Skip to main content

Preparation Of Cost Sheet

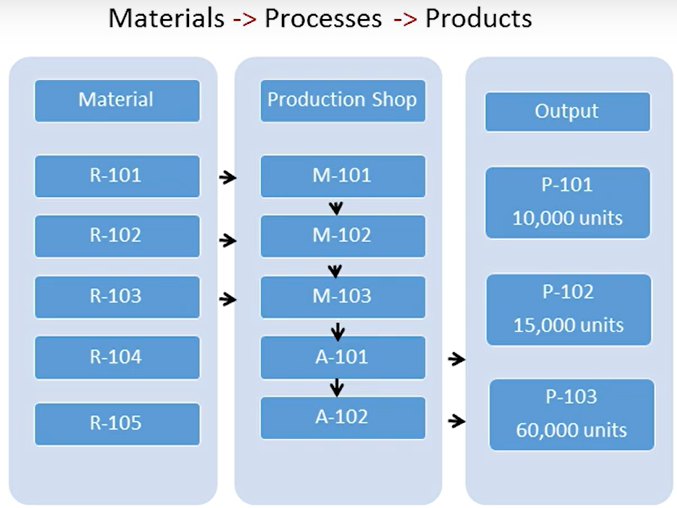

Cost Sheet Preparation: Autocomp Ltd

1. Cost Sheet Overview

-

Definition: Final output of the costing department showing cost of production per unit.

-

Service Industry: Analogous cost sheet shows cost of delivering each service.

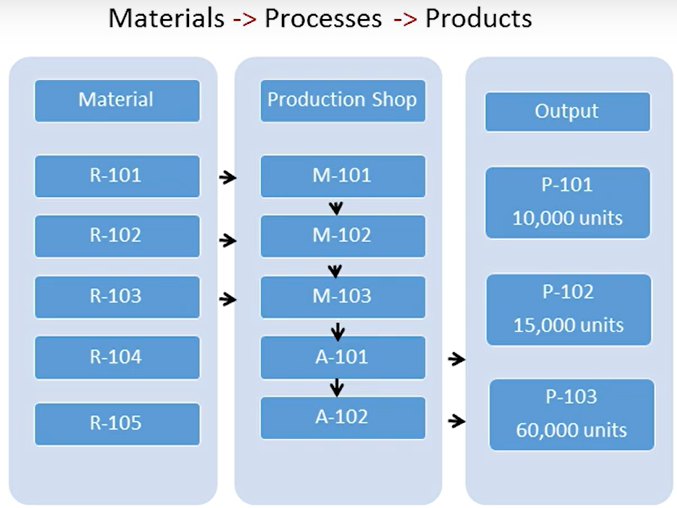

2. Company & Products

-

Company: Autocomp Ltd.

-

End Products:

-

Materials / Components (R‑101 to R‑105)

-

Production Facilities:

