Debentures and Bonds

Understanding Debentures and Corporate Bonds

Debentures

Definition:

A debenture is a formal document issued by a company that serves as an acknowledgement of a debt. Think of it as a loan certificate or an "IOU" from the company to the lender (debenture holder). According to the Companies Act 2013, the definition of debentures includes debenture stock, bonds, and other similar securities, whether secured by the company's assets or not. Essentially, when a company needs to borrow significant sums of money for a long, fixed duration, it can issue debentures to the public.

Issuance:

Companies issue debentures to the public for subscription much like how shares are offered. A debenture is a formal, written acknowledgement of the borrowed money, carrying the company's seal and specifying all pertinent details of the loan.

Key Features of Debentures:

- Debt Instrument: A debenture represents a debt for the company, and the debenture holder is essentially a creditor.

- Fixed Interest Rate: Debentures usually come with a fixed rate of interest, payable at regular intervals.

- Fixed Repayment Term: They also have a fixed repayment term, at the end of which the principal amount is repaid.

- No Ownership Stake: Holding a debenture does not confer any ownership rights to the debenture holder.

Advantages of Debentures:

- Fixed Income for Investors: Debentures appeal to investors seeking a steady income stream with relatively less risk compared to stocks.

- No Dilution of Control: Unlike issuing equity shares, debentures do not dilute the existing shareholders' control over the company.

- Tax Deductible Interest: Interest payments on debentures are tax-deductible, reducing the effective cost of borrowing for the company.

- No Profit Sharing: Unlike equity, the company does not have to share its profits with debenture holders, beyond the fixed interest payments.

- Suitable for Stable Earnings: Debentures are best used by companies with consistent and predictable sales and earnings.

Disadvantages of Debentures:

- Reduced Borrowing Capacity: Issuing debentures can reduce a company's capacity to borrow further funds in the future.

- Repayment Obligation: With redeemable debentures, the company has to make provisions for repayment on the specified date, regardless of its financial situation.

- Fixed Burden on Earnings: Debentures create a permanent obligation for interest payment, placing a burden, especially during periods when company earnings are volatile or low.

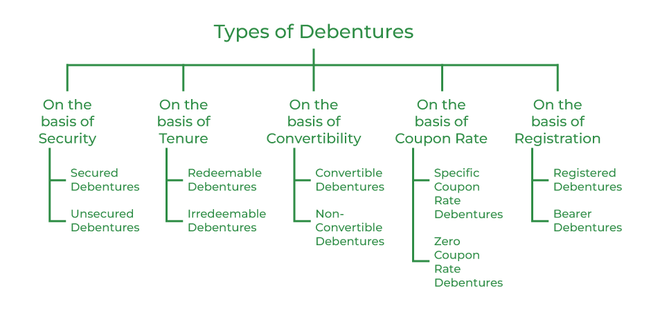

Types of Debentures:

-

Secured and Unsecured Debentures:

- Secured Debentures: These have a charge or security on the assets of the company. This means that if the company fails to repay the debt, the debenture holders have a claim on specific assets of the company.

- Unsecured Debentures: These do not have any security or charge on the assets of the company. They are purely based on the creditworthiness of the issuing company.

-

Registered and Bearer Debentures:

- Registered Debentures: These are recorded in the company's register of debenture holders. Transfer requires a formal instrument of transfer.

- Bearer Debentures: These are transferable simply by delivery to another person without needing to be registered in a register of the company.

-

Convertible and Non-Convertible Debentures:

- Convertible Debentures: These can be converted into equity shares after a specified period.

- Non-Convertible Debentures: These cannot be converted into equity shares and remain as debt instruments until maturity.

-

First and Second Debentures:

- First Debentures: These have priority in repayment compared to other debentures.

- Second Debentures: These are repaid after the first debentures have been fully repaid.

Corporate Bonds

Definition:

Corporate bonds are debt instruments issued by companies to raise capital. They are essentially a promise from the company to repay a specified amount (the principal or face value) at a future date (maturity date), along with interest payments at regular intervals until maturity.

