Global financial system vs Domestic financial system

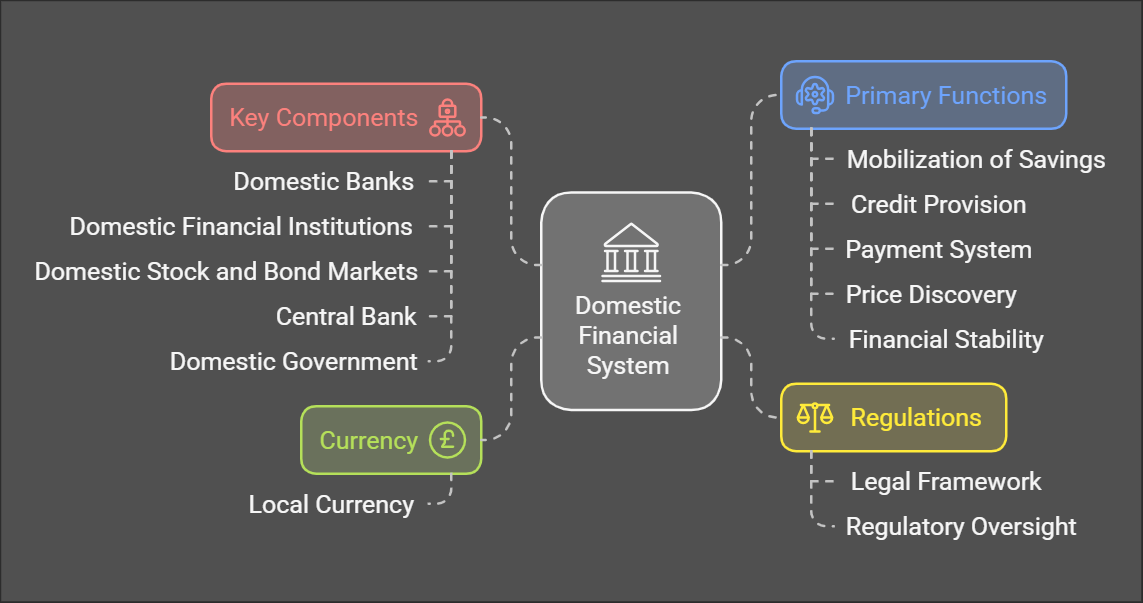

Domestic Financial System

Definition: The network of institutions, markets, and regulations within a specific country that facilitates the flow of funds between savers and borrowers. It operates primarily within the geographic and jurisdictional boundaries of a single nation-state.

Key Components and Players: *

Domestic Banks: Commercial banks, credit unions, and other depository institutions that accept deposits and provide loans to individuals and businesses within the country.

*

Domestic Financial Institutions: Includes insurance companies, pension funds, mutual funds, investment firms, and other financial intermediaries operating primarily within the national economy.

*

Domestic Stock and Bond Markets: Platforms for the issuance and trading of securities (stocks and bonds) of domestically incorporated companies and the government.

*

Central Bank: The primary monetary authority responsible for setting monetary policy, regulating the financial sector, maintaining financial stability, and acting as a lender of last resort for domestic banks.

*

Domestic Government: Plays a regulatory role, issues government bonds, and influences economic activity through fiscal policies.

Currency:

Transactions are predominantly conducted in the local currency of the country (e.g., the US Dollar in the United States, the Euro in the Eurozone, the Yen in Japan).

Regulations:

Governed by the legal framework, financial laws, and regulatory oversight of the national government and its central bank or other regulatory bodies.

Primary Functions:

Mobilization of Savings: Channels domestic savings into productive investments.

*

Credit Provision: Facilitates access to credit for local businesses, consumers, and government entities.

Payment System: Provides a means for efficient payment and settlement of domestic transactions.

*

Price Discovery: Establishes the prices of domestic financial assets through market mechanisms.

*

Financial Stability: Maintains the integrity and stability of the financial system within the country's borders.

-

Example: The financial system of Canada, the financial system of Germany, the financial system of India.

