Fundamental Principles of Life Insurance

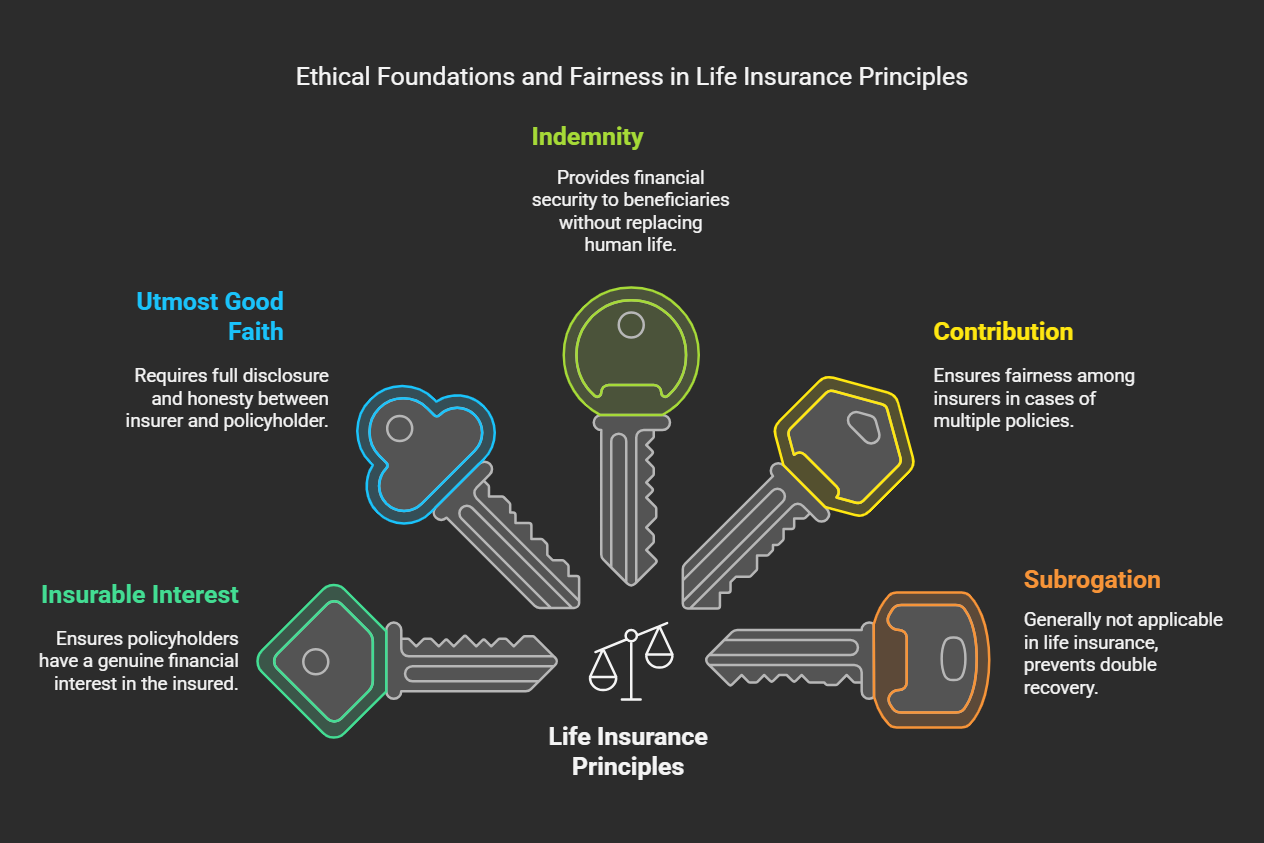

Life insurance, while a contract, is built upon a foundation of fundamental principles that ensure fairness and stability within the industry. Here are the key principles:

- Principle of Insurable Interest:

Meaning: The policyholder must have a genuine financial interest in the life of the insured person. This prevents wagering or gambling on someone's life. Purpose: To ensure that the policyholder would suffer a financial loss upon the death of the insured. To prevent moral hazard (the temptation to intentionally cause harm). Examples: A spouse has an insurable interest in their partner. A parent has an insurable interest in their child. A business partner has an insurable interest in their fellow partner.

- Principle of Utmost Good Faith (Uberrimae Fidei):

Meaning: Both the insurer and the policyholder must disclose all relevant information truthfully and completely. There should be no concealment or misrepresentation of material facts. Purpose: To ensure that the insurer can accurately assess the risk and determine the appropriate premium. To maintain trust and transparency in the insurance relationship. Examples: The policyholder must disclose their medical history accurately. The insurer must clearly explain the terms and conditions of the policy.

- Principle of Indemnity (with exceptions):

Meaning: In general insurance, the insured is restored to their pre-loss financial position. However, life insurance is an exception. Exception in Life Insurance: Human life has no measurable monetary value. Therefore, life insurance is a "valued policy," where a predetermined sum assured is paid upon the insured's death. Purpose: To provide financial security to the beneficiaries, rather than attempting to replace the deceased's life.

- Principle of Contribution (Related to multiple policies):

Meaning: If a person has multiple life insurance policies covering the same risk, all insurers contribute proportionally to the claim. This prevents the beneficiary from profiting from multiple policies. Purpose: To ensure fairness among insurers and prevent over-indemnification. Applicability: This is more relevant to general insurance, but can apply in cases of multiple life insurance policies with overlapping beneficiaries.

- Principle of Subrogation (Generally not applicable):

Meaning: The insurer steps into the shoes of the insured to recover losses from a responsible third party. This is generally not applicable to life insurance, as there is no third party to pursue. Purpose: To prevent the insured from recovering twice for the same loss.

- Principle of Causa Proxima (Proximate Cause):

Meaning: The loss must be directly and proximately caused by the insured peril. The insurer is liable only for losses directly resulting from the covered event. Purpose: To determine whether a loss is covered under the policy. These principles form the ethical and legal framework for life insurance, ensuring that the system operates fairly and effectively for all parties involved.

No Comments