Key Characteristics:

- Debt Obligation: A corporate bond represents a debt obligation of the issuing company.

- Principal Repayment: The company promises to return the face value of the bond at maturity.

- Interest Payments: Bondholders receive regular interest payments (usually semiannually) until maturity.

- No Ownership: Owning a corporate bond does not grant any ownership or voting rights in the company.

- Issued by Large Corporations: These bonds are typically issued by large established corporations, financial institutions, and sometimes by government agencies.

- May or may not be backed by assets: Corporate bonds can be backed up by collateral or physical assets. However, in contrast debentures are usually not backed up by any collateral.

How Corporate Bonds Work:

When you purchase a corporate bond, you are essentially lending money to the company. The company then uses these funds for various purposes like business expansion, research and development, or other strategic initiatives. The company makes periodic interest payments to you, and when the bond matures, the company repays the original amount you invested (the face value).

Distinction between Bonds and Debentures:

While both bonds and debentures represent debt instruments, a key difference often lies in the collateral. Corporate bonds are often backed up by collateral or physical assets, where as debentures issued by private companies often are not backed up by any collateral or security.

Special Types of Bonds

-

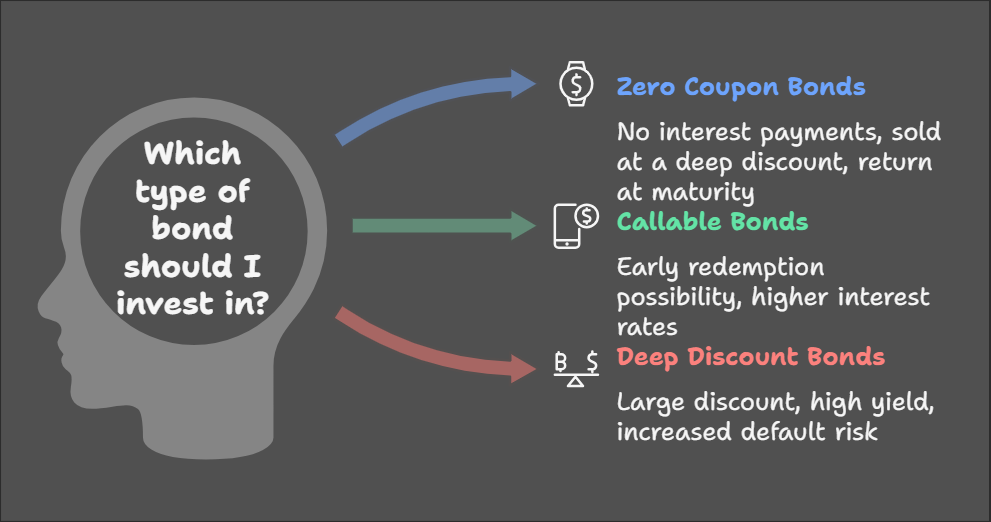

Zero Coupon Bonds/Zero Interest Bonds:

- No Interest Payments: These bonds do not pay any periodic interest.

- Deep Discount: They are sold at a significant discount to their face value.

- Return on Maturity: The investor's return comes from the difference between the discounted purchase price and the full face value received at maturity.

-

Callable Bonds:

- Redeemable Early: These bonds give the issuer the right to redeem them before the stated maturity date.

- Issuer Benefit: The company may call the bond if market interest rates drop, allowing them to re-borrow at a lower rate.

- Higher Interest Rates: Callable bonds often offer a higher interest rate to compensate investors for the possibility of early redemption.

-

Deep Discount Bonds:

- Large Discount: These bonds sell at a considerable discount from their par value (typically a discount of 20% or more).

- High Yield: Their yield is significantly higher than other fixed-income securities with similar risk profiles.

- Increased Default Risk: Such large discounts might signal underlying credit concerns with the issuer, indicating a greater risk of default.

No Comments