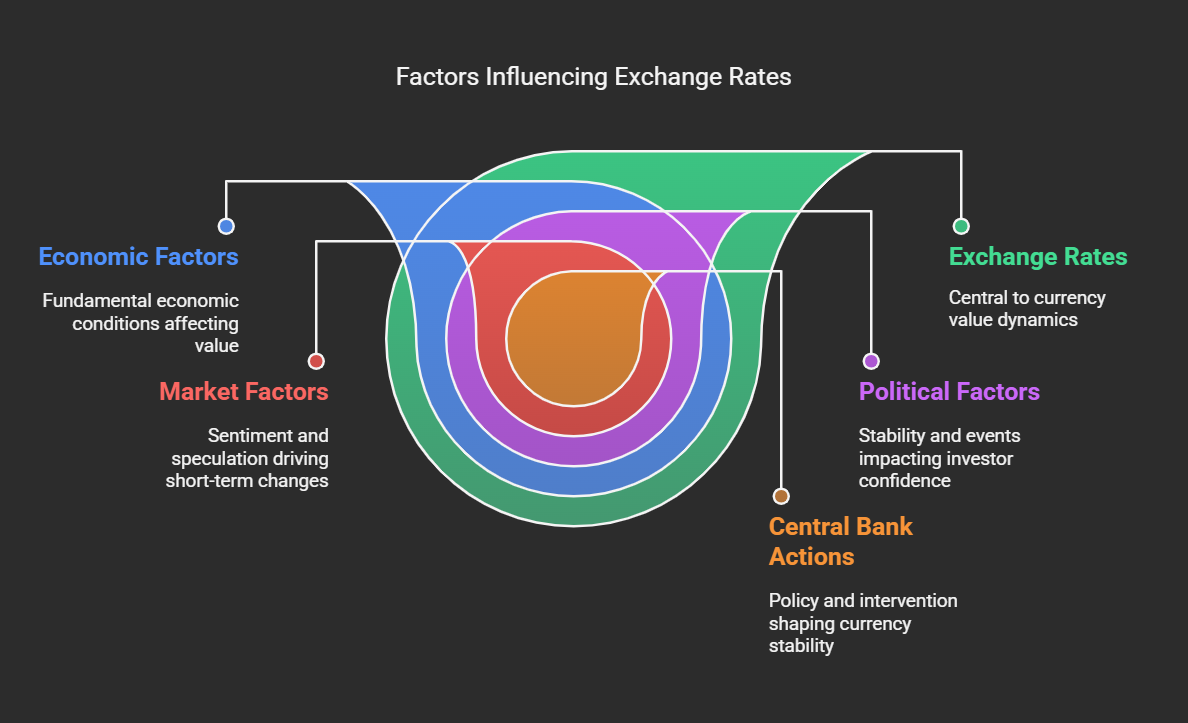

factors that influence exchange rates

Exchange rates are constantly shifting, driven by a complex web of economic, political, and market forces. To better understand these movements, here's a breakdown of the key factors:

Economic Factors:

Economic Factors:

Interest Rates: Central banks adjust interest rates to control inflation and stimulate economic growth. Higher interest rates can attract foreign investment, increasing demand for a currency and pushing its value up. Inflation: High inflation reduces a currency's purchasing power. Countries with lower inflation rates tend to have stronger currencies. Economic Growth (GDP): A strong and growing economy attracts foreign investment. Positive economic data can boost investor confidence and increase demand for a currency. Trade Balance: A trade surplus (exports exceeding imports) increases demand for a country's currency. A trade deficit (imports exceeding exports) can weaken a currency. Government Debt: High levels of government debt can create uncertainty and reduce investor confidence. This can lead to a decrease in the value of a currency.

Political Factors:

Political Stability: Political instability or uncertainty can deter foreign investment. Stable political environments tend to attract investment and strengthen currencies. Geopolitical Events: Wars, elections, and international relations can significantly impact currency values.

Market Factors:

Market Sentiment: Investor psychology and expectations play a crucial role. News events and market rumors can trigger rapid shifts in currency values. Speculation: Traders buy and sell currencies to profit from anticipated price movements. Speculative trading can increase market volatility. Supply and Demand: Like any market, currency values are ultimately determined by the forces of supply and demand. Central Bank Actions:

Monetary Policy: Central banks use monetary policy tools, such as interest rate adjustments, to influence currency values. Intervention: Central banks may intervene in the forex market to buy or sell currencies, attempting to stabilize or influence exchange rates. Understanding these factors is essential for anyone involved in international trade, finance, or investment.

No Comments