Skip to main content

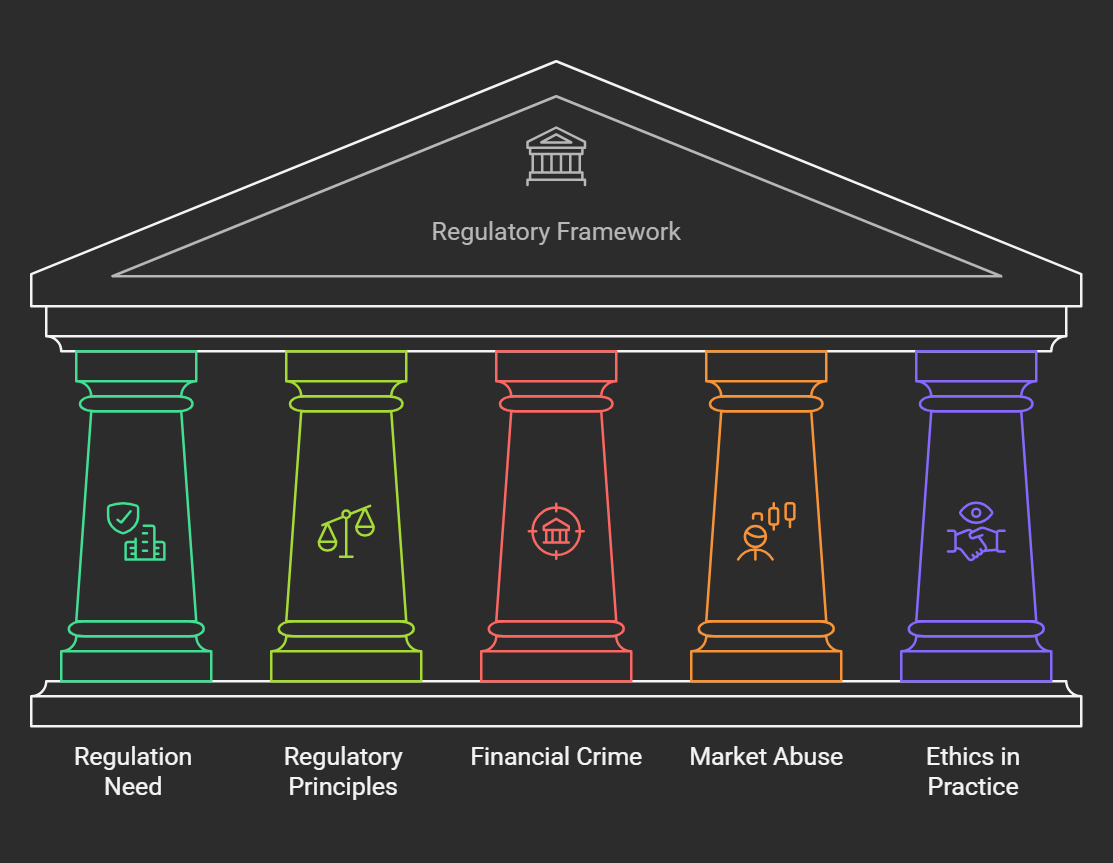

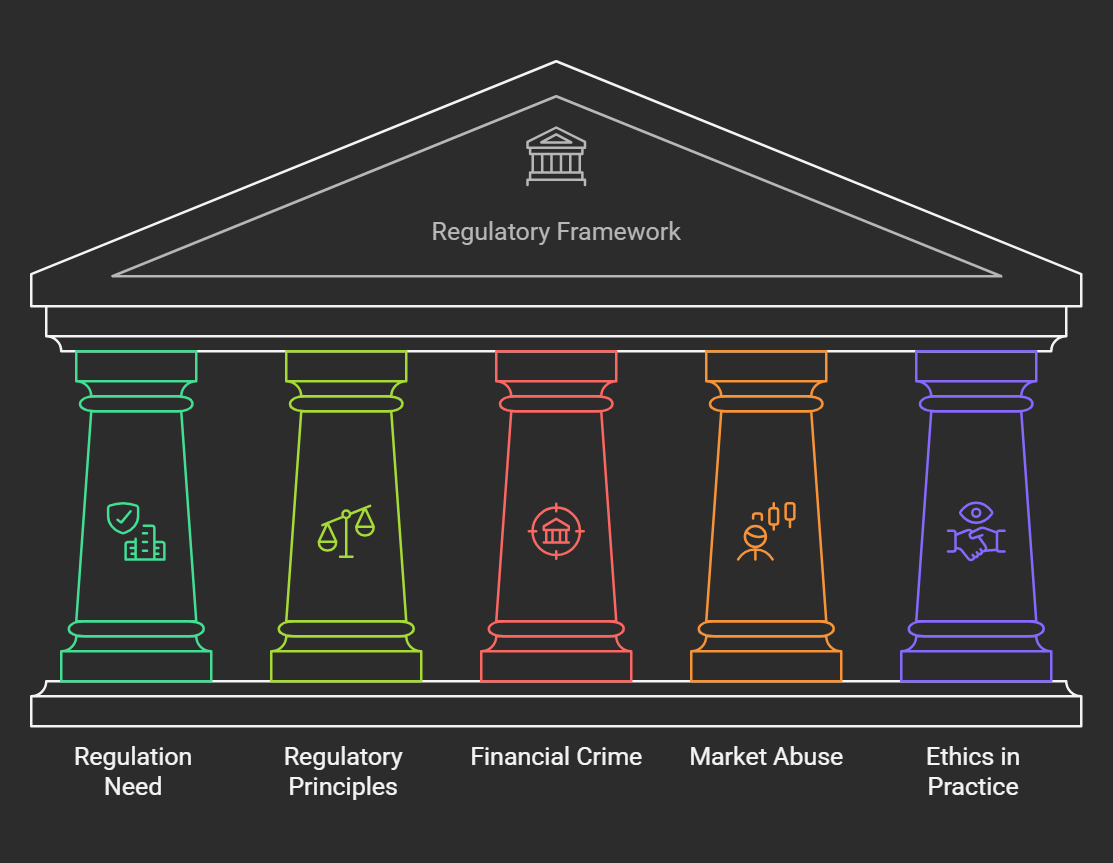

Regulation and Ethics

Regulatory Principles, Financial Crime, Ethics: Course Notes

1. Need for Regulation

-

Protect Investors: Ensure fair markets and prevent fraud.

-

Maintain Market Integrity: Promote transparency and prevent market manipulation.

-

Promote Financial Stability: Prevent systemic risk and protect the overall economy.

-

Build Public Confidence: Encourage participation in financial markets.

-

Address Information Asymmetry: Level the playing field between financial institutions and individuals.

2. Regulatory Principles

-

Transparency: Clear disclosure of information about products, fees, and risks.

-

Accountability: Holding individuals and firms responsible for their actions.

-

Proportionality: Regulations should be appropriate for the size and complexity of the firm.

-

Consistency: Applying regulations fairly and consistently across the market.

-

Effectiveness: Regulations should achieve their intended objectives.

-

Efficiency: Minimizing the cost and burden of regulation.

-

Risk-Based Approach: Focusing regulatory efforts on areas with the highest risk.

-

International Cooperation: Collaborating with other countries to address cross-border issues.

3. Financial Crime

-

Definition: Illegal acts involving money or financial assets.

-

Types of Financial Crime:

-

Money Laundering: Concealing the origins of illegally obtained money.

-

Fraud: Deceiving others for financial gain (e.g., investment fraud, insurance fraud).

-

Bribery and Corruption: Offering or accepting payments to influence decisions.

-

Terrorist Financing: Providing financial support to terrorist organizations.

-

Cybercrime: Using computers and networks to commit financial crimes (e.g., phishing, hacking).

-

Impact:

- Erodes public trust in financial institutions.