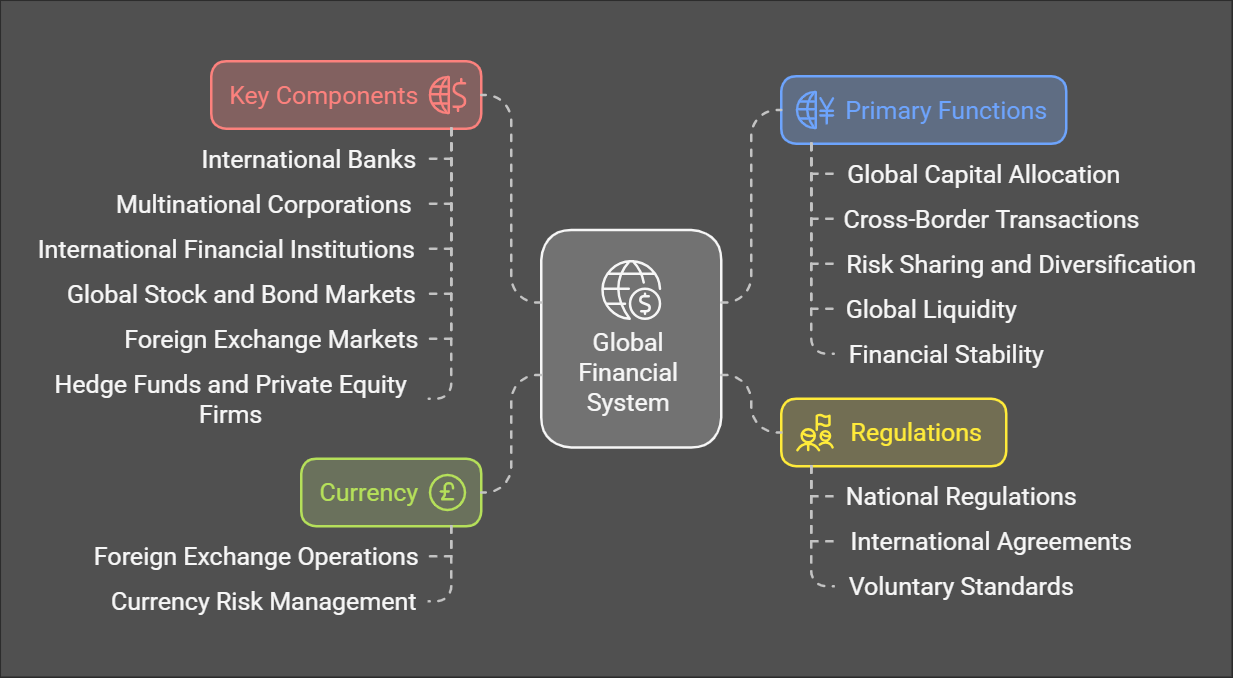

Global Financial System

Definition: The interconnected network of institutions, markets, and regulations across national borders that facilitates the flow of capital, investment, and financial transactions on a worldwide scale. It involves complex interactions among national financial systems.

Key Components and Players:

International Banks: Financial institutions with branches and subsidiaries operating across multiple countries, providing cross-border banking services.

Multinational Corporations (MNCs): Large companies with operations in multiple countries, which access global capital markets for funding and engage in cross-border trade.

*

International Financial Institutions (IFIs): Organizations like the International Monetary Fund (IMF), the World Bank, and regional development banks, providing loans, technical assistance, and policy guidance to countries.

*

Global Stock and Bond Markets: Platforms for the issuance and trading of securities from issuers around the world, allowing for cross-border capital flows.

*

Foreign Exchange Markets (Forex): Decentralized global markets for the trading of different currencies.

*

Hedge Funds and Private Equity Firms: Investment vehicles that operate globally, seeking higher returns by investing in diverse asset classes and markets across the globe.

Currency:

Involves transactions in multiple currencies, requiring the need for foreign exchange operations and management of currency risk.

Regulations:

Subject to a complex interplay of national regulations, international agreements, and voluntary standards. This regulatory environment is more intricate and faces challenges in international cooperation and enforcement.

Primary Functions:

Global Capital Allocation: Facilitates the efficient allocation of capital across different countries, industries, and asset classes.

Cross-Border Transactions: Enables international trade, investment, and financial flows.

Risk Sharing and Diversification: Allows investors to diversify portfolios across different markets and reduce country-specific risk.

Global Liquidity: Provides the necessary liquidity for smooth functioning of the global financial system.

Financial Stability: Aims to maintain global financial stability, although this is often challenging due to interconnectedness and diverse regulatory regimes.

-

Example: The global network of banks involved in trade finance, the international bond market, the operation of global payment systems.

Key Differences - A Concise Comparison

| Feature | Domestic Financial System | Global Financial System |

|---|---|---|

| Definition | Financial system within a single nation. | Interconnected network of systems worldwide. |

| Scope | Confined to national borders. | Spans across all national boundaries. |

| Players | Primarily national institutions. | Includes international institutions & MNCs. |

| Currency | Primarily local currency. | Multiple currencies, requires FX transactions. |

| Regulations | National laws and regulatory framework. | Complex mix of national & international rules. |

| Focus | Domestic capital formation and economic activity. | Cross-border capital flows and international finance. |

| Complexity | Relatively less complex. | Highly complex due to interconnectedness. |

| Stability | Primary goal is national financial stability. | Aims for global financial stability but faces challenges. |

Summary

- Domestic: The foundational financial framework within a specific country, focusing on local savings, investment, and stability.

- Global: The interconnected system that transcends national borders, facilitating international capital flows, trade, and finance, and striving for worldwide stability, albeit with greater complexity and challenges. The Global system relies on smooth functioning and interactions of individual Domestic systems.

No Comments