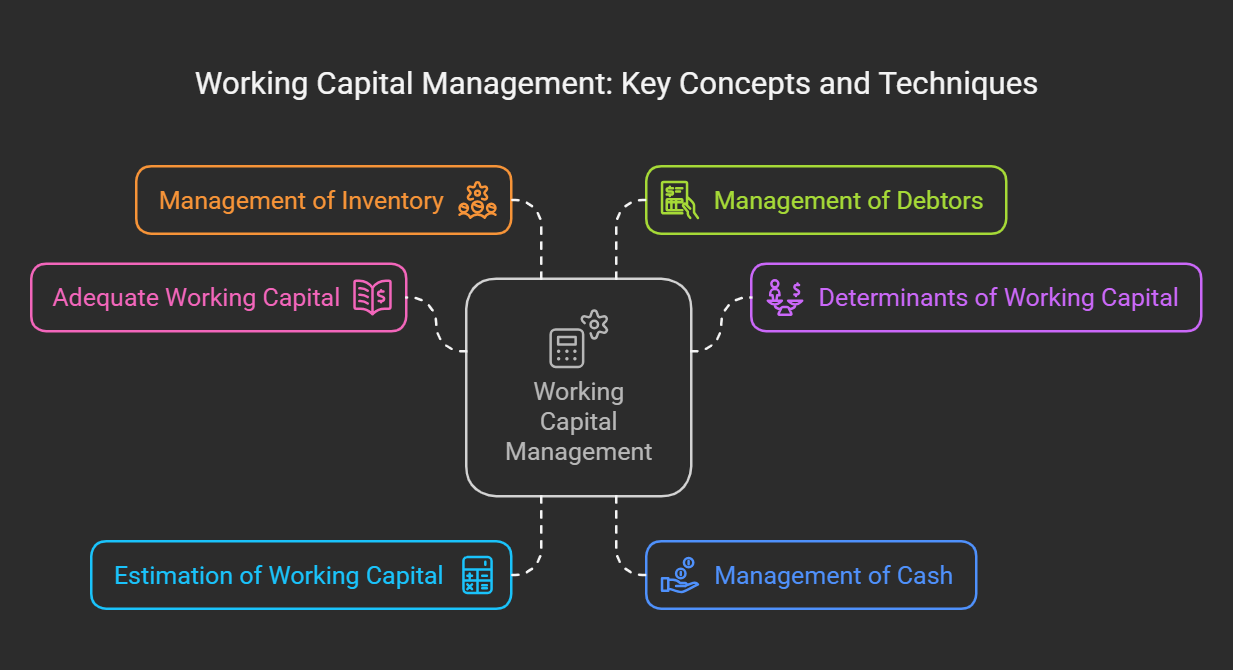

advantages of working capital , determinants of working capital , estimation of working capital , management of cash

Working Capital Management Notes

IV. Adequate Working Capital

Definition: Optimal level of current assets to operate smoothly, meet obligations, and seize opportunities.

Consequences of Inadequate Working Capital:

- Inability to pay bills (penalties, credit damage).

- Missed opportunities.

- Inventory shortages (lost sales).

- Reliance on expensive short-term financing.

- Possible insolvency.

Consequences of Excessive Working Capital:

- Idle funds (missed investment opportunities).

- High inventory holding costs.

- Risk of obsolescence/damage.

- Inefficient resource use.

- Lower ROI.

Determining Adequacy:

-

Ratios:

- Current Ratio (Current Assets / Current Liabilities)

- Quick Ratio (Quick Assets / Current Liabilities)

- Cash Flow Forecasting: Project future inflows/outflows.

- Industry Benchmarks: Compare to industry averages.

- Operational Analysis: Evaluate inventory, receivables, and payables management.

V. Determinants of Working Capital

Factors influencing working capital needs:

- Nature of Business: Manufacturing vs. Service (Manufacturing requires more). Seasonal businesses.

- Size of Business: Larger companies need more.

- Production Cycle: Longer cycle = more work-in-progress inventory.

- Credit Policy: Liberal credit increases receivables.

- Inventory Turnover: Low turnover = more tied up in inventory.

- Availability of Credit: Easier access reduces cash balance needs.

- Operating Efficiency: Efficient operations reduce needs (e.g., JIT).

- Inflation: Higher costs may require more capital.

- Growth Rate: Rapid growth often needs more capital.

- Business Cycle: Expansions increase needs, recessions decrease.

- Technology: Improvements reduce needs.

- Profit Margins: High margins may reduce needs.

- Price Level Changes: Increased material and labor costs require more.

VI. Estimation of Working Capital

- Based on calculating current assets and liabilities.

-

Key Inputs:

- Projected Sales

- Production Cycle

- Credit Terms (to/from suppliers & customers)

- Operating Expenses

- Contingency (safety margin)

VII. Management of Cash

Objective: Sufficient cash to meet obligations, minimizing holding costs.

Techniques:

- Cash Budgeting: Forecast inflows/outflows.

- Cash Collection Management: Speed up collections.

- Cash Disbursement Management: Optimize payment timing.

- Investment of Surplus Cash: Short-term marketable securities.

- Electronic Funds Transfer (EFT): Speed up transactions.

- Lockbox System: Accelerate payment collection.

- Zero Balance Account (ZBA): Transfer funds only when needed.

- Concentration Banking: Centralize cash management.

VIII. Management of Inventory (Theory Only)

Objective: Optimal inventory level, meet demand, minimize holding costs.

Techniques:

- Economic Order Quantity (EOQ): Optimal order size.

- Just-in-Time (JIT) Inventory: Materials arrive just in time for production.

- Materials Requirement Planning (MRP): Planning material requirements based on schedules.

- ABC Analysis: Classify inventory by value (A, B, C).

- Vendor-Managed Inventory (VMI): Suppliers manage inventory.

- Perpetual Inventory System: Continuous record of inventory.

- Periodic Inventory System: Physical counts at intervals.

IX. Management of Debtors (Accounts Receivable) - (Theory Only)

Objective: Collect payments quickly, minimize bad debt risk.

Techniques:

- Credit Policy: Clear terms and procedures.

- Credit Analysis: Assess creditworthiness.

- Invoice Management: Prompt and accurate invoicing.

- Collection Procedures: Follow up on overdue accounts.

- Discounts for Early Payment: Incentives for early payment.

- Factoring: Sell receivables at a discount.

- Securitization: Bundle and sell receivables to investors.

- Letters of Credit: Guarantee payment.

- Aging Schedule: Group receivables by age (outstanding time).

No Comments