Banking Regulation in India

This document outlines a structured approach to understanding banking regulation in India, incorporating key topics, a timeline for learning, and suggested resources.

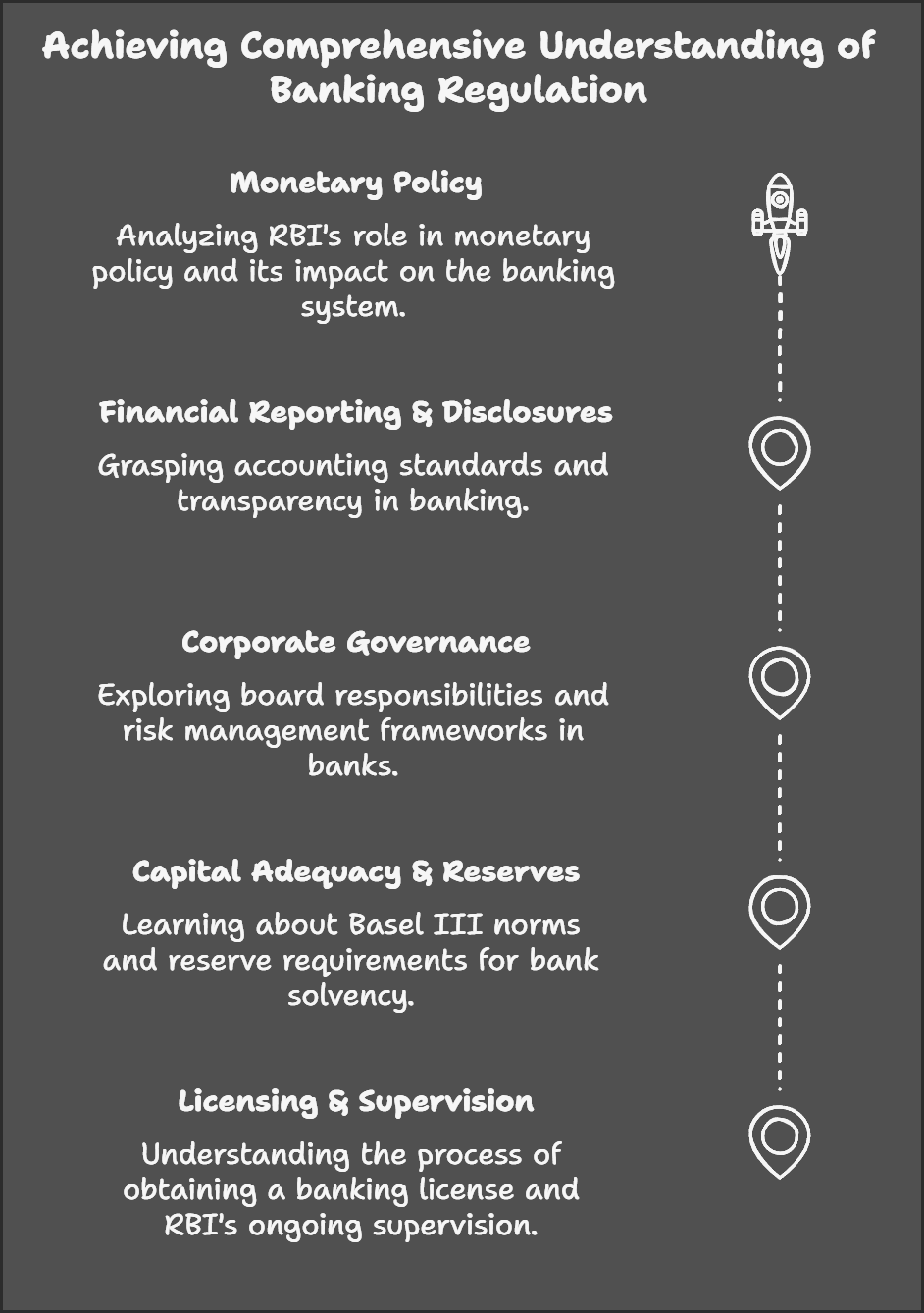

Key Topics

-

Licensing and Supervision:

- The process for obtaining a banking license from the Reserve Bank of India (RBI).

- Ongoing supervision by the RBI, including on-site inspections and off-site monitoring.

- Enforcement actions taken by the RBI in case of non-compliance.

-

Capital Adequacy and Reserve Requirements:

- Capital adequacy norms (Basel III framework) and their importance for bank solvency.

- Reserve requirements, including the Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

- How these requirements influence a bank's lending capacity and liquidity.

-

Corporate Governance:

- Board structure and responsibilities in banks.

- Risk management framework and internal controls.

- Importance of ethical conduct and transparency in banking operations.

-

Financial Reporting and Disclosures:

- Accounting standards and reporting requirements for banks.

- Disclosure of key financial information to stakeholders.

- Ensuring transparency and accountability in financial reporting.

-

Monetary Policy:

- The role of the RBI in formulating and implementing monetary policy.

- Monetary policy tools (repo rate, reverse repo rate, OMO, etc.) and their impact on the banking system.

- How monetary policy influences interest rates, credit availability, and inflation.

Learning Timeline

- Week 1: Licensing and Supervision, Capital Adequacy and Reserve Requirements.

- Week 2: Corporate Governance, Financial Reporting and Disclosures.

- Week 3: Monetary Policy, Review and Consolidation.

Case Study Examples

- The Global Financial Crisis of 2008: Examine the regulatory failures that contributed to the crisis and the subsequent reforms.

- The Collapse of Lehman Brothers: Analyze the impact of inadequate risk management and capital adequacy on a major financial institution.

- The Satyam Scam: Study the corporate governance failures that led to the accounting scandal.

- The PMC Bank Crisis: Investigate the regulatory lapses and governance issues that resulted in the bank's collapse.

By following this structured approach and utilizing the suggested resources, you can gain a comprehensive understanding of banking regulation in India.

No Comments