- Damages the economy.

- Supports criminal activities.

4. Insider Trading and Market Abuse

-

Insider Trading: Trading on confidential information that is not available to the public.

-

Illegal: Unfair advantage over other investors.

-

Market Abuse: Any behavior that distorts or manipulates the market.

-

Includes:

-

Spreading false rumors.

-

Manipulating prices.

-

Concealing ownership.

-

Examples of Market Abuse:

-

Pump and Dump: Artificially inflating the price of a stock and then selling it for a profit.

-

Wash Trading: Buying and selling the same security to create the illusion of activity.

-

Consequences:

-

Criminal Penalties: Fines, imprisonment.

-

Civil Penalties: Fines, disgorgement of profits.

-

Reputational Damage: Loss of trust and business.

5. Integrity and Ethics in Professional Practice

-

Importance:

- Building trust with clients.

- Maintaining the reputation of the profession.

- Ensuring fair and ethical practices.

-

Key Ethical Principles:

-

Integrity: Honesty, trustworthiness, and moral soundness.

-

Objectivity: Impartiality and unbiased decision-making.

-

Competence: Maintaining the necessary skills and knowledge to provide competent service.

-

Fairness: Treating all clients equitably and without discrimination.

-

Confidentiality: Protecting client's private information.

-

Professionalism: Maintaining a high standard of conduct and representing the profession in a positive light.

-

Code of Ethics:

- Formal set of rules and guidelines for ethical conduct.

-

Ethical Dilemmas:

- Situations where ethical principles conflict.

- Requires careful consideration and judgment.

-

Whistleblowing:

- Reporting unethical or illegal behavior to the appropriate authorities.

- Protected by law in many jurisdictions.

-

Consequences of Unethical Behavior:

- Loss of clients.

- Disciplinary actions.

- Legal penalties.

- Reputational damage.

No Comments