Capital Structure: Meaning, Importance, and Determinants

What is Capital Structure?

Think of a building's framework. It's not made of just one material; it's a blend of steel, concrete, and wood to provide strength and stability. Similarly, a company needs a well-planned capital structure, which is the way it raises money to fund its operations and growth. This "structure" is the specific mix of different sources of long-term funding.

In simpler terms, capital structure refers to how a company finances its assets through a combination of:

Essentially, a company's capital structure reflects the proportion of each of these sources in its overall long-term funding strategy.

Definitions from Financial Experts:

- Gerstenberg: Defines capital structure as the make-up of a company's capitalization, including "all long-term capital resources viz., loans, reserves, shares, and bonds."

- John J. Hampton: Describes capital structure as "the combination of debt and equity securities that comprise a firm’s financing of its assets."

- I.M. Pandey: Defines it as the "mix of long-term sources of funds, such as, debentures, long- term debts, preference share capital and equity share capital including reserves and surplus."

Key Aspects of Capital Structure:

- Focus on Long-Term Funding: Capital structure is primarily concerned with the long-term financing needs of the business.

- Mix and Proportion: It emphasizes the specific mix or combination and proportions of debt, equity, and other long-term funding sources.

- Impact on Firm Value: The chosen capital structure significantly impacts the company's financial risk, profitability, and overall value.

- Strategic Decision: Designing a suitable capital structure is a vital decision in financial management.

Capital Structure vs. Financial Structure vs. Assets Structure

It is essential to understand how capital structure relates to financial structure and assets structure, as these terms are often confused.

-

Financial Structure: This is the broader term, encompassing all sources of a company's funding. It includes short-term debts (like accounts payable), long-term debts, and shareholder's equity. Think of it as the entire "liabilities and equity" side of the balance sheet.

- Financial Structure = Short-term Debt + Long-term Debt + Shareholders' Equity

-

Capital Structure: This is a part of the financial structure. It focuses more specifically on the long-term sources of finance, such as long-term debt and shareholders' equity.

- Capital Structure = Long-term Debt + Shareholders' Equity

- Some financial experts might include short-term debt for a more comprehensive view of long-term financing.

-

Assets Structure: This refers to the composition of a company's assets—both fixed assets (like machinery and buildings) and current assets (like cash and inventory). This is the "assets" side of the balance sheet.

- Assets Structure = Fixed Assets + Current Assets

In essence, a company's capital structure indicates how it finances its assets over the long term, while the financial structure captures the entire funding base, including short-term liabilities.

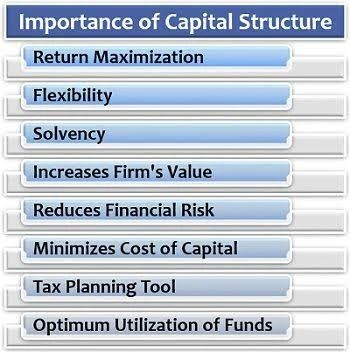

Why Capital Structure Matters: Its Importance

A well-designed capital structure can bring significant benefits to a business:

- Enhancing Firm Value: A sound structure can increase the market price of shares and securities, leading to a higher overall value for the company.

- Effective Use of Funds: A good capital structure ensures funds are raised from the right sources in the best proportions for optimal utilization. It helps avoid both over and under-capitalization.

- Maximizing Returns (Trading on Equity): By increasing the proportion of debt (which is often the cheapest source of capital) in the capital structure, a company can boost returns to equity shareholders. This is known as "trading on equity," and happens when the return on the company's investments is higher than the cost of debt.

- Minimizing Cost of Capital: Since debt capital is typically cheaper than equity due to interest being tax-deductible, a well-structured capital structure minimizes the overall cost of capital, which benefits shareholders.

- Maintaining Solvency and Liquidity: A balanced approach to capital structure prevents over-reliance on debt. This is because too much debt can lead to solvency issues, especially if earnings are poor, as the company will have to pay back interest regardless.

- Flexibility for Growth and Adjustment: A sound capital structure allows for expansion or reduction of debt capital, enabling the company to adjust according to changing market conditions.

- Preservation of Control: A good capital structure does not dilute the control of the equity shareholders. This is achieved by avoiding an excessive reliance on equity-based funding.

- Mitigating Financial Risk: A sensible mix of debt and equity capital protects the business from excessive financial risk due to large fixed obligations for interest payments and debt repayment.

Understanding "Optimum Capital Structure"

The optimum capital structure is the ideal capital structure for a company. It is the specific mix of debt and equity which leads to:

- Minimum Weighted Average Cost of Capital (WACC): WACC is the average cost of raising funds from all sources. The optimum structure seeks to minimize this.

- Maximum Value of the Firm: The aim is to maximize the value of the company for its shareholders.

This is the most desirable state, where a company's financing strategy supports both growth and stability, resulting in maximum shareholder value.

What Factors Determine Capital Structure?

Several factors influence how a company designs its capital structure:

- Trading on Equity and EBIT-EPS Analysis: This involves strategically using long-term debt and preference share capital to increase Earnings Per Share (EPS). Using more debt works well if the return on investment is higher than the cost of debt. The tax-deductibility of interest further enhances the benefit of debt.

- Stability and Growth of Sales: Companies with stable sales can take on more debt as they have predictable income to cover obligations. Higher growth rate also allow greater debt usage.

- Cost of Capital: A company aims to minimize the overall cost of capital. Equity is usually more expensive than debt, with preference shares being in between.

- Cash Flow Ability: Companies with strong and stable cash flows can comfortably manage debt obligations, including interest and principal repayments.

- Control Considerations: Companies seeking to avoid dilution of control of existing shareholders may prefer debt financing over equity.

- Flexibility: The capital structure should allow companies to easily substitute one form of financing for another to economize the use of funds. The debt and preference shares can be redeemed, hence provide some flexibility.

- Size of the Firm: Smaller companies often have difficulty raising long-term debt due to higher interest rates and stricter terms.

- Marketability and Timing: Market conditions like boom or depression influence whether equity or debt is more suitable for raising capital. A highly levered firm may find it hard to get more debt.

- Floatation Costs: The costs involved in issuing securities (brokerage, prospectus, etc.). Debt is usually cheaper to raise than equity.

- Purpose of Funds: If funds are for productive investments, debt is appropriate, as interest can be paid using the profits from the investment. For non-productive purposes, equity is preferred.

- Legal Restrictions: Government regulations can influence the amount and type of securities a company can issue.

No Comments