Point of Indifference

Understanding the Point of Indifference

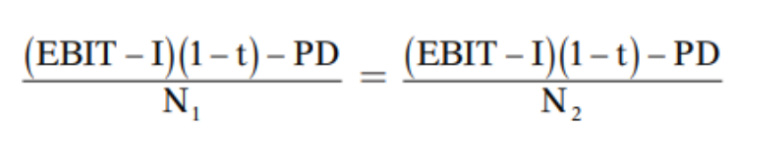

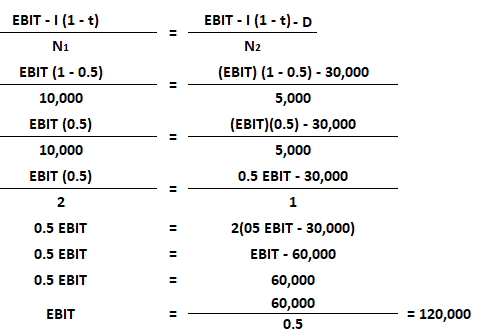

The point of indifference, in the context of capital structure, represents the specific level of Earnings Before Interest and Taxes (EBIT) at which two different capital structures will result in the same Earnings Per Share (EPS). Imagine a company considering two different ways to finance its operations—one using more debt and one using more equity. At most levels of EBIT, one financing approach will typically result in a better EPS than the other. The point of indifference is the unique level of EBIT where the two different capital structures achieve the same EPS. It essentially marks the threshold where the benefits of one financing method begin to outweigh the benefits of another. It's the level of operational profit at which a company would be indifferent between the two capital structures from the shareholder’s point of view, because the impact on earnings per share is the same.

How the Point of Indifference is Useful

The concept of the point of indifference is valuable because it helps companies make more informed decisions about their capital structure. If a company anticipates that its EBIT will likely be above the point of indifference, it might find that the capital structure with more debt will be more favorable. This is because at higher EBIT levels, the benefits of financial leverage (increased profit due to using debt) can significantly boost EPS. On the other hand, if a company anticipates that its EBIT will probably be below the point of indifference, then the financing option with less debt and more equity could prove to be the better choice, as it can avoid the financial risks and fixed interest obligations associated with debts. The point of indifference offers a way to evaluate different capital structures based on the company's projected earnings. By doing so, a company can choose a capital structure that is better suited to their outlook on its future profitability.

No Comments