-

Machine Shops: M‑101, M‑102, M‑103

-

Assembly Shops: A‑101, A‑102

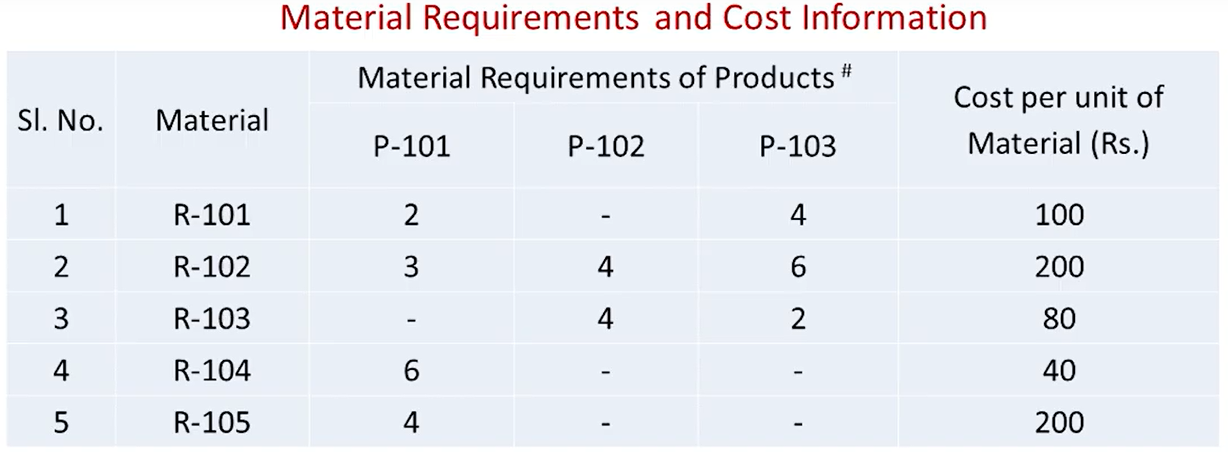

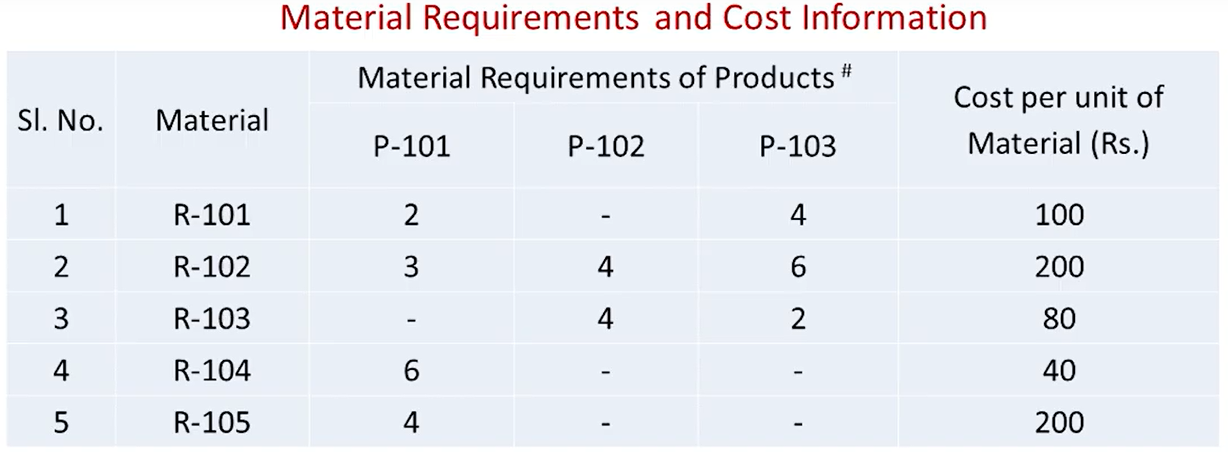

3. Material Requirements & Costs

-

Per‑unit material mix:

- P‑101 uses 4 materials

- P‑102 uses 2 materials

- P‑103 uses 3 materials

-

Compute per‑unit material cost:

- Multiply quantity of each material × cost per unit.

