Costing System

1. Illustrative Example: Government Hospital Tender

- Context: You work for a government hospital inviting tenders for two widely used tablets.

-

Products:

-

Tablet A (Adult):

- Contains a few chemicals with higher dosages.

-

Tablet B (Children):

- Shares three chemicals with Tablet A, plus two different ones.

- Dosages are smaller.

-

Tablet A (Adult):

-

Observation:

Two pharmaceutical firms submit substantially different price quotes. -

Key Insight:

Difference arises because each firm uses a different costing system—specifically, they allocate common costs differently in a multi‑product environment.

2. Designing a Costing System: Three‑Step Process

-

Establish the Cost Object or Cost Center

- A cost object (or cost head) is the lowest level at which cost data are collected.

- Examples: Material, salary, repairs, freight, travel expenses, customers, dealers.

- Cost objects are grouped into cost centers (e.g., Production Cost Center, Purchase Cost Center).

- A cost object (or cost head) is the lowest level at which cost data are collected.

-

Cost Accumulation

- Create records to capture costs as they occur.

- Material requisition slips: Track materials issued to jobs/processes.

- Employee sheets / Machine log books: Log labor and machine usage per job.

- Costs are recorded under their respective cost objects.

- Create records to capture costs as they occur.

-

Cost Assignment

- Direct costs: Traced straight to the product or service (e.g., raw materials).

-

Common costs: Must be allocated across multiple products.

- Examples: Depreciation of factory building, managers’ salaries.

- Allocation bases include output quantity, material cost, labor hours, machine hours.

- Choice of allocation base → different product costs → different tender quotes.

3. Common vs. Exclusive Costs

-

Common Costs:

- Occur when several products share machines or resources.

- Can represent 20 %–80 % of total costs.

- Higher for high‑value‑added products on shared resources.

-

Exclusive Costs:

- When each product has its dedicated production facility.

- Result in fewer common costs to allocate.

4. Activity‑Based Costing (ABC)

- Developed to address arbitrary allocation of common costs.

-

Key Features:

- Identifies activities as cost objects.

- Allocates overhead based on actual drivers (e.g., number of set‑ups, inspection hours).

-

Trend:

- Increasing adoption as firms seek more accurate product costing.

5. Major Costing Systems

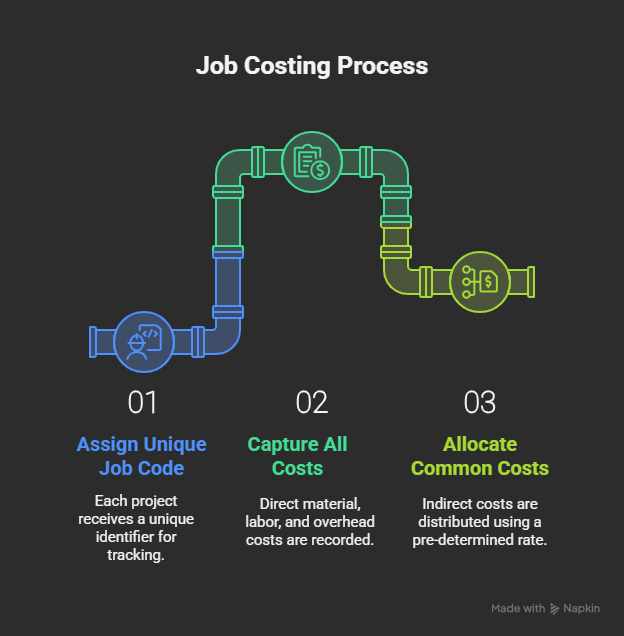

5.1 Job Costing

- When to Use: Custom orders or services.

-

Examples:

- IT projects (e.g., Infosys executes per client order).

- Construction contracts (e.g., Gammon India).

- Automobile service stations (each vehicle service → one “job”).

-

Process:

- Assign a unique job code.

- Capture all material, labor, and overhead under that code.

- Allocate common costs on job completion using a pre‑determined rate.

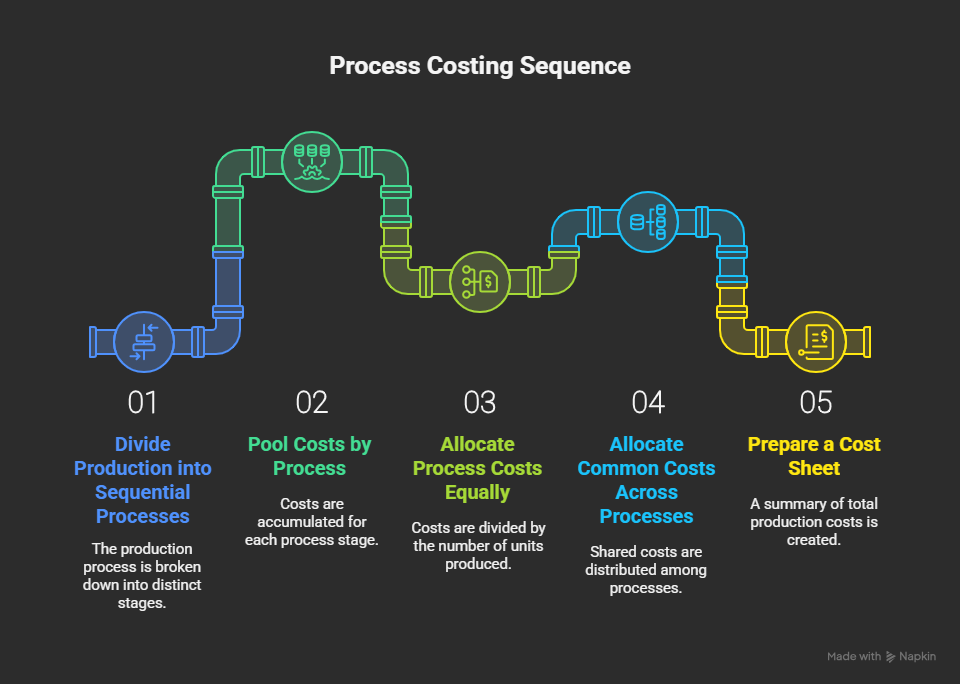

5.2 Process Costing

- When to Use: Mass production of identical units.

-

Examples:

- Manufacturing (sugar, cement, fertilizer).

- Service providers with uniform services (banking, insurance, telecom).

-

Process:

- Divide production into sequential processes (each → cost center).

- Pool material, labor, and overhead costs by process.

- Allocate process costs equally to all units passing through.

- Allocate common costs across processes as needed.

- Prepare a cost sheet showing material cost + cost per process.

No Comments