Functions of Financial System

Key Functions of the Financial System

The financial system plays a crucial role in the economy by performing several key functions:

1. Mobilization of Savings:

- Collecting funds from savers: Financial institutions, such as banks, collect savings from individuals and businesses through deposits, investments, and insurance premiums.

-

Channeling funds to productive uses: These collected funds are then channeled towards productive investments, such as:

- Business loans: Supporting business expansion and job creation.

- Home mortgages: Enabling individuals to purchase homes.

- Infrastructure projects: Funding the development of roads, bridges, and other essential infrastructure.

2. Provision of Liquidity:

- Facilitating easy conversion of assets into cash: The financial system provides mechanisms for individuals and businesses to quickly convert their assets into cash when needed.

-

Examples:

- Checking and savings accounts: Offer easy access to funds.

- Stock markets: Provide a platform for buying and selling stocks, allowing investors to quickly convert their investments into cash.

3. Size Transformation (Capital Formation):

- Pooling small savings into large investments: Financial institutions pool small savings from many individuals into larger amounts, enabling them to finance large projects that would otherwise be inaccessible.

- Example: Banks collect deposits from many individuals and then lend those funds to businesses for expansion.

4. Maturity Transformation:

- Matching short-term savings with long-term investments: Financial institutions accept short-term deposits (like checking accounts) and use them to fund long-term investments (like mortgages).

- Example: Banks accept short-term deposits and use them to provide long-term loans to borrowers for home purchases.

5. Risk Transformation:

- Diversifying and managing risk: Financial institutions help individuals and businesses manage and diversify their risks.

-

Examples:

- Insurance: Protects individuals and businesses from unforeseen events like accidents, natural disasters, and legal liabilities.

- Diversified investment portfolios: Allow investors to spread their risk across different assets.

These functions are interconnected and essential for the efficient functioning of the economy. By mobilizing savings, providing liquidity, and managing risk, the financial system supports economic growth, promotes innovation, and improves the overall well-being of individuals and businesses.

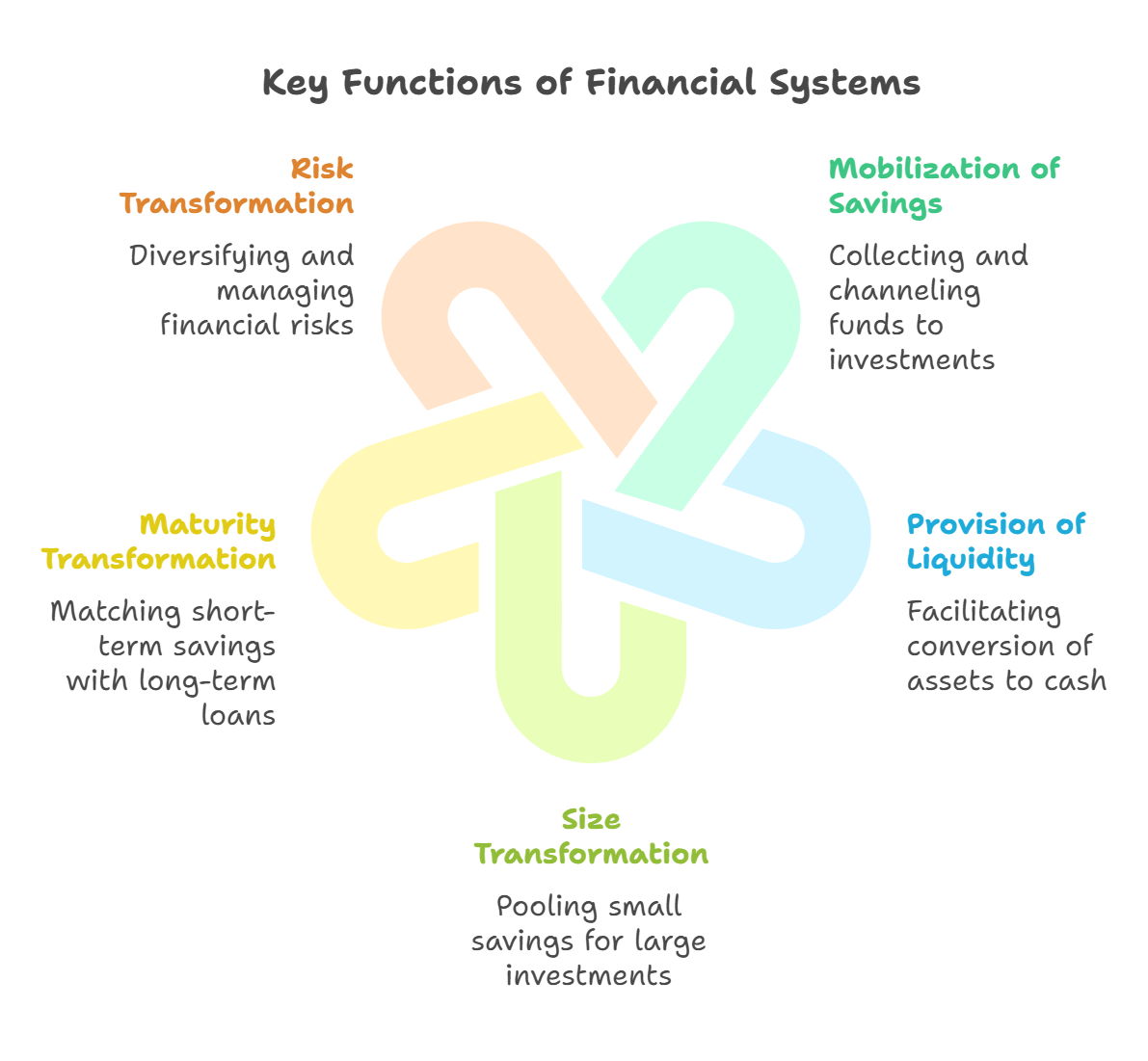

Key Functions of Financial Systems

Risk Transformation

Mobilization of Savings

Diversifying and managing financial risks

Collecting and channeling funds to investments

Maturity Transformation

Provision of Liquidity

Matching short-term savings with long-term loans

Facilitating conversion of assets to cash

Size Transformation

Pooling small savings for large investments

No Comments