-

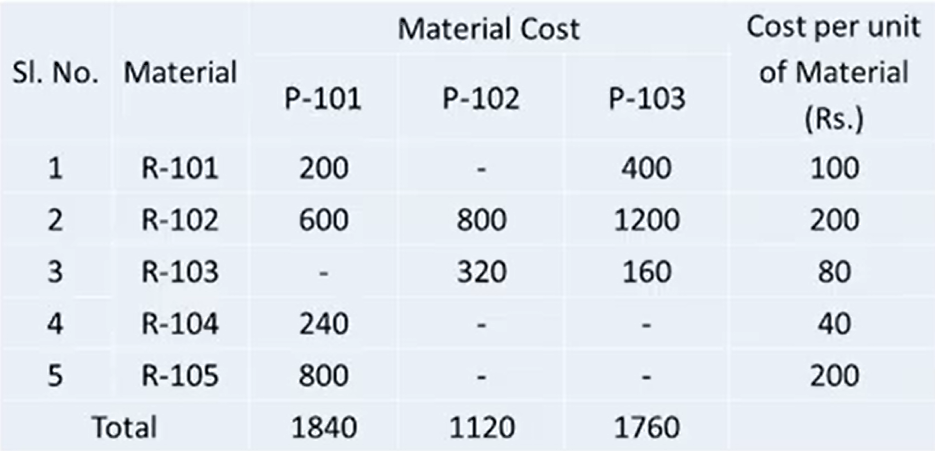

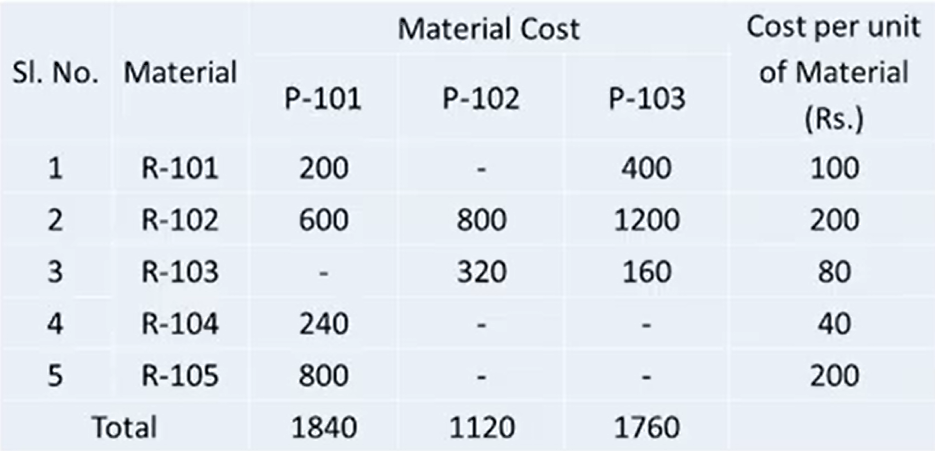

Results:

- P‑101: ₹1,840

- P‑102: ₹1,120

- P‑103: ₹1,760

-

Monthly material cost:

