globalization & Trade:

- Reduced trade barriers and increased free trade agreements.

- Integration of national economies through global supply chains.

-

Technological Advancements:

- Improvements in communication and information technology.

- Faster and more efficient cross-border transactions.

-

Financial Market Deregulation:

- Relaxation of capital controls and free movement of funds.

- Growth of global financial centers and instruments.

-

Reduced Transportation Costs:

- Efficiencies in shipping, air freight, and logistics.

- Lower cost of transporting goods across borders.

-

Market Saturation:

- Seeking new growth opportunities outside of saturated domestic markets.

-

Resource Scarcity:

- Accessing natural resources and raw materials not available domestically.

- Strategic Advantages:

Forms of Internationalization

- Exporting: Selling goods and services to foreign markets.

- Importing: Sourcing goods and services from foreign markets.

- Foreign Direct Investment (FDI): Investing directly in foreign operations and assets.

- Strategic Alliances and Joint Ventures: Partnering with foreign companies for specific projects.

- Licensing and Franchising: Granting foreign companies the right to use intellectual property or business models.

- Portfolio Investment: Investing in foreign stocks, bonds, and other financial assets.

- International Banking: Providing financial services across national borders.

Impact of Internationalization

- Increased Trade: Growth in global trade volumes and trade flows.

- Capital Flows: Movement of capital across national borders.

- Global Supply Chains: Complex interconnected production networks.

- Financial Integration: Greater interaction between financial institutions and markets.

- Economic Interdependence: Increased reliance of economies on one another.

- Technological Diffusion: Spreading technology and innovation across countries.

- Cultural Exchange: Increased interaction and exchange of ideas across different cultures.

Challenges and Risks

- Economic Volatility: Increased exposure to global economic shocks.

- Financial Crises: Potential for systemic risks and contagion effects.

- Political Instability: Geopolitical conflicts and protectionist policies.

- Cultural Misunderstandings: Issues related to cultural differences.

- Regulatory Complexity: Navigating diverse legal and regulatory systems.

No Comments