- P‑101: 10,000 × ₹1,840 = ₹18.40 million

- P‑102: 15,000 × ₹1,120 = ₹16.80 million

- P‑103: 60,000 × ₹1,760 = ₹105.60 million

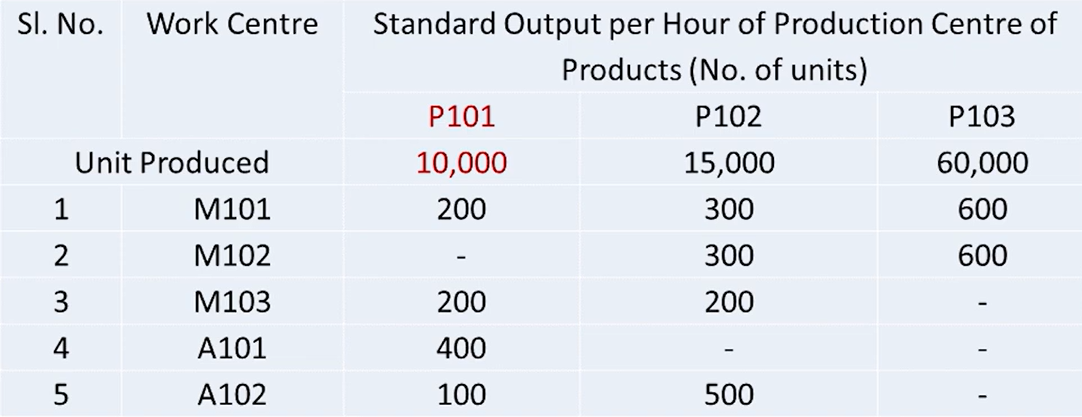

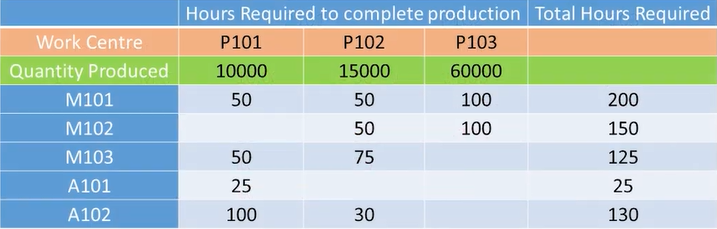

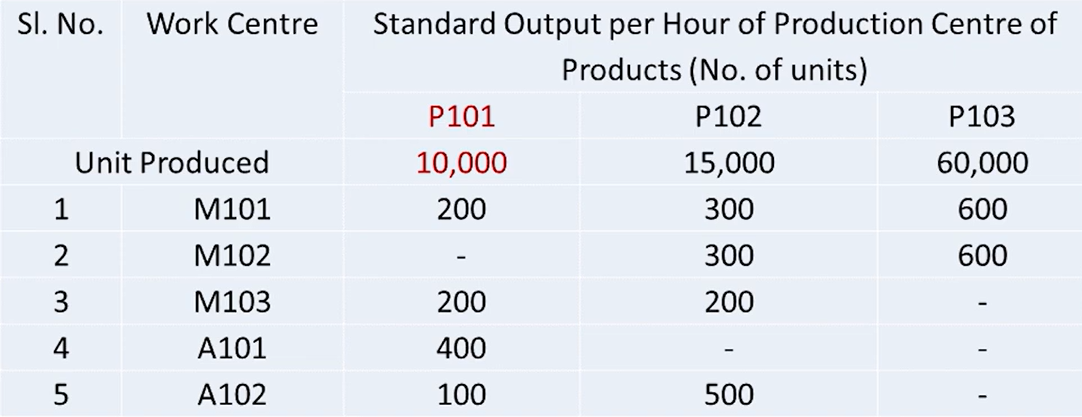

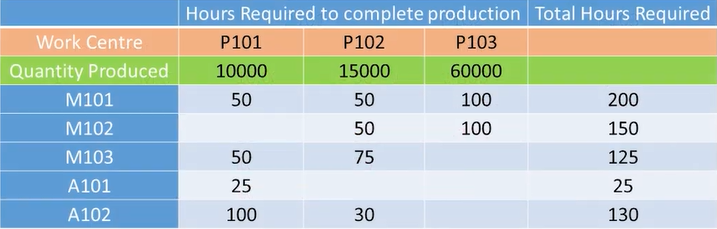

4. Machine & Assembly Hour Requirements

-

Throughput rates (units/hour) per machine center vary by product.

-

Compute hours required:

Hours = Units produced / Units per hour

-

Capacity vs. Usage (per month = 200 hrs):

- M‑101: 200 hrs used (full)

- M‑102: 150 hrs used (idle 50 hrs)

- M‑103: 125 hrs used (idle 75 hrs)

- A‑101: 25 hrs used (idle 175 hrs)

- A‑102: full utilization for those products that require it

5. Allocating Production Center Costs & Idle Capacity

-

Cost pools per center:

- Labor

- Power & fuel

- Depreciation

-

Idle capacity treatment options:

-

Charge full cost (including idle hours) → customer bears all expenses.

-

Charge only utilized hours → exclude idle‑time cost from product.

-

Assumption for this exercise: Option 1 (charge full cost).

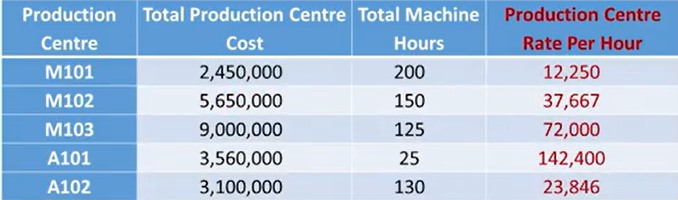

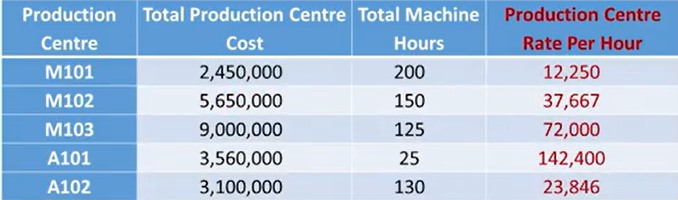

6. Machine / Assembly Hour Rates

-

Rate per hour = (Total center cost) ÷ (Actual hours worked)

-

Example (M‑101):

- Total cost ₹2,450,000 ÷ 200 hrs = ₹12,250/hr

-

Note: Higher rates result from low utilization (idle time).

7. Assigning Production Center Cost to Products

8. Labor Cost Allocation (for support of common‑cost allocation)

-

Compute labor rate per center:

- Center labor cost ÷ hours worked

- E.g., M‑101: ₹300,000 ÷ 200 hrs = ₹1,500/hr

-

Product‑wise labor cost:

- Multiply product labor hours × labor rate

- E.g., P‑101 labor = 1,087 hrs × ₹1,500 = ₹1.63 million

-

Results:

- P‑101: ₹1.63 million

- P‑102: ₹0.97 million

- P‑103: ₹0.45 million

9. Support Department Cost Allocation

-

Departments: Purchase, Stores, Quality Control, Maintenance, Accounting & Admin, Canteen

-

Allocation bases:

| Department |

Allocation Base |

| Purchase |

Material cost |

| Stores |

Material cost |

| Maintenance |

Machine hours |

| Quality Control |

Units produced |

| Canteen & Personnel |

Product labor cost |

| Accounting & Admin |

Units produced |

-

Process:

- Compute each department’s total cost share per product using its chosen base ratio.

10. Final Cost Sheet & Unit Costs

-

Cost categories:

- Material

- Production center (machine + assembly)

- Support center (all service departments)

-

Per‑unit costs:

| Product |

Total Cost/Unit (₹) |

| P‑101 |

3,009 |

| P‑102 |

1,782 |

| P‑103 |

1,886 |

-

Cost structure (% of unit cost):

- Material cost: largest share

- Production center cost: next largest

- Support center cost: relatively small

- P‑103 is highly material‑intensive (≈ 93 % material).

No Comments